💰 Bitcoin & Liquidity

The Scarcity Trade for a Broken Fiat World

🔑 Executive Summary

Bitcoin is no longer just a speculative tech bet. In a world of fractured liquidity, rising political inflation, and decaying trust in sovereign stores of value, Bitcoin is emerging as a global liquidity barometer and a digital scarcity reserve.

It tracks global M2 more closely than equities or gold.

It has become a credible allocation sleeve for institutional portfolios.

It offers asymmetric upside during liquidity surges and long-term protection against fiat erosion.

The volatility isn’t a bug. It’s the price of optionality in a capital-starved macro regime.

🌍 Macro Lens: Bitcoin as a Liquidity Sponge

Liquidity Sensitivity: Bitcoin’s correlation with global M2 growth is ~0.65 with a 30–90 day lag, confirming it reacts more to aggregate liquidity than to policy rates alone.

Global M2 Surge: As of Q3 2025, global M2 (U.S., EU, China, Japan, UK) exceeds $95 trillion - driven by deficit monetization, shadow liquidity, and sovereign balance sheet expansion.

Shadow Liquidity: Bitcoin prices have responded more to balance sheet expansion and reverse repo drawdowns than to Fed funds guidance.

BTC = the marginal signal for excess liquidity. Gold = the lagging, less responsive cousin.

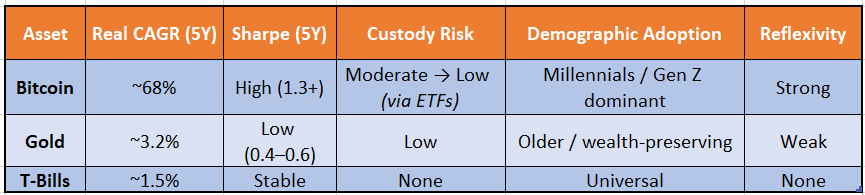

💰 Scarcity vs Sovereignty: Bitcoin vs Gold

Gold is under-owned by those under 40.

Bitcoin benefits from self-reinforcing flows (ETF + social + narrative reflexivity).