Carney’s First 150 Days: The Economic Scorecard Is Failing

Tariffs unresolved, mortgages up, jobs soft - five months in, outcomes beat speeches.

🔑 Executive Summary

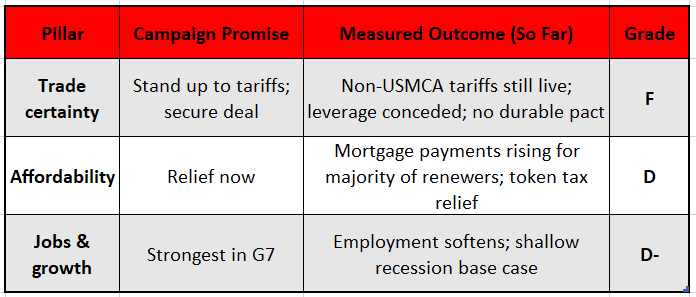

Carney campaigned on a simple triad - shield Canadians from tariffs, restore affordability, deliver top-tier growth - and the tape is grading him harshly.

The U.S. tariff wall on non-USMCA goods still stands, the labour market is softening, and mortgage math is steamrolling talking points as renewal cohorts roll into higher payments.

Yes, most USMCA-qualifying flows remain duty-free, but that doesn’t rescue the outcome that matters: household cash flow and business capex are worse today than on day one. On the three pillars that households feel and markets price - trade certainty, jobs, affordability - the early record is failing.

🚧 Trade & Tariffs: From “Stand Strong” to Standing Still

Promise: Neutralize the tariff threat and lock a durable framework.

Reality: Washington’s 35% levy on non-USMCA Canadian goods (plus transshipment penalties) still applies; no comprehensive deal is in hand despite Ottawa sacrificing leverage (DST shelved).

USMCA-covered flows - the bulk of trade, including most energy - remain exempt, but that is a baseline, not an achievement.

Result: Higher uncertainty premia, deferred capex, creeping collateral damage in trade-adjacent jobs.

A government that ran on “stability” has delivered policy overhang instead of certainty.

🧯 Growth & Labor: The Data Don’t Care About Podiums

Employment rolled over in July; unemployment is stuck in the high-6s and biased higher.

Macro path: A shallow recession through late 2025 is now the base case as trade friction bleeds into hiring, overtime, and hours worked.

If you can’t de-risk the trade channel, you must out-stimulate or de-regulate elsewhere. Neither has appeared at meaningful scale.

🏠 Affordability: Mortgage Math > Messaging

Policy headline: Bottom tax bracket cut to 14%.

Household reality: Fixed mortgage quotes drifted up with GoC term premia and wider lender spreads; ~60% of 2025–26 renewers face higher payments (roughly ~10% in 2025; ~6% in 2026).

Bottom line: Affordability is the monthly payment; it is moving the wrong way. A marginal tax tweak can’t offset renewal shock.

🎯 Inflation & Rates: Cosmetic Win, Structural Problem

Headline CPI briefly printed ~1.9% y/y as goods disinflated, but core is sticky near ~3%.

Tariff pass-through plus expiring relief risk a re-steepen to ~3% into 2026 even with weak growth.

BoC at 2.75%: With the front end pinned, term premium and renewal mechanics are doing the tightening.

The “we beat inflation” victory lap ignores the slope of the curve Canadians actually pay.

🧾 Scorecard vs. Stated Objectives

USMCA keeps most trade duty-free; the failure is not the baseline - it’s the inability to remove the overhang that’s suppressing capex and hiring.

🧱 Counterarguments & Rebuttals

“Most trade is USMCA-exempt.”

Correct - and irrelevant to execution. The promise wasn’t to rely on USMCA’s status quo; it was to defuse the new tariff overhang. That has not happened.

“Global slowdown did this.”

Then where are the offsets? A credible response would trade headlines for deliverables - tariff carve-outs, targeted investment incentives, or real mortgage relief. Five months in, the scoreboard is outcomes, not intentions.

📊 Market Implications & Positioning

Rates and curve - Underweight duration vs Canada Agg; lean to 2s10s or 5s10s steepeners (BoC pinned, term premium sticky). Add on dips in 10y yields; keep tight stops - headline risk is binary.

Credit - Overweight CAD IG vs HY as growth cools and refinancing costs bite; monitor banks’ Stage 1/2 builds through H2 2025.

Equities (Canada) - Underweight domestic cyclicals (autos/parts, discretionary retail).

Energy - most exports remain USMCA-exempt, but policy and input-cost uncertainty still argue for midstream/transport (take-or-pay) over upstream torque.

REITs and Utilities - headwinds from higher 10y cap rates; prefer CPI-linked rents and regulated ROE.

FX - CAD downside skew persists until there is a credible tariff de-escalation path or core CPI breaks lower.

🔁 What Would Change Our View

Tariff roll-offs or carve-outs (especially energy inputs) - lowers pass-through and term premium → duration longs, CAD relief.

Sustained CPI undershoot (headline and core <2% for multiple prints) - opens runway for cuts below 2.75%.

Labor break (UR >7.5% quickly) - flip to bull-steepeners as recession probability dominates.

🥔 Final Take

Carney’s first 150 days promised competence against exogenous shocks; instead we have tariff drag, renewal pain, and softening jobs. That’s not bad luck - it’s bad policy execution.

Until Ottawa converts press conferences into hard deliverables (tariff relief, real mortgage relief, or genuine growth offsets), expect stag-lite: soft growth, sticky core pressure, bear-steepening, and stressed renewal cohorts.

Sources: Bank of Canada; Statistics Canada; Reuters; Associated Press; Financial Times; The Washington Post; Government of Canada; Canadian Mortgage Trends.