🥔 Potato Capital Research Report - Cal-Maine Foods (CALM)

November 17th, 2025

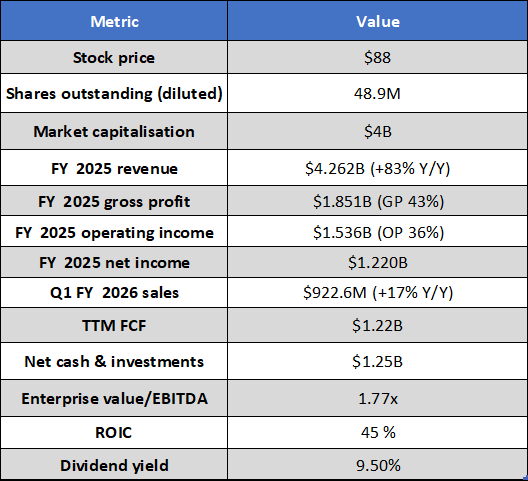

📌 Cal-Maine Foods, Inc. (NASDAQ:CALM)

Rating: Deep Value / High Upside

Base Case Fair Value: ~$333

Scenario-Weighted Fair Value: ~$333

Expected 12-Month IRR: ~278%

Conviction Tier: High

Thesis: Cal‑Maine Foods is the largest U.S. shell‑egg producer with a vertically integrated business model. FY‑2025 earnings surged because of historically high egg prices driven by avian‑influenza‑related supply constraints, while feed costs fell. The company generated exceptional free cash flow and built a fortress balance sheet with over $1 billion of net cash. However, the business is highly sensitive to egg prices and feed costs; FY‑2025 results are unlikely to be sustainable. Even under conservative assumptions the shares appear undervalued relative to peers, offering optionality from the company’s diversification into specialty eggs and prepared foods and potential multiple expansion.

🔑 Executive Summary

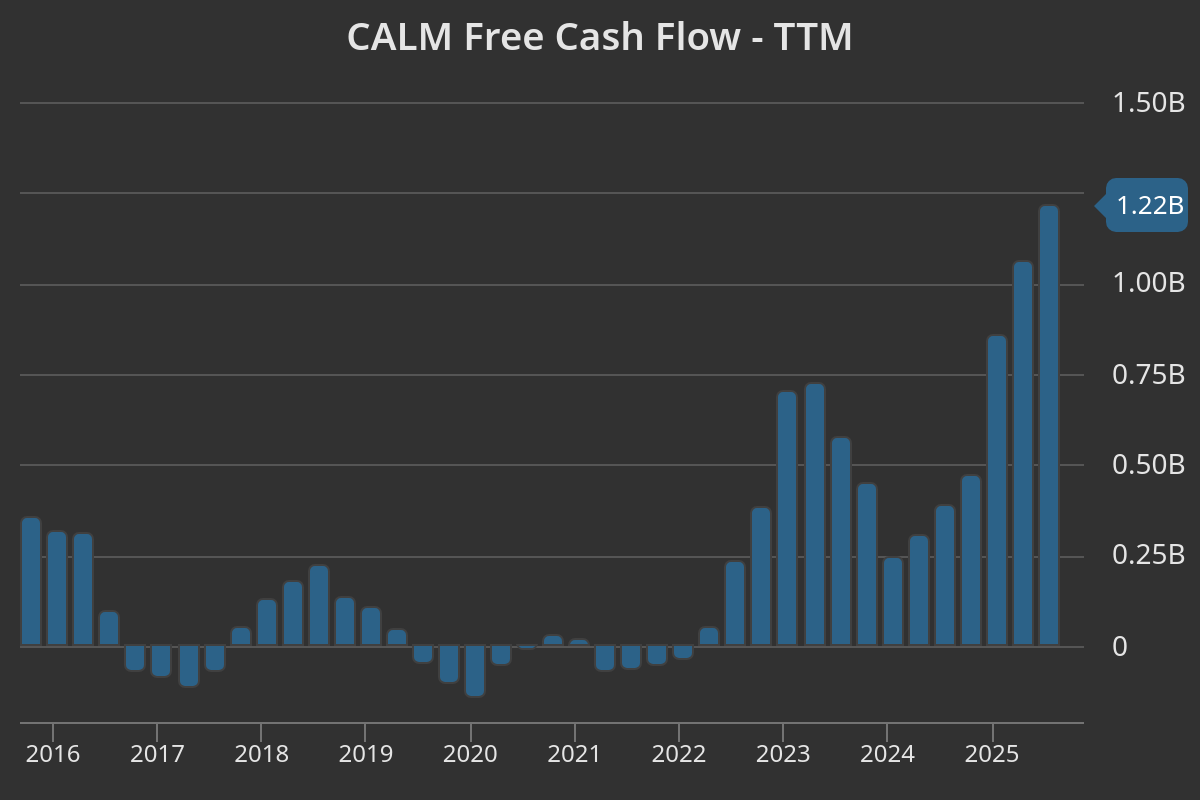

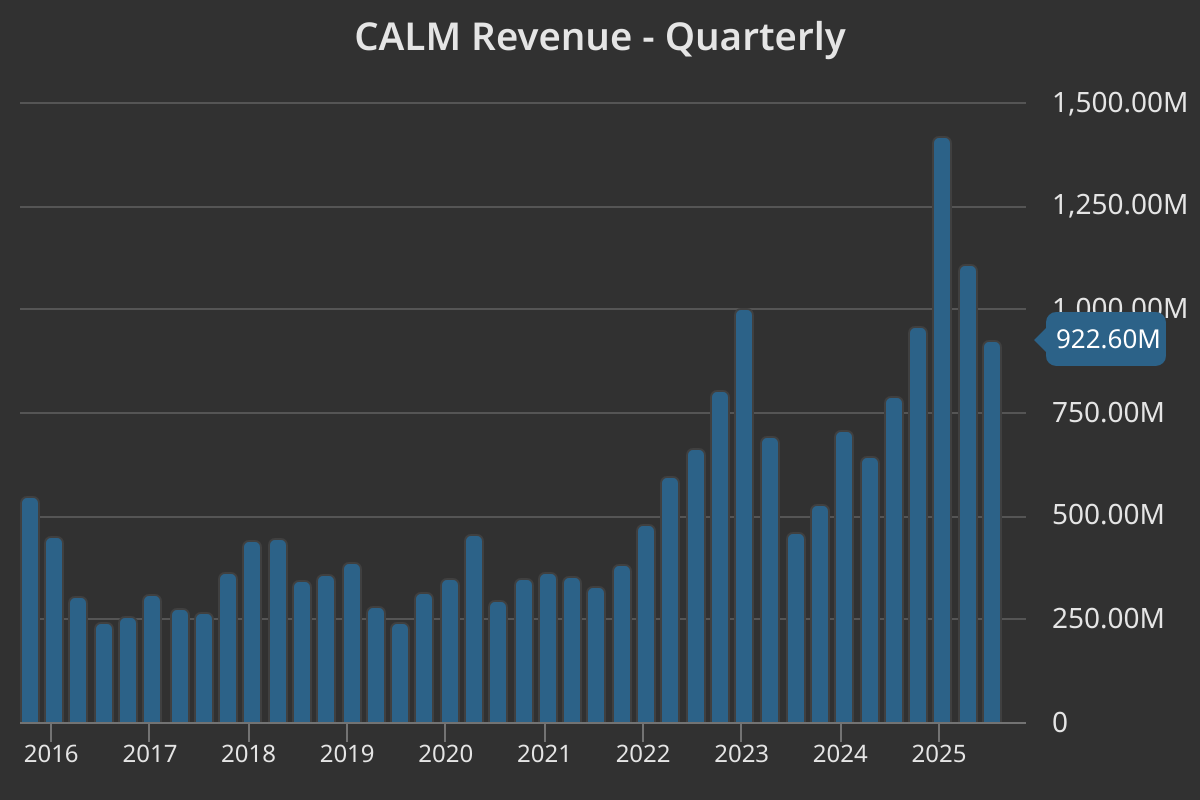

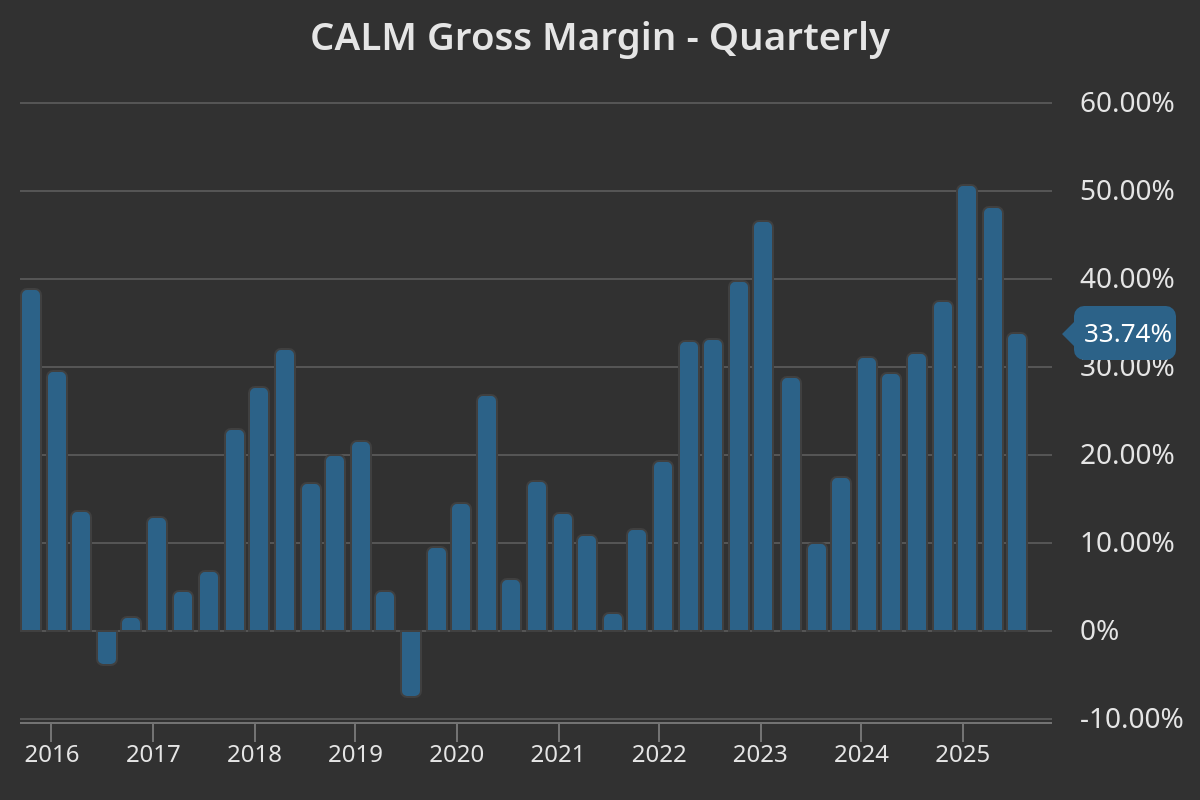

Cal‑Maine Foods (NASDAQ: CALM) produced record results in FY‑2025, with net sales up 83% to $4.26 billion and net income up >300% to $1.22 billion. Gross margin expanded to 43% and operating margin to 36% as the average selling price of conventional shell eggs more than doubled to $3.49 per dozen, while feed costs per dozen fell 11%. FY‑2025 free cash flow exceeded $1 billion, allowing Cal‑Maine to finish the year with net cash of about $1.25 billion and payout over $406 million in dividends. Q1 FY‑2026 results remained strong: net sales were $922.6 million, operating income $249.2 million and net cash from operations $278.6 million.

The company is accelerating a strategic shift toward higher‑margin specialty eggs and prepared foods. Specialty eggs and prepared foods together accounted for nearly 40% of Q1 FY‑2026 net sales. The acquisition of Echo Lake Foods (June 2025) expands Cal‑Maine into value‑added egg‑based foods and is expected to be accretive beginning FY‑2026. Meanwhile the company maintains disciplined capital allocation: reinvesting in cage‑free facilities, investing $15 million to expand Echo Lake capacity, and preserving balance‑sheet strength while authorizing up to $500 million in share repurchases.

Macro risks remain significant. Egg prices are volatile, depending on supply (highly pathogenic avian influenza outbreaks) and consumer demand, while feed costs are influenced by corn and soybean prices. A normalised pricing environment could compress margins dramatically; FY‑2024 revenue and net income were $2.33 billion and $277.9 million, respectively. Scenario‑weighted DCF analysis suggests intrinsic value around $333/share, well above the current ~$88 price; however, this valuation is highly sensitive to assumptions about egg price normalization and discount rates. Cal‑Maine’s high dividend yield and net‑cash balance provide a margin of safety, but investors should expect earnings volatility.

🧾 Earnings Recap

Fiscal 2025 vs. Fiscal 2024

Cal‑Maine operates on a May year‑end. FY‑2025 results were extraordinary compared with FY‑2024:

Net sales: $4.2619 billion, up 83% from $2.3264 billion in FY‑2024. Shell egg sales rose 81% to $4.02 billion, egg products & prepared foods 123% to $198.8 million, and other sales 115% to $43.1 million.

Gross profit: $1.8509 billion versus $541.6 million in FY‑2024. Gross margin expanded from 23.3% to 43.4%.

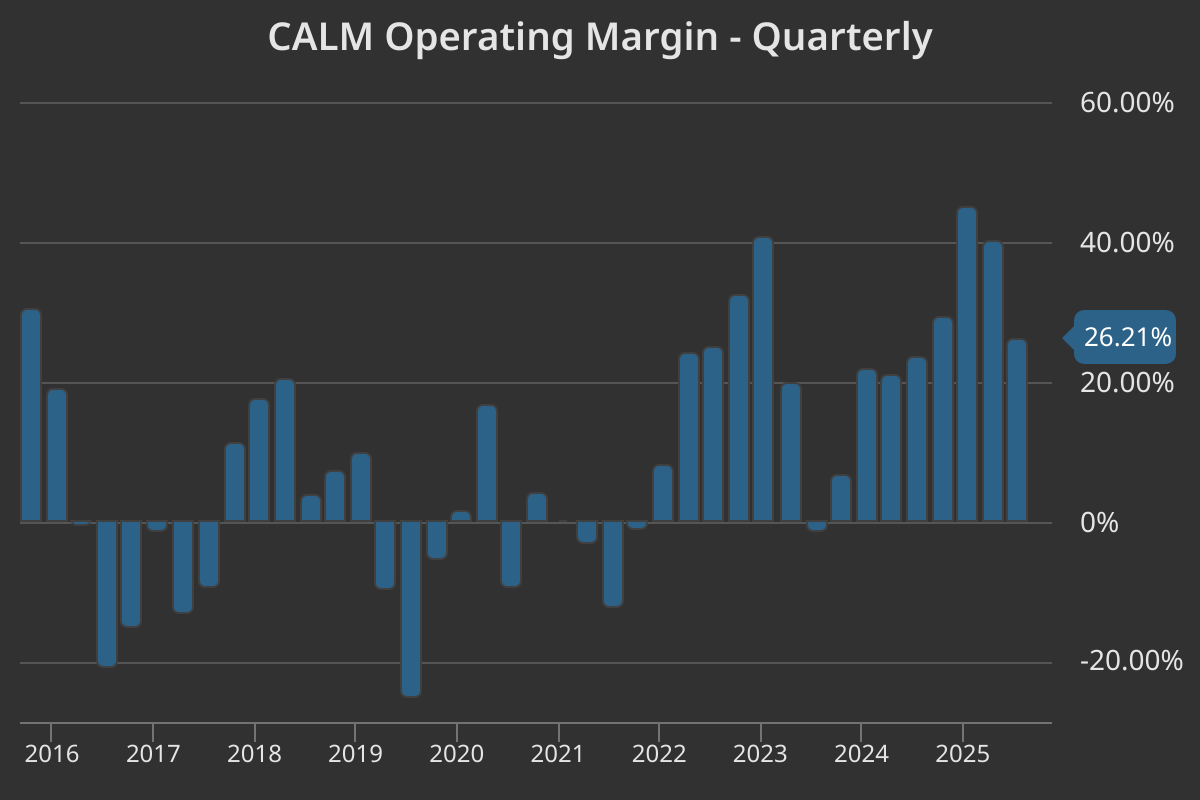

Operating income: $1.5365 billion versus $312 million; operating margin increased from 13.4% to 36.0%.

Net income: $1.220 billion, up from $277.9 million.

Dozens sold: 1.28 billion dozen, up 11.8%; conventional dozens rose 8.8% to 812 million while specialty dozens rose 17% to 470 million.

Average selling price: Conventional egg price surged to $3.49 per dozen versus $1.73 in FY‑2024; specialty eggs averaged $2.519 per dozen, up 9%.

Feed cost per dozen fell to $0.49 from $0.55.

Management attributed the revenue surge to a resurgence of highly pathogenic avian influenza (HPAI) during FY‑2025, which reduced the national layer flock and drove egg prices to record levels. The company also benefited from lower feed costs as corn and soybean prices declined.

Q4 FY‑2025

The Q4 FY‑2025 investor presentation (July 2025) reiterates that Cal‑Maine remains the nation’s largest egg producer and highlights its move toward specialty eggs and prepared foods. Management emphasized strong cash generation, disciplined reinvestment, and plans to maintain dividends and opportunistic buybacks.

Q1 FY‑2026

Key metrics from the Q1 FY‑2026 presentation include net sales $922.6 million, gross profit $311.3 million, operating income $249.2 million, net income $199.3 million, diluted EPS $4.12, and net cash flow from operations $278.6 million. Specialty eggs and prepared foods together accounted for nearly 40% of net sales, demonstrating continued diversification. Management highlighted that Echo Lake contributed $70.5 million of revenue and is expected to be mid‑single‑digit accretive with returns above Cal‑Maine’s cost of capital.