Doctor, the Sector Flatlined

Healthcare stocks are on life support - but value is returning

🔑 Executive Summary

The U.S. healthcare sector just triggered a rare historical signal: its worst relative performance to the S&P 500 in over 25 years. According to data from Ned Davis Research, the XLV/SPX total return ratio dropped to 91.56 - an all-time low going back to 1998. Not even the Global Financial Crisis or Obamacare debates pushed healthcare this far out of favor.

This isn’t just a technical footnote - it’s a moment of sector-wide dislocation. Sentiment has collapsed. Positioning has flipped defensive into discard. But under the surface, fundamentals haven’t broken. Free cash flow yields are rising. PEG ratios are compressing. And multiple subsectors - from managed care to life sciences - are trading at multi-year valuation troughs, despite strong cash generation and capital efficiency.

This is how rotation stories begin: not with hype, but with apathy, exits, and ignored upside.

In this post, we launch our Sector Series with a breakdown of healthcare’s capitulation - the macro mispricing driving it, the subsectors most exposed, and the conditions that could catalyze the next wave of defensible, long-duration upside.

🌍 Macro Lens: The Healthcare Regime Repricing

The healthcare sector hasn’t broken - it’s been macro’d out of the market.

Over the past 18 months, the macro regime has shifted violently against defensives. Healthcare got caught in the crossfire of four major structural headwinds:

🔺 Real Yields Ripping Higher

Healthcare acts like a long-duration equity bond - predictable cash flows, low volatility, modest growth.

Real yields surged to multi-decade highs, compressing valuation multiples sector-wide.

The market repriced the sector’s discount rate, not its cash flow - a classic derating without deterioration.

🔺 AI Mania + Risk-On Rotation

Capital rotated sharply into semis, industrials, and AI-linked names - leaving defensives behind.

Healthcare became a funding source as hedge funds and allocators chased momentum themes.

Even dominant compounders (LLY, TMO, ISRG) were punished - not for performance, but for not being AI enough.

🔺 U.S. Election Overhang

Market pricing reflects full fear of:

• Medicare reform

• Drug pricing intervention

• Anti-M&A scrutinyValuations in pharma and managed care suggest markets are pricing in worst-case policy risk.

Historically, these fears fade post-election - but the dislocation is already priced in.

🔺 Late-Cycle Confusion

Healthcare traditionally outperforms late in the cycle as a defensive growth anchor.

But fiscal stimulus and AI capex have distorted timing - delaying the normal rotation.

The setup is now compressed spring-style: when liquidity tightens or growth disappoints, healthcare may lead defensives higher.

💰 Valuation Framework: Mispriced Duration, Not Broken Earnings

Healthcare hasn’t fallen apart - it’s just been repriced. And in relative terms, it’s now trading at levels that mark decade-level dislocations. This isn’t deep value in the classic sense - earnings haven’t collapsed. What we’re seeing is mispriced cash flow duration in a regime that’s temporarily rewarding volatility and narrative, not stability and cash return.

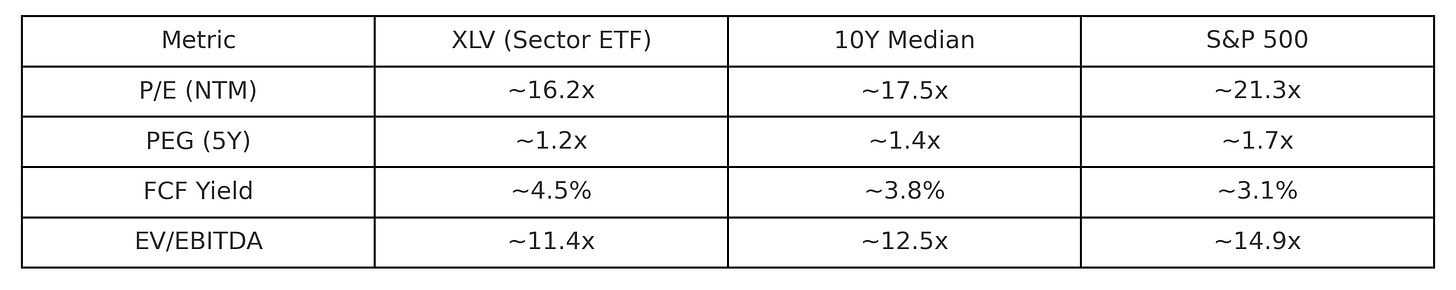

🧮 Core Valuation Metrics

PEG ratios have compressed while FCF yield spreads have widened.

XLV now trades at ~16.2x forward P/E, far below the S&P 500 at over 21x.

The FCF yield gap vs the index is ~140bps - the widest in more than a decade.

Several large-cap constituents offer scenario-weighted IRRs of 10–15%, backed by stable margins, modest leverage, and clear capital return policies.

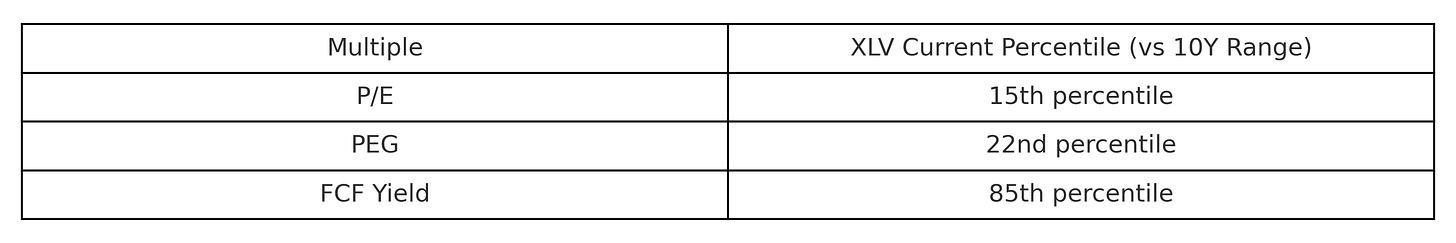

⏳ Historical Percentile Context

Relative to its own history, healthcare is trading at rare levels of neglect - not just cheap, but underappreciated for its risk-adjusted quality.

Forward P/E sits in the 15th percentile versus its 10-year range.

PEG ratio is in the bottom quartile, signaling market disinterest in steady compounders.

FCF yield is in the 85th percentile - investors are being paid more per dollar of cash flow than almost any time in the past decade.

That’s not a red flag. That’s a starting gun - especially in a sector with optionality, durability, and no need for narrative tailwinds to deliver returns.

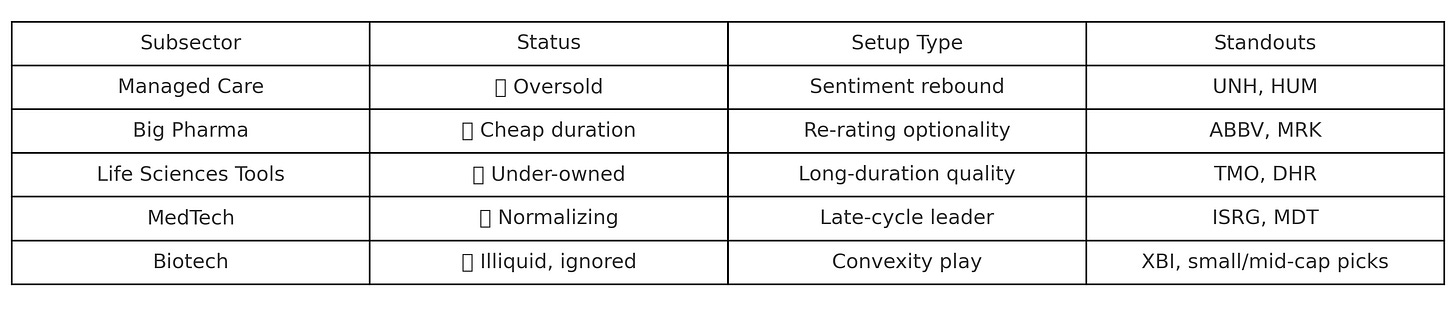

🧬 Subsector Breakdown

Healthcare isn’t a monolith. It’s a cluster of subsectors - each with different exposures to macro, regulation, and innovation. While the sector overall has de-rated, the pain and opportunity are not evenly distributed.

🏥 Managed Care (UNH, HUM, CI)

Why it’s down: Political overhang. Investors pricing in Medicare reform & reimbursement caps.

What matters: Enrollment stability, cost discipline, post-election clarity.

Our view: Valuations imply full policy shock. These names typically lead in risk-off rotation.

💊 Big Pharma (ABBV, PFE, JNJ, MRK)

Why it’s down: Patent cliffs, pipeline anxiety, pricing fears.

What matters: GLP-1 tailwinds, biosimilar impact, policy tone.

Our view: Cheapest duration in the market. PEGs ~1.0. Cash flow stable. Regulatory fears overstated.

🧪 Life Sciences Tools & Diagnostics (TMO, DHR, IQV)

Why it’s down: Biotech funding softness → tool demand slowdown.

What matters: CapEx recovery, metabolic testing, GLP-1 spillover.

Our view: High-quality names unfairly punished. This is long-duration optionality.

🧠 MedTech & Robotics (ISRG, SYK, MDT)

Why it’s down: Delayed elective recovery, international softness.

What matters: Procedure volume normalization, hospital CapEx.

Our view: Durable platforms + fast compression of valuation risk.

🧬 Biotech (XBI, ARKG basket)

Why it’s down: Liquidity drought, IPO freeze, M&A void.

What matters: Fed pivot, pipeline wins, large-cap M&A.

Our view: Optionality segment. High convexity, low expectations. Sector trades near book - historically a bottoming level.

Tactical Overlay: For convex exposure, long-dated XLV calls or biotech call spreads (XBI LEAPS, 10–15 delta) offer risk-defined upside on mean-reversion. No rerating needed - just macro normalization.

📉 Sentiment & Flows

If valuation is the math, sentiment is the dislocation - and healthcare is deep in the behavioral penalty box.

Despite steady fundamentals, the sector is being treated like it’s structurally broken. That disconnect is exactly where mispricing lives.

🧯 Institutional Positioning

Hedge funds have rotated out of defensives in favor of AI, cyclicals, and industrial beta.

Prime brokerage data shows multi-year low exposure to managed care and pharma.

📤 ETF & Fund Flows

XLV has seen sustained outflows YTD.

XBI had its worst 3-month stretch of outflows since 2016.

Retail ownership is also down sharply in UNH, MDT, and others.

😐 Narrative Mood

Surveys show healthcare near the bottom of sector preferences.

Strong earnings (e.g. TMO, HUM) met with shrugs or further selling.

Sector disconnected from risk-off flow - investors still chasing offense.

👀 What This Tells Us

This is not a story of earnings misses - it’s a story of narrative rejection.

Flow-driven drawdowns like this tend to overshoot - and snap back just as violently.

Quant Insight: Econometric patterns show this setup matches past sector reversals - high deviation from trend, positioning skew, and macro pressure. These reversals often re-rate before earnings catch up.

🥔 Final Take

This isn’t a bet on better headlines - it’s a bet on better math.

The healthcare sector is one macro regime shift away from a full re-rating. Duration is cheap. Flows are gone. Optionality is building.

This setup embodies the Potato Capital philosophy: capital-efficient cash flows, ignored by trend chasers, with IRR-driven upside built into the math - not the mood.

We’re overweighting our attention here. The apathy won’t last forever.