🥔 Potato Capital Research Report - Photronics (PLAB)

September 18, 2025

📌 Photronics, Inc. (NASDAQ: PLAB)

Rating: Buy (Undervalued) | Conviction: Mid-High

Current Price: $24.95

Base 12-Mo Target: $31.00

Scenario-Weighted Fair Value (today): $48.50/sh

Expected 12-Mo Return (Base): 24.2%

Scenario-Weighted Annualized IRR to FV (3-yr realization): 25.2%

🧭 Executive Summary

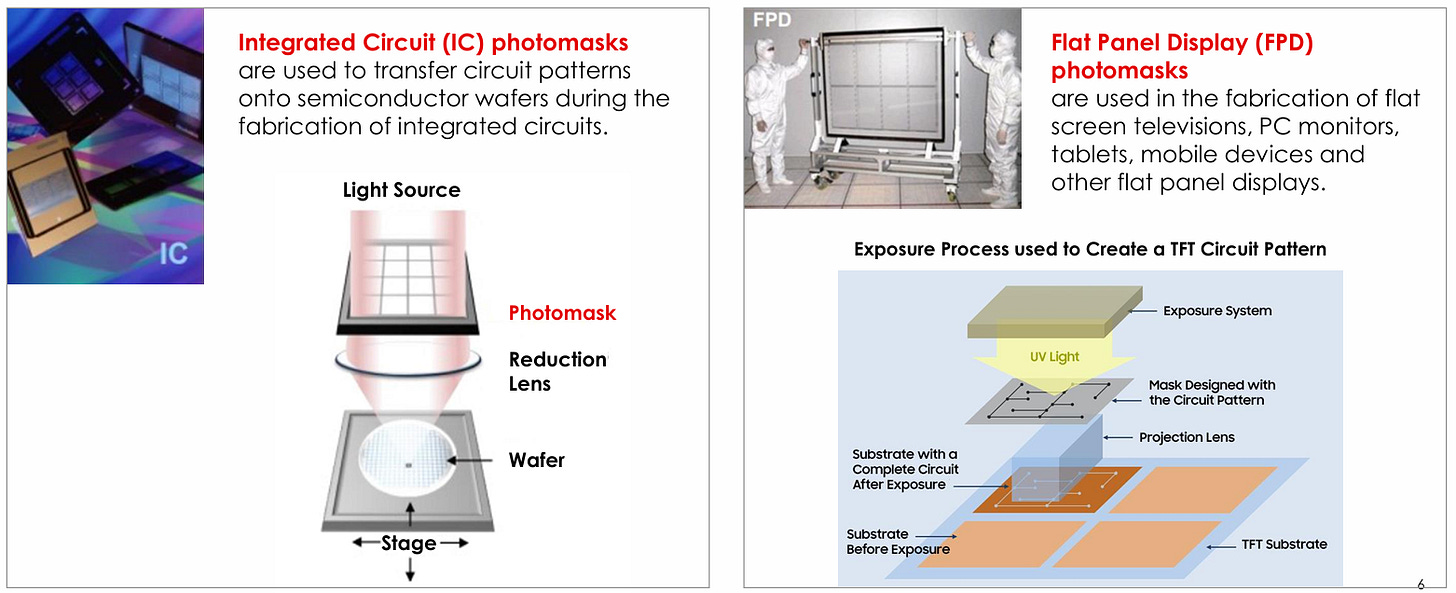

Photronics (PLAB) is a scarce, mission-critical merchant in photomask - the lithographic master template for integrated circuits (IC) and flat-panel displays (FPD). Its economics are driven less by wafer units and more by mask-set intensity, turn-time, and yield credibility. The firm is the only high-end commercial mask producer in the U.S., the largest commercial supplier in Taiwan, and runs a net-cash balance sheet of roughly $576M. Yet the market prices it like a commodity cyclical at ~3.1× EV/EBITDA.

Investors are extrapolating IC mainstream softness and foreign-exchange (FX) translation noise just as three supportive arcs intersect: (i) U.S. high-end qualification and ramp, (ii) AMOLED (active-matrix organic light-emitting diode) / G8.6-G10.5 FPD adoption, and (iii) 3nm→2nm foundry migration that increases layers, write times, and average selling price (ASP) per set. Our discounted cash flow (DCF) using a four-path × three-scenario framework, built on explicit year-by-year free cash flow (FCF), blends to $48.50/sh (Base $46-52; Bull $56-62; Bear ~ $40). With a balance sheet that lets management invest through the cycle and repurchase stock at a 24.8% annualized IRR (assumes 3-year convergence to $48.50), we see ~2× upside on normalization and a 25.2% scenario-weighted annualized IRR to fair value.