Fed to 3.0%

The New Neutral and What It Means for Markets

🔑 Executive Summary

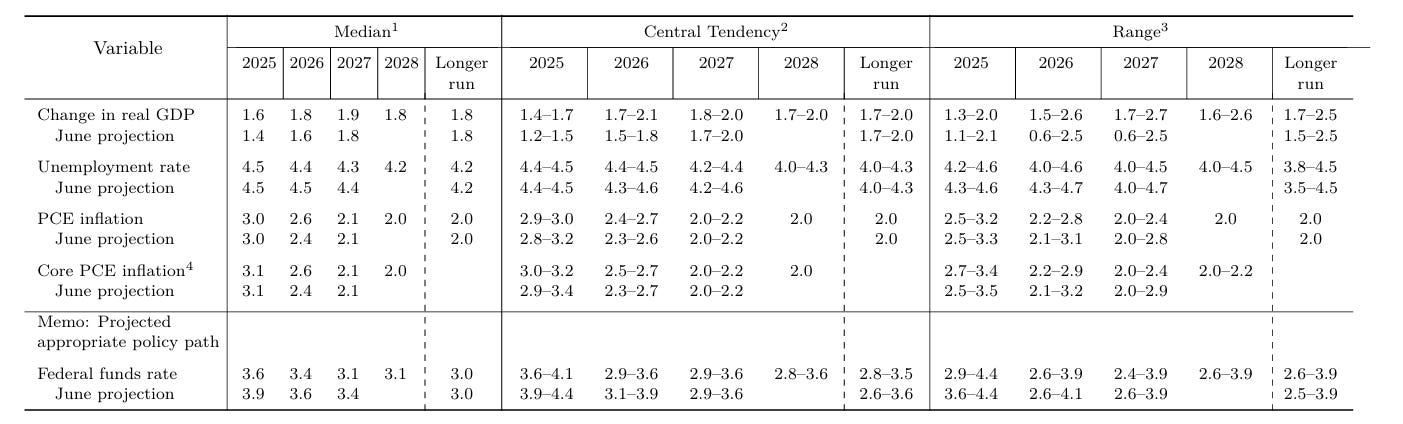

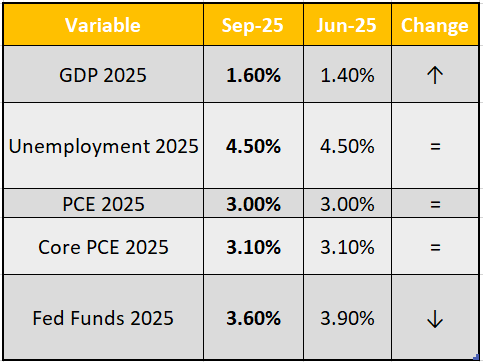

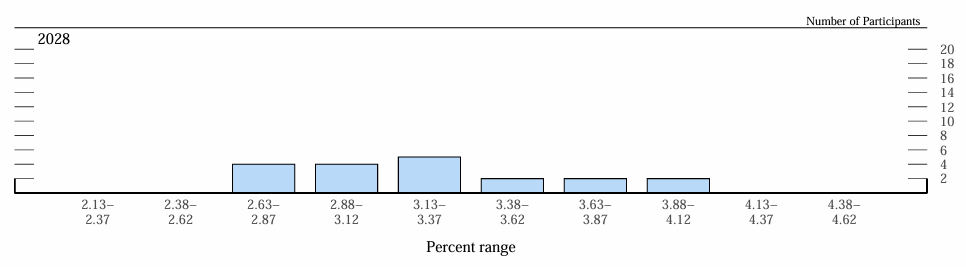

The Federal Reserve’s September Summary of Economic Projections (SEP) marked a subtle but important pivot. The near-term path for policy rates shifted lower, with the 2025 Fed Funds median moving to 3.6% from 3.9% in June. At the same time, the long-run neutral rate was reaffirmed at 3.0% - a level well above the 2.5% anchor markets grew accustomed to during the 2010s. Growth expectations were revised modestly higher, unemployment is projected to peak at just 4.5%, and inflation is expected to glide slowly toward target, reaching 2.0% by 2028.

This combination tells us two things: (1) the Fed believes the economy is resilient enough to withstand higher real rates than before, and (2) the era of “free money” is not coming back. A 3% neutral rate permanently raises the hurdle rate for every asset class.

Carry trades remain compelling, equities can still deliver upside, and smart stock selection plus hedging will generate alpha. The ZIRP-era “buy everything” playbook is gone, but this is not a bearish setup - it is a more selective, balanced, and convex one.

🧾 What Changed vs June & Historical Context

SEP vs June (medians):

Historical analogs:

1994-95 soft landing: Fed cut ~300 bps; S&P +37.6% in 1995, HY spreads tightened materially.

2004-06 tightening: Fed hiked to 5.25%; S&P cumulative +34%, HY spreads widened late.

2019-20 insurance cuts: Fed trimmed 75 bps; equities rallied until Covid shock.

The lesson: policy easing into growth resilience often delivers strong returns.

🌐 The Macro Lens - A Higher Neutral World

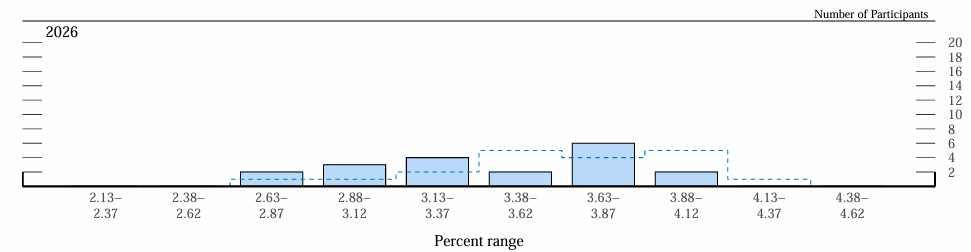

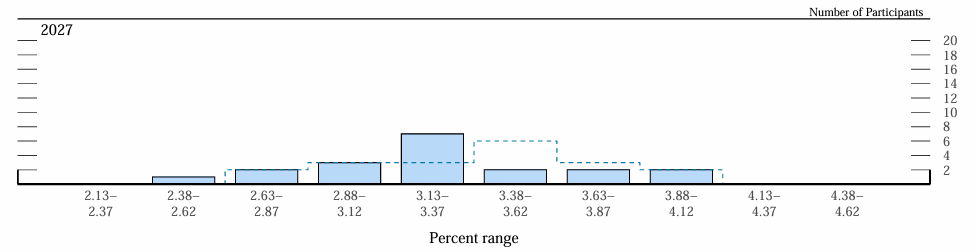

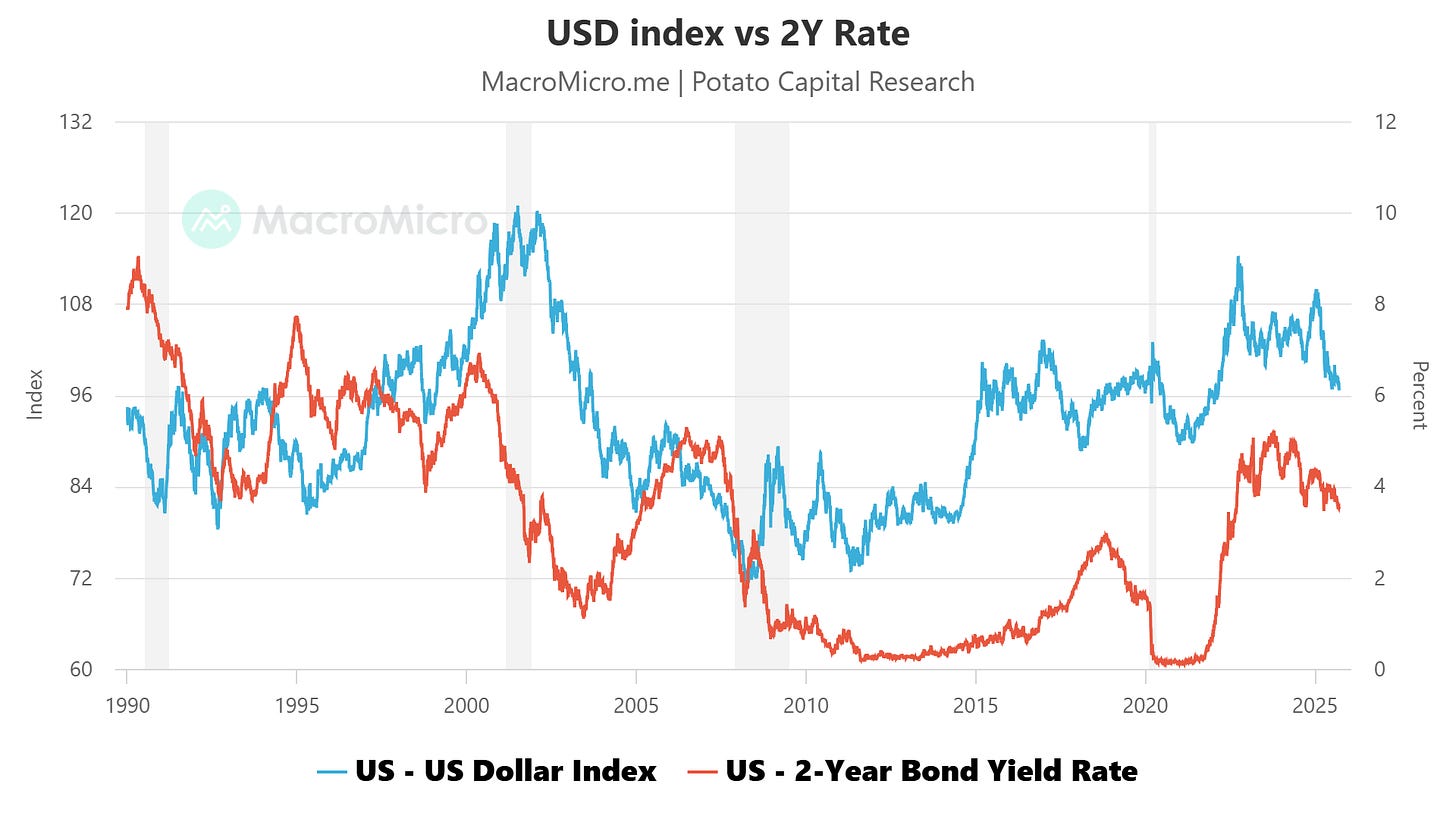

The Fed’s reaffirmation of a 3.0% long-run rate implies a real neutral (r*) of ~1%. That is double the 2010s average. Markets are still catching up: Fed Funds futures price a terminal ~3.1% by end-2026, while the SEP dots show 3.4%.

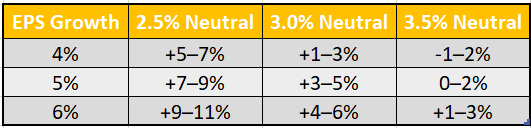

Why does neutral matter? Because it is the discount rate for all future cash flows. Every 50 bps added to r* trims ~1-1.5 turns off fair-value SPX multiples. It is the difference between a 20x market and an 18x market.

This isn’t bearish - it simply means multiples won’t expand recklessly. Growth, earnings, and stock selection matter more than cheap money.

💰 Valuation Framework - IRR in a 3% World

Equities, bonds, and credit now have to be judged against a materially higher neutral rate. That changes the relative playbook:

Equities: At 3.0% neutral, the market’s fair multiple is ~18x. That implies mid-single-digit equity IRRs, not the double-digit surges of the ZIRP era. Importantly, leadership narrows - stock selection is everything. Companies with ROIC > WACC spreads and balance-sheet strength deserve premium multiples; capital-intensive laggards do not.

Bonds: The cleanest carry. A 10Y UST at ~4.0% already pays investors for simply holding duration. If yields roll down the curve as the Fed cuts, investors pick up another 200–250 bps of performance. Convex upside remains if disinflation accelerates.

Credit: Investment grade offers reliable carry with spreads ~100 bps, producing ~5-6% IRRs. High yield screens attractively on paper at ~8-9%, but the 2026-27 refinancing wall looms large. HY outperforms in bull scenarios, underperforms in base and bear.

SPX IRR Sensitivity (Neutral Rate vs EPS Growth):

📊 Scenarios and Probabilities

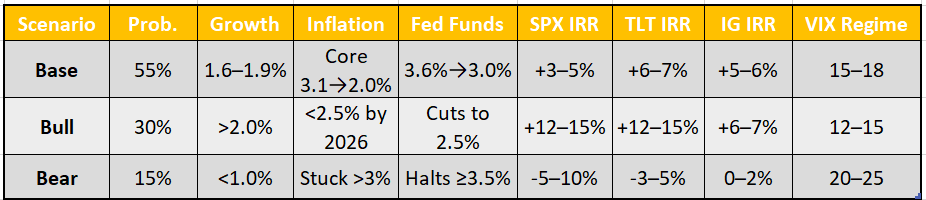

The path forward isn’t a single line, it’s a distribution. We think about the next 12-18 months as a weighted set of regimes:

Base Case (55%): The Fed follows its dots, cutting toward 3.0% by 2026. Growth runs modestly, unemployment peaks just above 4.5%, and inflation drifts lower. SPX ekes out mid-single-digit returns, bonds deliver ~7%, and volatility stays subdued in the 15-18 range. This is “carry works, equity selective.”

Bull Case (30%): Disinflation accelerates, with core PCE falling below 2.5% by 2026. The Fed is able to cut more aggressively toward 2.5% without sacrificing credibility. Multiples re-expand toward 20x, SPX delivers double-digit IRRs, and TLT rallies 50-75 bps. This is where equities and duration both pay, with VIX in the low teens.

Bear Case (15%): Services inflation proves sticky, forcing the Fed to halt cutting at or above 3.5%. Growth stalls <1%, and unemployment ticks higher. Equities derate 2-3 multiple turns, credit spreads widen, and long-end yields drift higher on fiscal stress. VIX jumps into the 20-25 range. This is where convex hedges matter.

🌍 Cross-Asset and Global Divergence

Policy divergence is central. With the Fed’s neutral ~100 bps above the ECB’s, the dollar retains a structural bid, trimming 20-25% of S&P earnings that are foreign-sourced.

Gold remains inversely linked to real yields, with a beta ~-0.6. At 10Y reals near 2%, fair value sits $3,200-3,400. But central-bank buying and fiscal deficits add convexity: optionality to $3,600+.

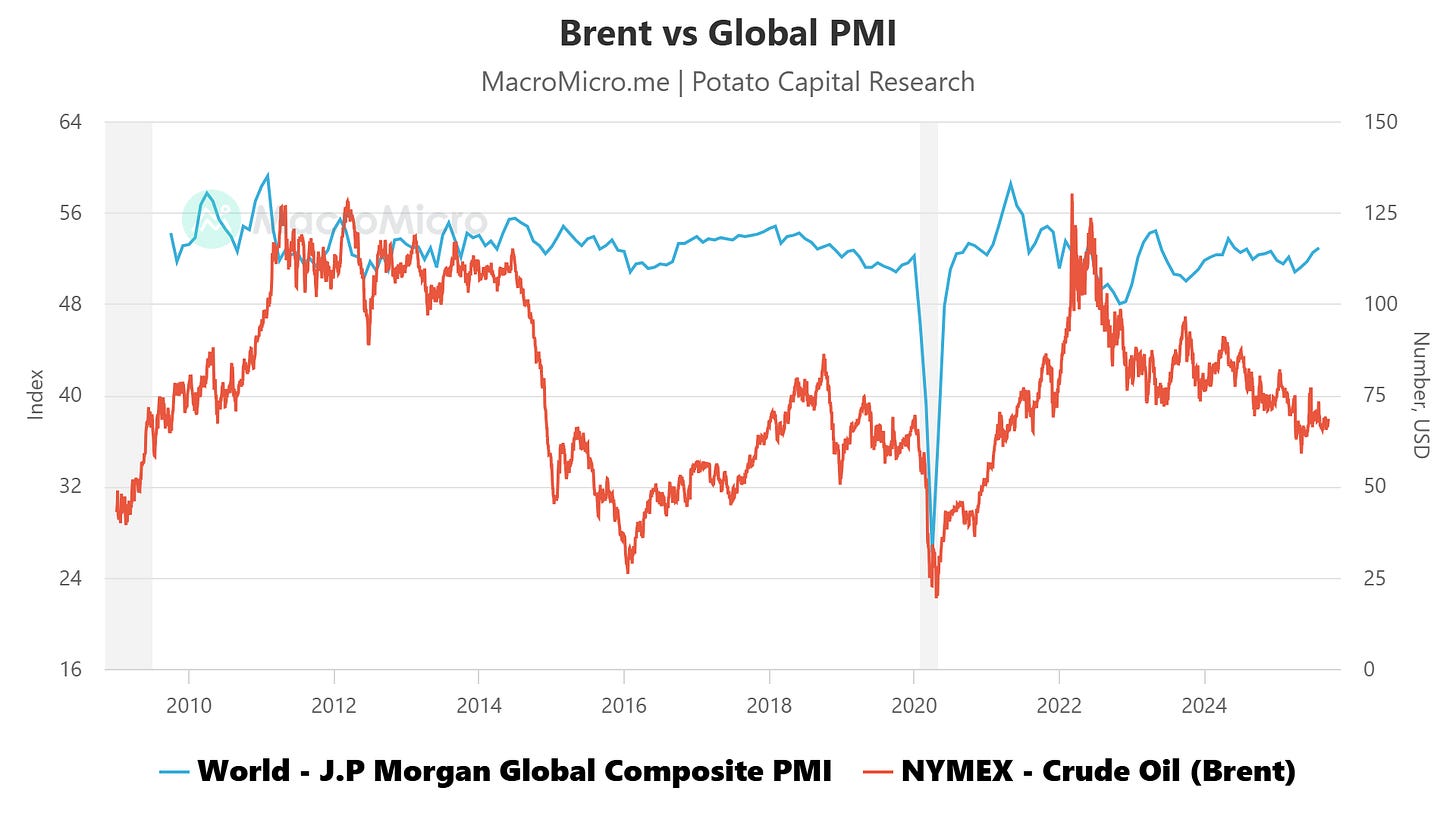

Oil should remain firm, with Brent in the $85-95 range under soft-landing demand.

🏦 Liquidity, QT, and Fiscal Drag

Liquidity dynamics are crucial.

Money market funds: Assets stand at $7.3-7.4T. Even a 10% rotation = ~$700B, easily outpacing typical annual equity inflows.

QT: The Fed still drains ~$95B/month, ~$1.1T annually. That offsets some of the easing.

Fiscal: Deficit ~6% GDP; ~$2T issuance supply pressures the long end.

Flows are sequenced: institutions first shift bills → bonds → IG, with equities catching inflows later. Retail, conditioned by 5% “risk-free” yields, will rotate more slowly.

⚠️ Risks and Optionality

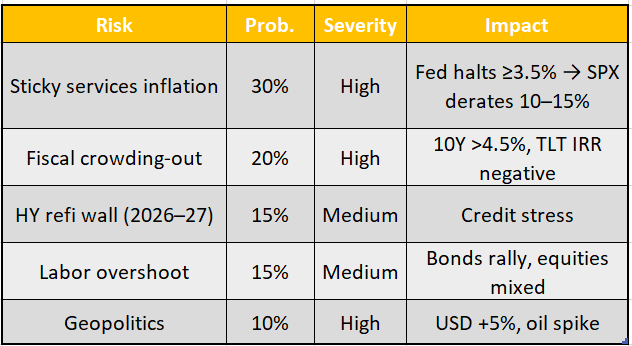

Risks in this cycle are asymmetric - the Fed has room to ease, but sticky inflation or fiscal stress can quickly cap upside. What matters isn’t just the risks themselves, but the mechanism:

Sticky services inflation (30% / high): If inflation stalls above 3%, Powell is forced to halt cuts ≥3.5%. That implies ~2–3 turns of SPX multiple compression and a return of 20+ VIX.

Fiscal crowding-out (20% / high): With ~$2T issuance, if term premium rises, 10Y >4.5% is possible. That turns TLT negative and crimps equity valuation.

HY refi wall (15% / medium): ~$1T in maturities during 2026–27 must refinance at 7–9% vs 3–4% in 2021. That widens spreads and raises tail risk for credit.

Labor overshoot (15% / medium): If unemployment spikes >5.5%, Fed cuts accelerate. Bonds rally, but equities face margin pressure.

Geopolitics (10% / high): Oil spikes and USD strengthens — stagflation-lite scenario.

Optionality sits on the upside: a disinflation surprise (10%) could push Fed Funds toward 2.5%, lifting TLT +15% and SPX +12%.

🥔 Final Take

The Fed trimmed the path but not the mission. Neutral is 3%, not 0%. That means:

Carry wins: Bonds and IG credit offer steady mid-single-digit IRRs, with convex upside if disinflation accelerates.

Equities still work - selectively: SPX delivers mid-single-digit IRRs in base, but double-digit upside is achievable in bull scenarios.

Liquidity caveat: QT and deficits temper the tailwinds, but not enough to derail risk assets.

Convex hedges required: Sticky inflation and HY refinancing risks keep downside tails alive.

Stock selection drives alpha: With beta capped, alpha shifts to high-ROIC compounders, capital-efficient cyclicals, and secular growth winners. This is where outperformance will be generated.

The SEP validates a soft-landing with higher neutral framework. Upside is convex, downside can be hedged, and dispersion creates opportunity.

Sources: Federal Reserve SEP (Sept 2025), ICI Money Market Fund Statistics (Sept 2025), ICE BofA Credit Indices, WSJ/MarketWatch Treasury data, World Gold Council, MacroMicro, Slickcharts historical returns, Potato Capital Research estimates.