🥔 Potato Capital Research Report - Roblox Corporation (RBLX)

August 29, 2025

📌 Roblox (NYSE: RBLX)

Rating: Short

Spot Price: $127

Blended Fair Value (Updated): $27/sh

Base 12-mo Target: $26

Scenario-Weighted Target: $27

Expected 12-mo IRR: -65% to -90%

Conviction Tier: High-Conviction Short (Regulatory Fragility)

🔑 Executive Summary

Roblox (RBLX) runs one of the world’s largest user-generated gaming platforms. Players buy Robux (virtual currency) and spend it inside creator-built experiences; creators receive cash payouts; Roblox keeps the spread. The operating engine is DAUs × monetization per user (bookings/user), with a moderation stack and cloud infra running behind the scenes.

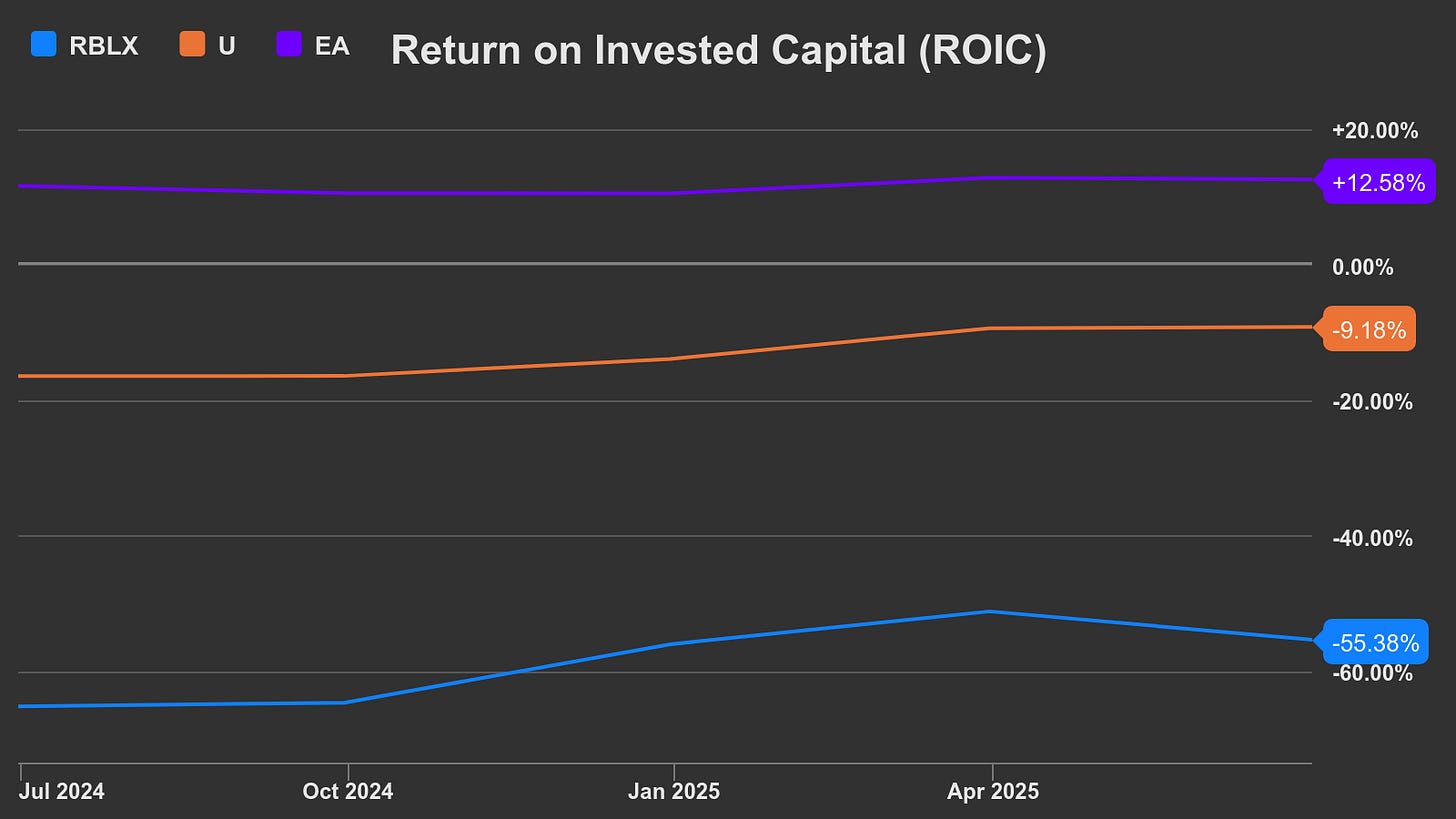

Scale is real - 111.8M DAUs generating 27.4B hours in Q2’25 - but monetization per user has stalled (average bookings per paying user/MUP -$20, low-single-digit growth) while unit costs rise. Developer payouts (≈20%+ of bookings), Trust & Safety and infra (low-teens % of bookings), plus heavy SBC dilute the margin pool. The result is negative ROIC vs ~11% WACC - more users don’t produce operating leverage; they increase moderation intensity and legal exposure.

The narrative has flipped from metaverse compounder to child-safety crisis and regulatory drag. Litigation and policy regimes (state AGs, FTC/COPPA, EU DSA, UK OSA) now set the pace of news flow. Each enforcement step or headline can dent bookings, raise costs, or restrict access - especially because parents ultimately gate usage.

We anchor FY25 to Roblox’s FCF guidance (~$1.05B midpoint) and run our 4-path DCF (5Y/10Y × PG/EM) across Bull/Base/Bear. The scenario-weighted fair value is ~$27/sh. Today’s $127 implies -79% Base IRR over 12 months. Even Bull (14% rev CAGR, margin lift, 10% WACC) caps at ~$44-54/sh - still ~65% downside. Bear/Stress cluster $10-21/sh. There is no plausible upside path that supports triple-digit prices.

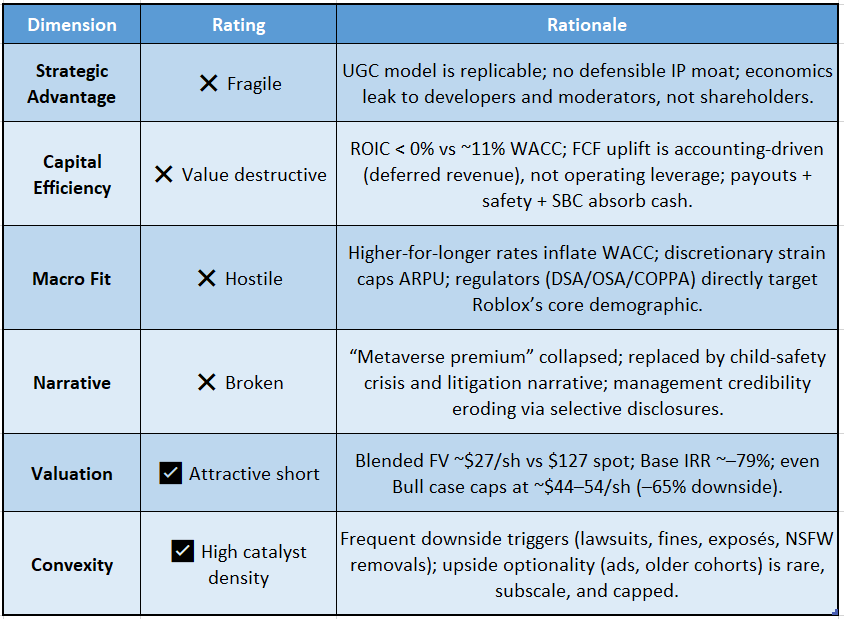

Roblox is priced like a durable compounder but behaves like a terminal-value mirage: activity scales, owner economics do not. Legal and parental gatekeeping create one-way convexity for shorts - frequent downside catalysts, capped upside.

📉 Quarterly Earnings Recap (Q2’25)

Roblox delivered headline growth in Q2’25, but the economics show a widening contradiction between scale and profitability.

Revenue: $1,080.7M (+21% YoY, flattered by a $58.9M Q2’24 revenue acceleration).

Bookings: $1,437.6M (+51% YoY) - outpacing revenue, as deferred revenue inflows continue to swell.

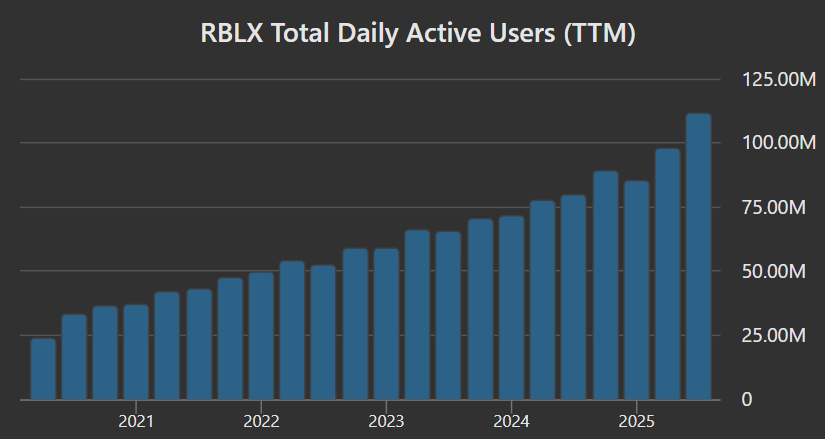

DAUs: 111.8M (+41% YoY), a record.

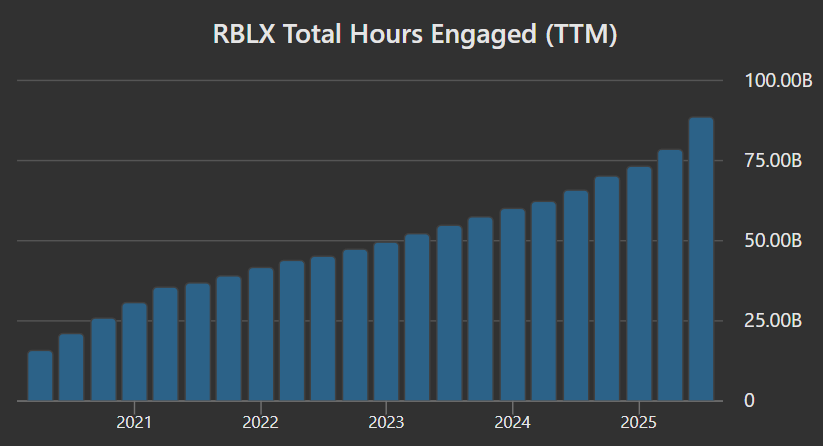

Hours Engaged: 27.4B (+58% YoY), another record.

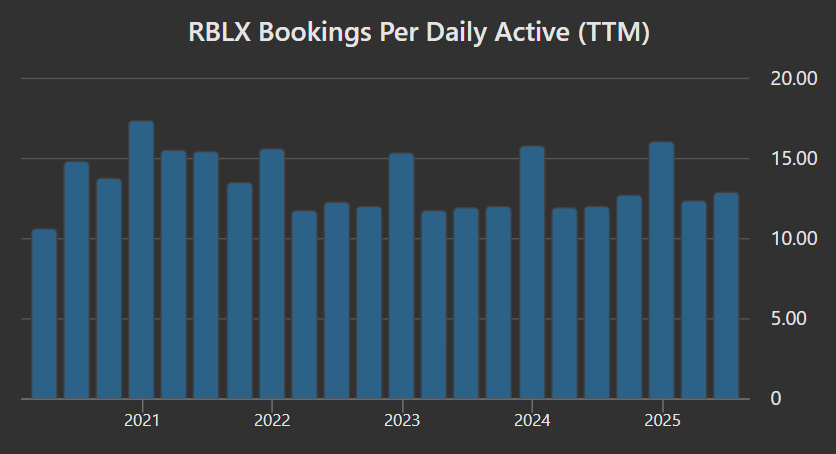

Avg Bookings/MUP: $20.48 (+6% YoY), with regional divergence (U.S./Canada +18%, International +11%).

Developer Exchange Fees: $316.4M (≈22% of bookings) - structurally dilutive.

Infra & Trust/Safety: $152.6M (≈11% of bookings).

Net Loss: –$279.8M; Adj. EBITDA: $18.4M.

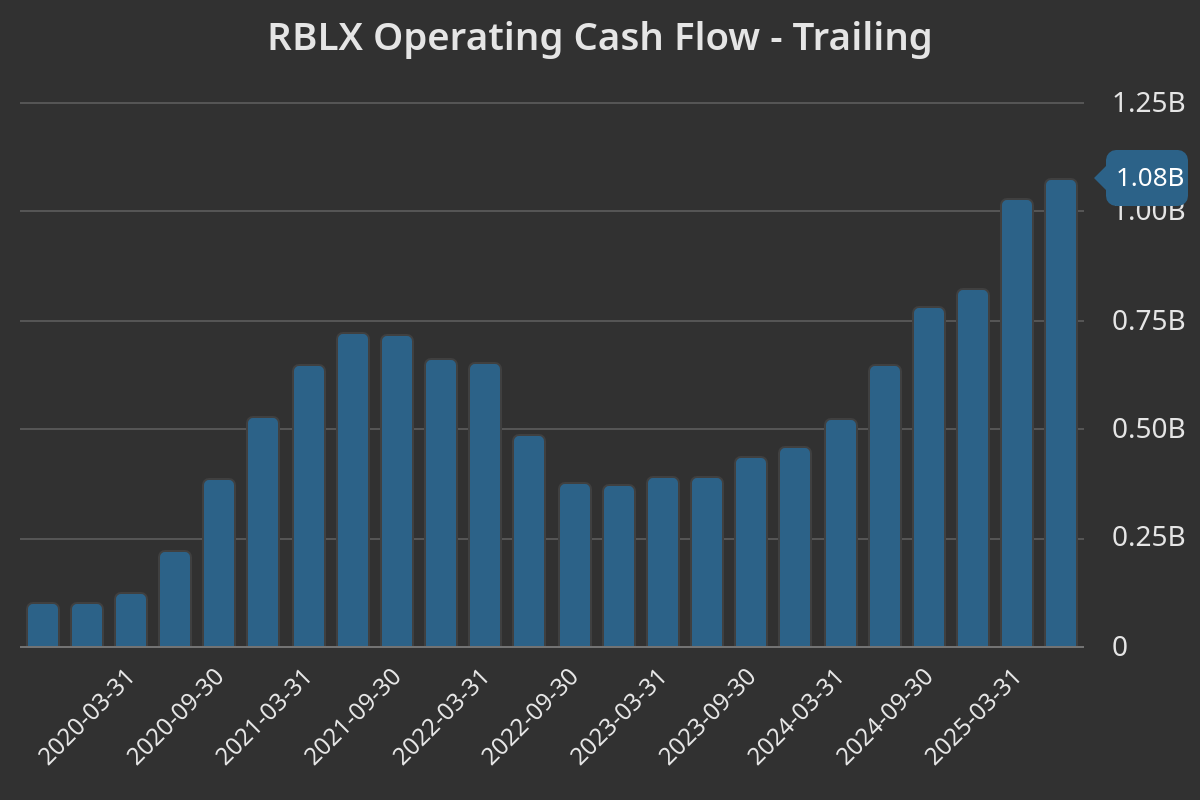

Operating Cash Flow: $199.3M (+32% YoY).

Free Cash Flow: $176.7M (+58% YoY, aided by a delayed $30M payout).

The read-through:

Hours +58% vs ABPDAU +6% = intensity without pricing power.

Reported FCF gains lean on deferred revenue and payout timing, not structural margin lift.

Each incremental user pulls forward higher moderation and payout costs, leaving owners no leverage.

Management points to bookings growth, but GAAP losses deepen and FCF sustainability rests on timing quirks.

🌎 Macro Lens

Roblox’s equity story rests on a world that no longer exists. Its multiple presumes zero-rate discounting, light-touch oversight, and unconstrained discretionary spend. The actual macro backdrop is the inverse.

Rates & Discounting

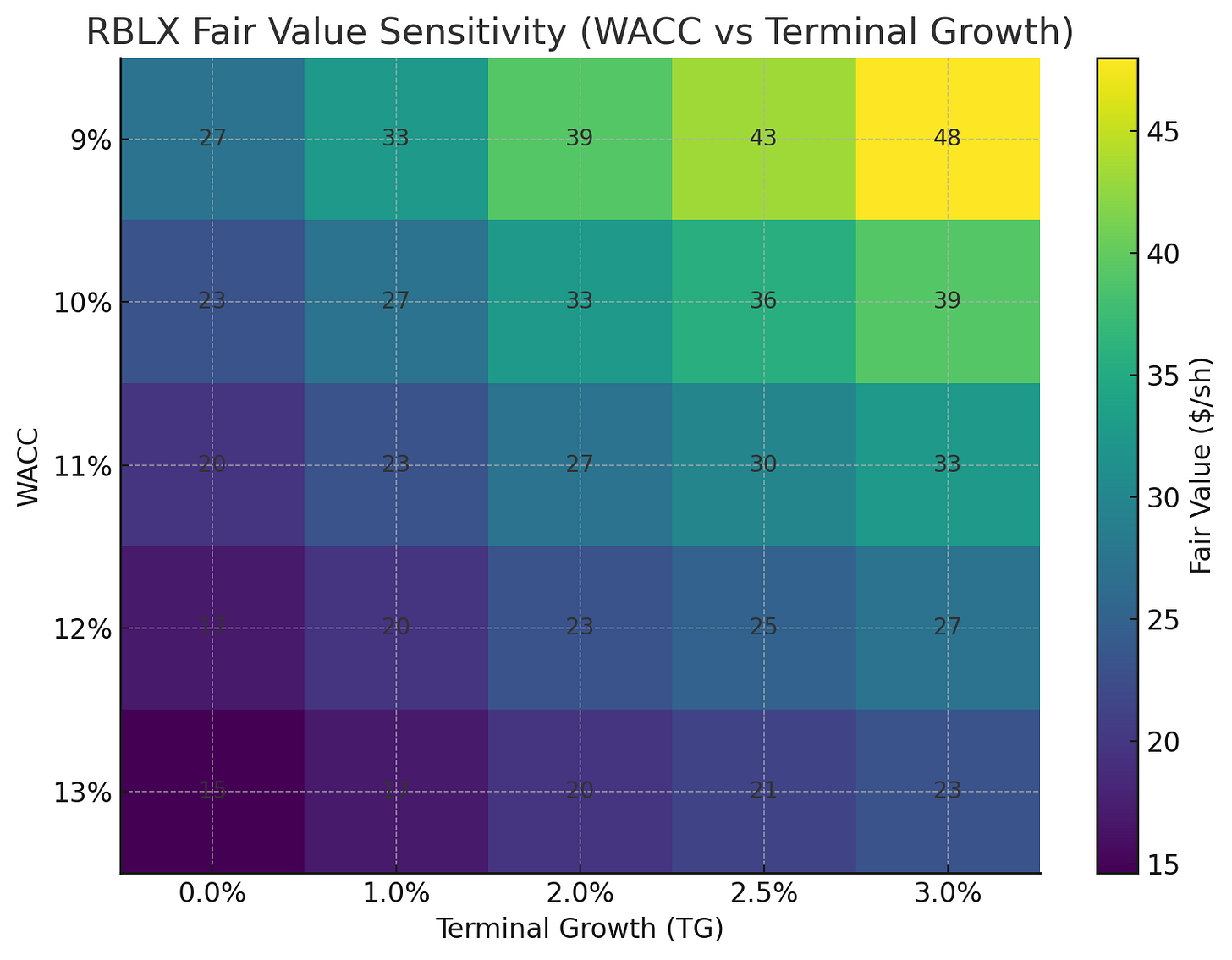

Real yields remain structurally higher than the 2015–2020 “metaverse narrative” era. A +100 bps move in our WACC assumption compresses Roblox’s DCF value by ~12–15%. Duration-heavy equities with terminal-value dependence are the most sensitive, and Roblox is the archetype.

Consumer Strain

Roblox monetizes discretionary spend from a young demographic. Conversion of free users into payers has stalled at ~13–15%, and average bookings per user are flatlining. With family budgets pressured by inflation and higher rates, Roblox has little pricing power to push ARPU higher. Engagement may rise, but discretionary squeeze limits monetization.

Regulatory Regime Shift

Enforcement is not theoretical:

EU DSA: fines up to 6% of global turnover.

UK OSA: up to 10% of revenue.

U.S. COPPA/FTC: heightened scrutiny, potential settlements.

Each of these could equate to hundreds of millions in annual drag - directly comparable to Roblox’s reported FCF.

Geopolitical & Social Backdrop

Roblox has already been banned in multiple Gulf states on safety grounds. That precedent matters: once regulators see peers act, bans become politically viable elsewhere. Parents - the actual gatekeepers of DAU growth - are influenced by this narrative globally.

Equity Context

Traditional publishers trade on mid-teens EV/FCF multiples (EA ~17×, TTWO ~19×). Roblox, at >40× EV/FCF, is priced as a secular compounder immune to discount rates and policy. The disconnect is glaring: a loss-making, child-centric platform carries a multiple 2–3× higher than profitable IP owners.

Roblox is valued as if the macro backdrop were still 2019. The macro reality - higher WACC, strained consumer, regulatory overhang - destroys that terminal assumption set.

🏢 Company Overview

Roblox is not a conventional game publisher. It is a three-layer platform economy built on the Robux virtual currency:

Users purchase Robux and spend them inside creator-built experiences.

Developers receive payouts in real currency when their content earns Robux.

Roblox Corp retains the spread as its gross margin pool.

The mechanics:

Roblox monetizes primarily through the sale of Robux.

When users buy Robux, the cash is recognized as deferred revenue (bookings).

As Robux are spent, the company records GAAP revenue.

In theory, this creates a self-reinforcing loop: more DAUs → more Robux purchased → higher bookings → higher payouts → stronger ecosystem.

The leakages:

In practice, the loop leaks at multiple points:

Developer payouts exceed $700M TTM, now ~20%+ of bookings, and rise as a function of engagement.

Infrastructure and Trust & Safety costs are recurring, not one-offs, running in the low-teens % of bookings.

Stock-based compensation (SBC) is extreme - >$600M, or ~16% of revenue in 2024 - creating dilution and consuming economic value.

The structural problem: Roblox scales activity but not profitability. For owners, the system is value-destructive: ROIC < 0% vs WACC ~11%. The economic surplus accrues to developers (payouts), employees (SBC), and infrastructure providers, not shareholders.

📊 Segment KPI Dashboard

Roblox reports massive scale metrics, but each KPI underscores the platform’s structural fragility.

DAUs: 111.8M (+41% YoY). Growth is skewing toward Rest of World markets, where monetization is weakest. The U.S./Canada base remains Roblox’s economic engine, but saturation is visible, making incremental DAUs less valuable.

Hours Engaged: 27.4B (+58% YoY). Engagement intensity continues to climb, but it does not translate into proportional monetization. More time on-platform increases infra/safety burden rather than ARPU.

Average Bookings per DAU (ABPDAU): ~$11, flatlining over multiple years. In Q2, U.S./Canada ABPDAU grew +18%, but International only +11%. The global blended trend is low-single-digit growth - insufficient to offset rising costs.

Developer Payouts: $316.4M in Q2, or 22% of bookings. Payouts grow mechanically with engagement, capping Roblox’s gross margin expansion potential. Unlike traditional publishers, the more Roblox grows, the more it must pay out.

Safety & Infrastructure Costs: $152.6M in Q2, or 11% of bookings. These costs rise in tandem with DAUs and hours, functioning as a “regulatory tax” on growth.

Unit Economics: When DAUs rise, Roblox generates higher bookings, but those flows are absorbed by payouts and moderation. Incremental DAUs contribute little to owner returns. Engagement expands, but the cash generated is absorbed by payouts and moderation

📈 Capital Allocation & Growth Strategy

Roblox’s capital allocation reflects defensive triage, not a reinvestment flywheel; leaving little capacity for shareholder return or scalable reinvestment.

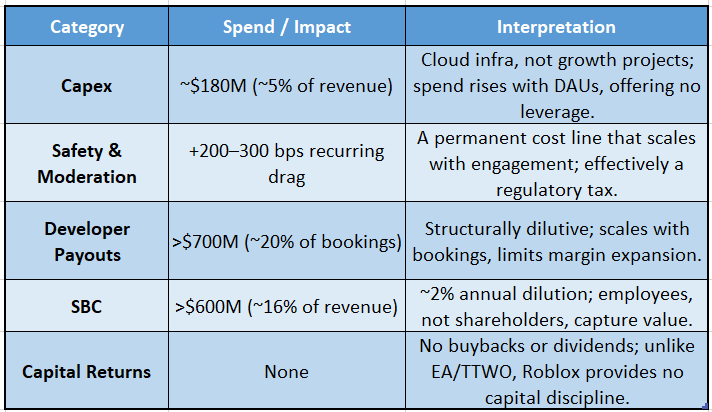

Capital Deployment Snapshot (2024A):

Growth Angles

Roblox highlights advertising and older cohort engagement as growth levers. In practice, these remain subscale (<3% of revenue). Ads are nascent and low-margin; older cohorts add hours, not monetization.

Roblox reinvests to sustain the platform, not to compound capital.

Each reinvestment line (safety, infra, payouts, SBC) grows in proportion to scale, ensuring owners never capture incremental returns.

In contrast to publishers who allocate FCF to IP investment and buybacks, Roblox is locked in a treadmill of cost absorption.

Capital allocation does not create durable value, it merely keeps the platform running under regulatory and operational strain.

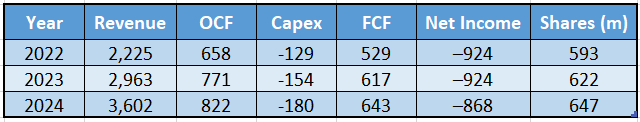

💵 Financial Snapshot

3-Year History (USD mm):

FY25 Guidance (as of Jul 31, 2025):

Accounting note: 2024 revenue was boosted by a $98M acceleration from shortening the estimated average paying user life (28→27 months), which flatters YoY comparisons; Roblox flags this explicitly in guidance.

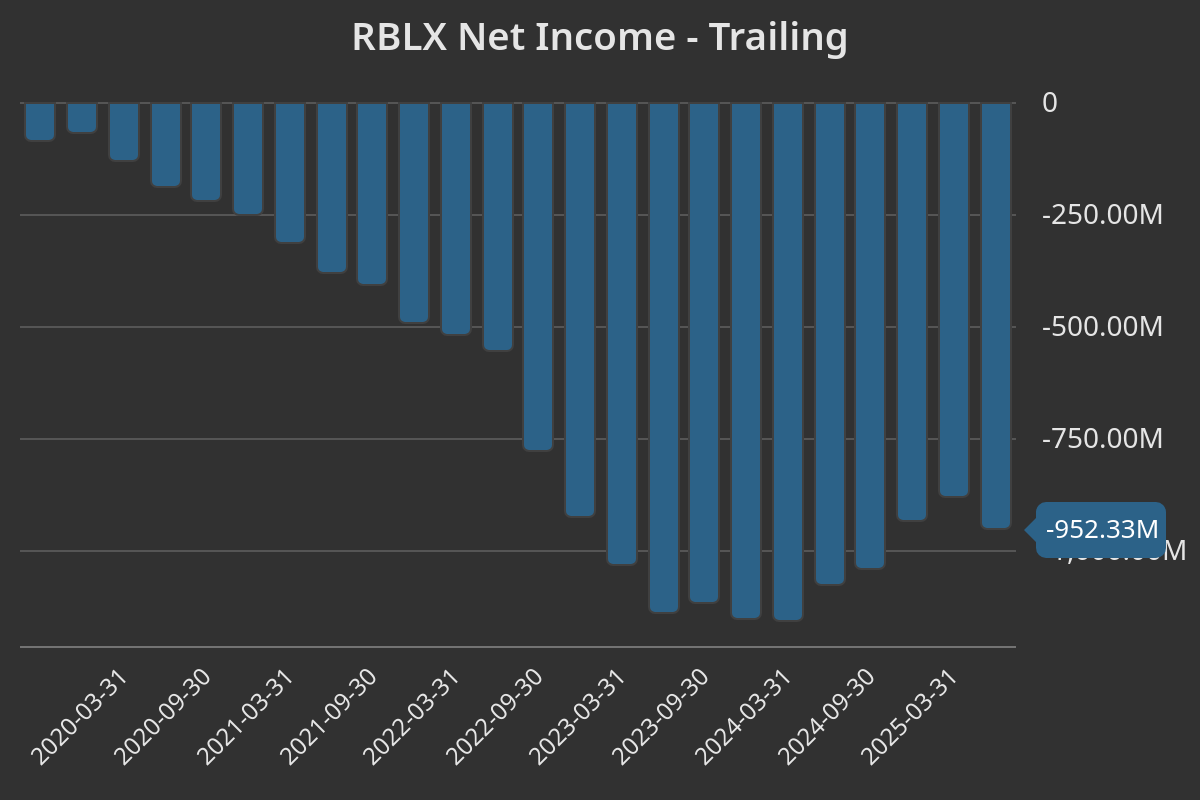

Cash generation is real (FY25 FCF guide ~$1.05B midpoint), but GAAP losses widen given immediate opex vs deferred revenue recognition.

Bookings surge (raised FY25 outlook to $5.87–5.97B) is positive for liquidity, but the timing mismatch means little relief to profitability near term - consistent with our thesis that owner economics don’t scale.

🗂 MD&A Insights

Roblox’s management commentary consistently emphasizes top-line engagement while minimizing or reframing the structural drags on profitability.

Engagement over economics

DAUs (+41% YoY) and Hours (+58% YoY) are celebrated as proof of platform vibrancy.

Flat ABPDAU (~$11) - the single most important monetization metric - is relegated to a footnote.

This selective emphasis creates a gap between narrative and financial reality.

Safety as innovation

Initiatives like Sentinel AI and Trusted Connections are presented as product enhancements.

In practice, they are recurring cost centers that grow in proportion to DAUs.

Management reframes mandatory spend as product innovation, masking its economic impact.

Regulatory minimization

Fines under the EU DSA (≤6% turnover) and UK OSA (≤10% of revenue) are described as standard oversight. No dollar quantification is offered.

Given that 6-10% of revenue equates to $260-$450M annually, omission is glaring given that the potential fines rival Roblox’s entire FY25 FCF guide.

Developer payouts reframed as ecosystem strength

Roblox highlights $316M in Q2 dev payouts as a sign of creator success.

Absent is the fact that payouts now consume ~22% of bookings, directly limiting gross margin scalability.

The MD&A shows a credibility gap: management positions structural cost drag and regulatory fines as marginal, when they are in fact determinants of equity value. By focusing on “hours engaged” while omitting ABPDAU stagnation and payout creep, the company avoids confronting its core economic problem - scale does not generate leverage.

For investors, this dislocation story (metaverse, innovation, ecosystem health) diverges from the math (flat monetization, rising drag, negative ROIC). That credibility mismatch is precisely where valuation compression finds fuel.

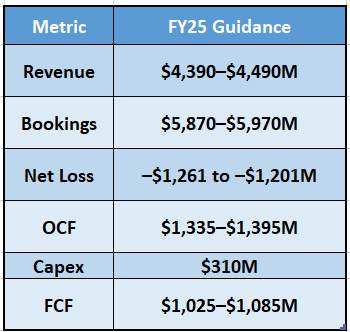

💰 Valuation Framework

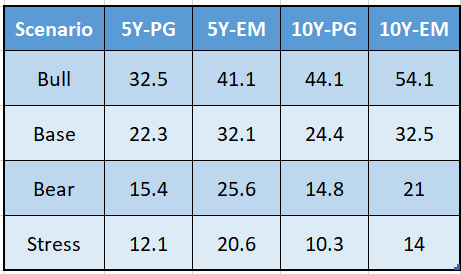

We anchor forecasts to Roblox’s FY25 FCF guidance of $1.05B midpoint. Using the Potato Capital 4-path blended DCF (5Y/10Y × Perpetual Growth/Exit Multiple), with explicit forecasts through 2034, a Base WACC of 11%, and dilution ~2% annually, we arrive at the following intrinsic values:

DCF Results:

Scenario-Weighted Blended Fair Value:

Weighted across Bull (20%), Base (50%), Bear (30%), Stress (0%), and averaging PG/EM paths, fair value at $27/sh.

Interpretation:

Base case: ~$22-25/sh under PG; ~$32/sh under EM. Even the generous EM path still implies ~-75% downside.

Bull case: ~$44-54/sh under best assumptions (14% CAGR, margin lift, low WACC). Still ~-65% downside.

Bear/Stress: Cluster ~$10-21/sh. In line with catastrophic downside.

Implied multiple check: Spot price implies >100× Year-5 FCF - economically indefensible, especially with ROIC < 0%.

Sensitivity:

+100 bps WACC = ~12-15% hit to FV.

Even raising exit multiples to 25-30× caps value at ~$40-50/sh.

Even with improved cash flow guidance, fair value is anchored in the mid-$20s. Roblox remains 5-6× overvalued and priced as if policy, rates, and monetization risks do not exist.

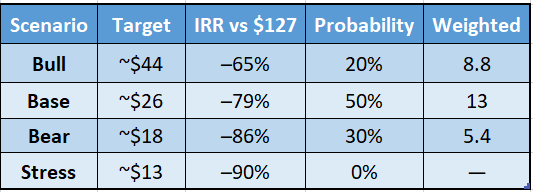

📈 Scenario Return Framework

We translate our 4-path DCF outputs into explicit IRRs versus the current share price of $127.23. Even with updated FY25 guidance, the setup is uniformly asymmetric: downside is large and frequent, upside is capped.

Scenario Outcomes (Blended PG+EM):

Weighted Target: $27/sh

Weighted IRR: -79%

Interpretation:

Bull (20%): Even with 14% CAGR, margin lift, and WACC compression, Roblox is worth ~$44 - a 65% haircut from today. The best case is still a major loss.

Base (50%): ~$26 fair value, ~79% downside, consistent with Roblox’s own cash flow guidance but reflecting persistent unit cost drag.

Bear (30%): ~$18 fair value, ~86% downside, reflecting weaker monetization and higher regulatory costs.

Stress (Reference): ~$13, near-zero equity value in a compounded downside regime.

Convexity:

Upside is mathematically capped (no scenario >$54/sh). Downside has multiple, frequent triggers: regulatory fines, parental veto, ABPDAU stagnation, payout creep, litigation.

At $127, Roblox requires investors to underwrite >100× Year-5 FCF. Our scenarios show no credible pathway that sustains such a valuation.

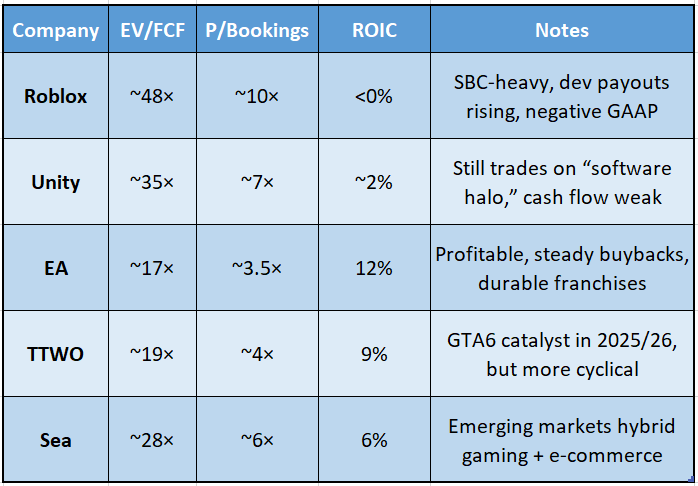

📊 Peer Comparison

Roblox trades at venture-like multiples despite persistent GAAP losses and negative ROIC. Traditional publishers, with durable IP libraries and shareholder return programs, trade at a fraction of Roblox’s valuation.

Peer Multiples Snapshot (NTM):

Observations:

Roblox premium: Trades at ~48× EV/FCF, nearly 3× EA/TTWO, while generating negative ROIC.

Unity parallel: Unity is also structurally challenged, but at ~35× EV/FCF it still trades lower than Roblox, despite being a true software business with switching costs.

Publishers (EA/TTWO): Trade at ~17-19× EV/FCF, reflecting durable IP, positive ROIC, and shareholder capital returns (buybacks/dividends). Roblox lacks all three.

Sea: Even an EM hybrid with weaker governance trades lower multiples than Roblox, while still offering positive ROIC.

Roblox’s multiples are not justified by economics. It is priced like a secular compounder, but its unit economics resemble an unprofitable publisher with rising compliance risk. A peer re-rate alone would collapse Roblox into the teens to twenties, consistent with our DCF outputs.

⚡ What Moves This Stock

Roblox’s equity path is not driven by incremental KPIs; it is driven by binary narrative shocks. The downside catalysts are frequent and compounding, while upside optionality is both rare and capped.

Legal & Regulatory

State AG lawsuits: Active suits (e.g., Louisiana AG) allege prioritization of growth over child safety. Settlements or judgments could run into the hundreds of millions, equivalent to Roblox’s guided FY25 FCF.

FTC/COPPA enforcement: Roblox’s demographic profile makes it a prime target for renewed privacy and child-protection actions.

EU DSA / UK OSA: Statutory fines up to 6-10% of revenue/turnover. With FY25 revenue guidance ~$4.4B, this implies potential penalties of $260-450M per annum - directly offsetting free cash flow.

Media & Public Narrative

Predator exposés and documentaries (e.g., collaborations with Chris Hansen, Hindenburg’s short report) raise mainstream awareness of platform risks.

Social amplification (#FreeSchlep) accelerates parental veto - the true gatekeeper of DAU growth.

Once “child safety crisis” becomes the dominant frame, Roblox loses its social license to scale.

Financial & Operational

ABPDAU stagnation: Bookings per user flatlining at ~$11 confirms monetization ceiling.

Safety opex creep: Trust & Safety now 11% of bookings; this line scales with DAUs, ensuring negative leverage.

Deferred revenue mechanics: Positive OCF/FCF headlines mask deeper GAAP losses; when investors shift focus, multiples compress quickly.

Platform Dynamics

NSFW removals & gating: Content takedowns reduce engagement hours and creator incentives.

Developer sentiment: High payouts but shrinking profitability; creator flight would fracture ecosystem health.

Asymmetry

Downside catalysts: frequent (lawsuits, headlines, safety costs, parental veto).

Upside catalysts: rare, require multiple concurrent wins (ads >10% revenue, safety credibility, older cohorts monetizing).

Roblox equity is a catalyst-heavy short. The tape is likely to be dominated by legal filings, safety exposés, and monetization disappointments - not upside surprises.

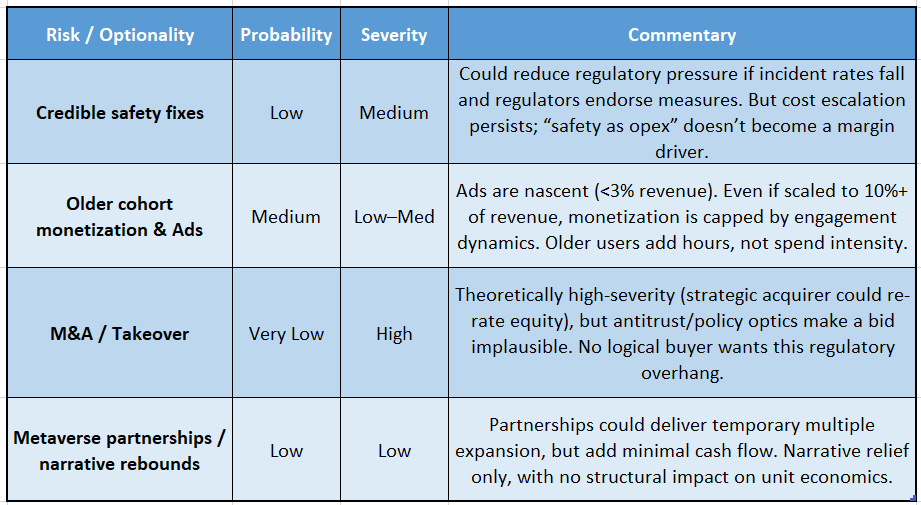

⚠️ Risks & Optionality

Roblox does carry potential offsets to the short thesis, but each is bounded by probability, scale, or structural drag. Optionality exists, yet none credibly bridges the gap between today’s $127 share price and intrinsic value in the $20s.

Probability × Severity Framework:

Credible safety progress is the most likely positive inflection - but it adds cost and caps scale; it does not drive profitability.

Ads/older cohorts could provide incremental revenue, but even at scale the economics remain dwarfed by payouts and safety costs.

M&A is a mirage: Roblox’s regulatory baggage makes it radioactive for large-cap tech acquirers.

Narrative partnerships offer only short-lived trading bounces, not fundamental upside.

Upside optionality exists in form, but not in substance. None of these scenarios repair the core contradiction: Roblox scales activity, not owner economics.

📋 Potato Capital Scorecard

Conviction Tier: High-Conviction Short (Regulatory Fragility)

🥔 Final Take

Roblox is not a metaverse compounder. It is a children’s gaming platform where scale amplifies liability rather than profitability. Engagement metrics continue to grow, but monetization per user is stalled, and every incremental DAU brings higher moderation costs, developer payouts, and legal exposure.

Even with stronger FY25 FCF guidance, intrinsic value anchors in the mid-$20s. Base IRR is -79%; even generous assumptions cap at -65% downside. In Bear and Stress regimes, equity value erodes toward the teens. There is no plausible path that sustains triple-digit share prices.

Parents and regulators - not users - control Roblox’s future. Both are now turning hostile, through lawsuits, bans, and growing media scrutiny. That makes Roblox an equity defined by regulatory fragility and valuation convexity.

Every DAU is a liability. Roblox stands as one of the clearest asymmetric shorts in our coverage universe - frequent downside catalysts, rare and capped upside optionality.

Sources: Company filings (10-Q/10-K, Roblox Corp), investor presentations, SEC EDGAR, StockAnalysis.com, Fintel, MacroTrends, TradingView, Finviz, public news outlets (Bloomberg, Reuters, WSJ, CNBC, Yahoo Finance), regulatory filings (FTC, EU DSA, UK OSA, state AG lawsuits), and Potato Capital proprietary modeling and analysis.