🥔 Potato Capital Research Report - Zoomd Technologies (ZOMD)

August 26, 2025

📌 Zoomd Technologies (TSXV: ZOMD)

Rating: Deep Value Buy

Current Price (Aug 26, 2025): C$2.47

Base Case 12-Mo Target: C$4.25 (+72%)

Scenario-Weighted Target: C$4.72

Expected 12-Mo IRR (weighted): +91%

Conviction Tier: High-Conviction Deep Value

🔑 Executive Summary

Zoomd Technologies (ZOMD) is an open-internet adtech platform combining a demand-side media buying stack (DSP), SDK integrations that embed into client apps, and a white-label SaaS layer. An AI optimization engine sits across the stack to allocate spend, raise campaign ROI, and reduce churn. Mix is still ~80% performance campaigns and ~20% SaaS, but SaaS is rising and matters because it is margin-rich and more recurring.

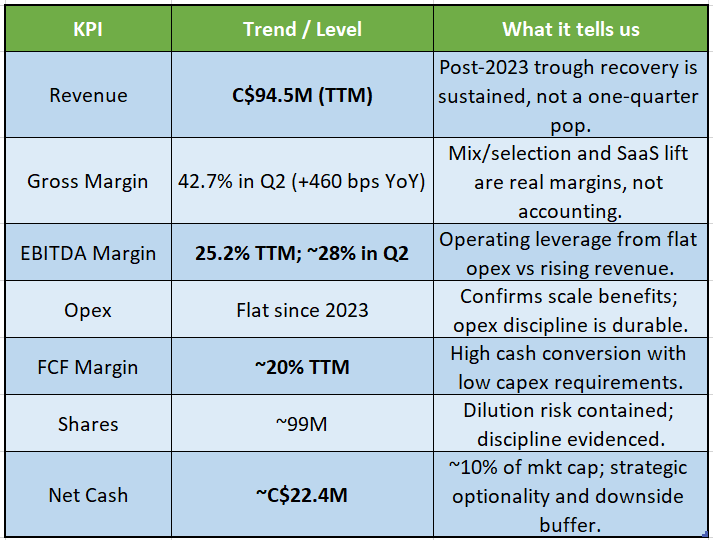

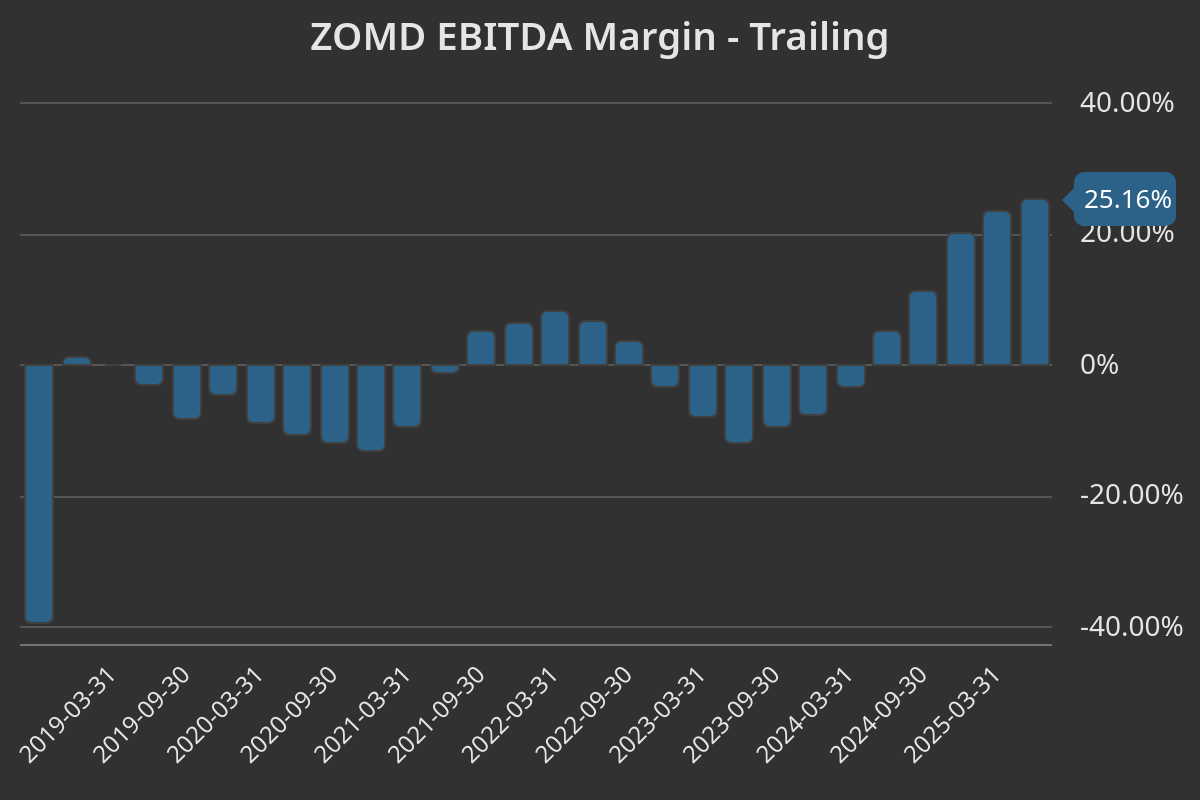

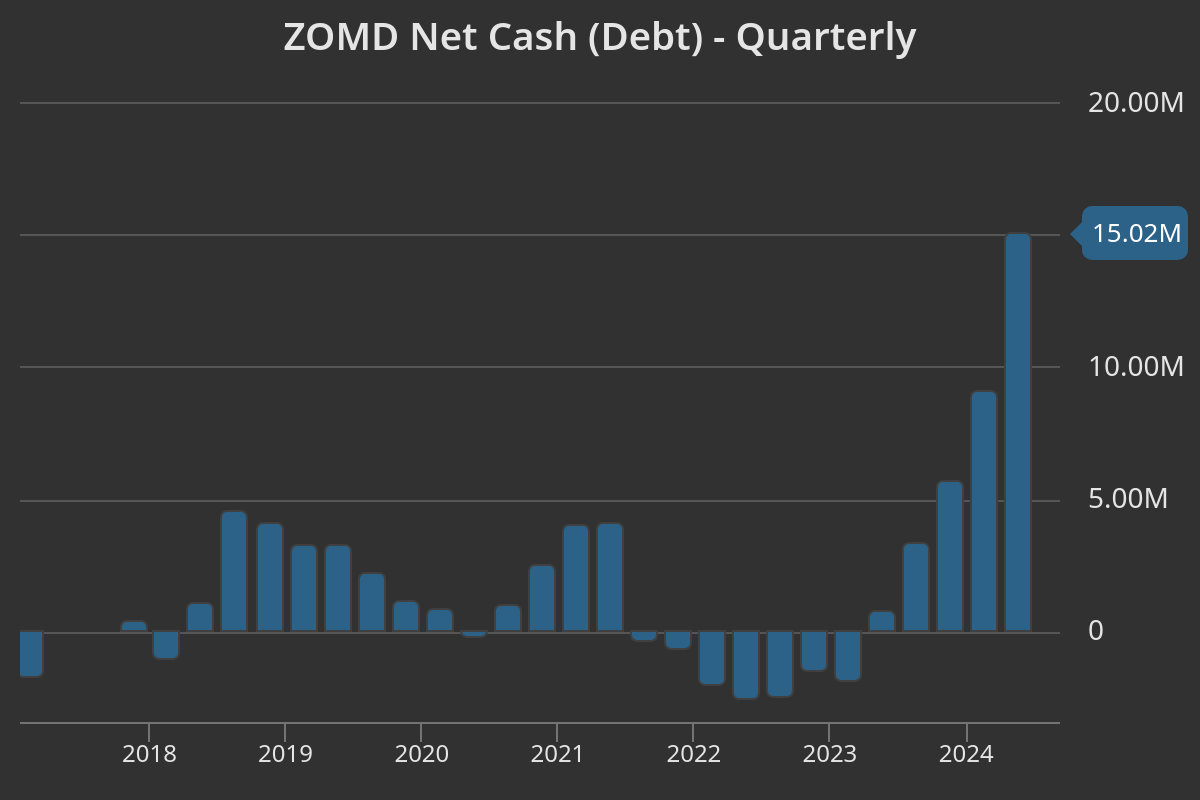

The business has crossed from aspirational to structurally profitable. Q2-2025 was another proof point: C$20.8M revenue (+22% YoY), 42.7% gross margin (+460 bps), ~28% EBITDA margin, positive net income, and strong cash conversion. On a trailing basis: C$94.5M revenue, C$24.5M EBITDA, C$18.6M FCF (~20% margin); net cash ~C$22.4M.

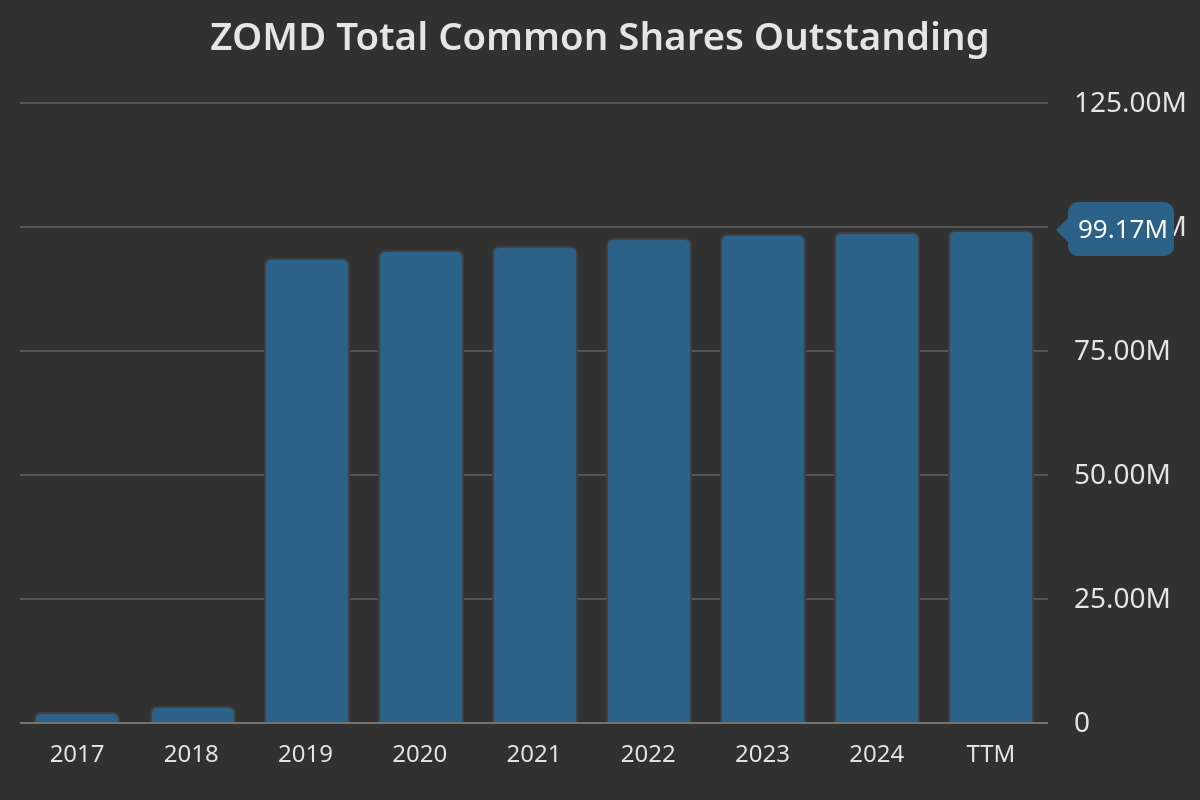

The equity still prices in terminal risk (microcap, liquidity, Israel domicile). Yet ROIC ~46% vs WACC ~11% (≈3500 bps spread) argues the opposite: value is being created per dollar reinvested. Current multiples (EV/EBITDA ~7.5-9×; EV/FCF ~9.6-12×; P/E ~10×) remain compressed vs peers despite cash generation and improving mix.

Using our blended DCF (5Y/10Y × PG/EM) anchored to filings and MD&A, the scenario-weighted FV is C$4.72/sh (+91%). Downside is cushioned by net cash and FCF; upside is driven by SaaS penetration, AI-enabled efficiency, and multiple expansion as terminal microcap gets repriced to profitable operator.

📊 Quarterly Earnings Recap

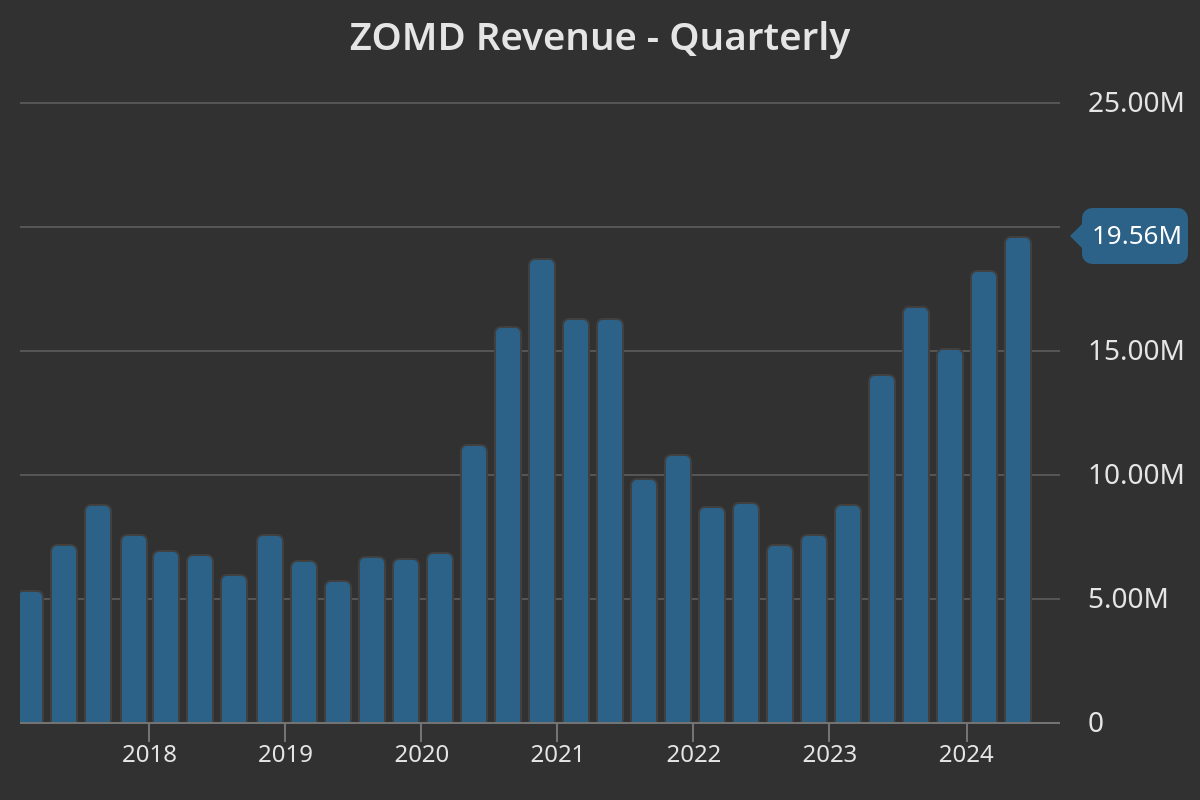

Revenue quality > revenue quantity.

YoY growth (+22%) was not volume-chasing; it was accompanied by a 460 bps gross-margin lift, reflecting an improved client mix and better campaign selection. This tells us management is allocating capacity to ROI-positive work (as they signaled), not just filling top-line.

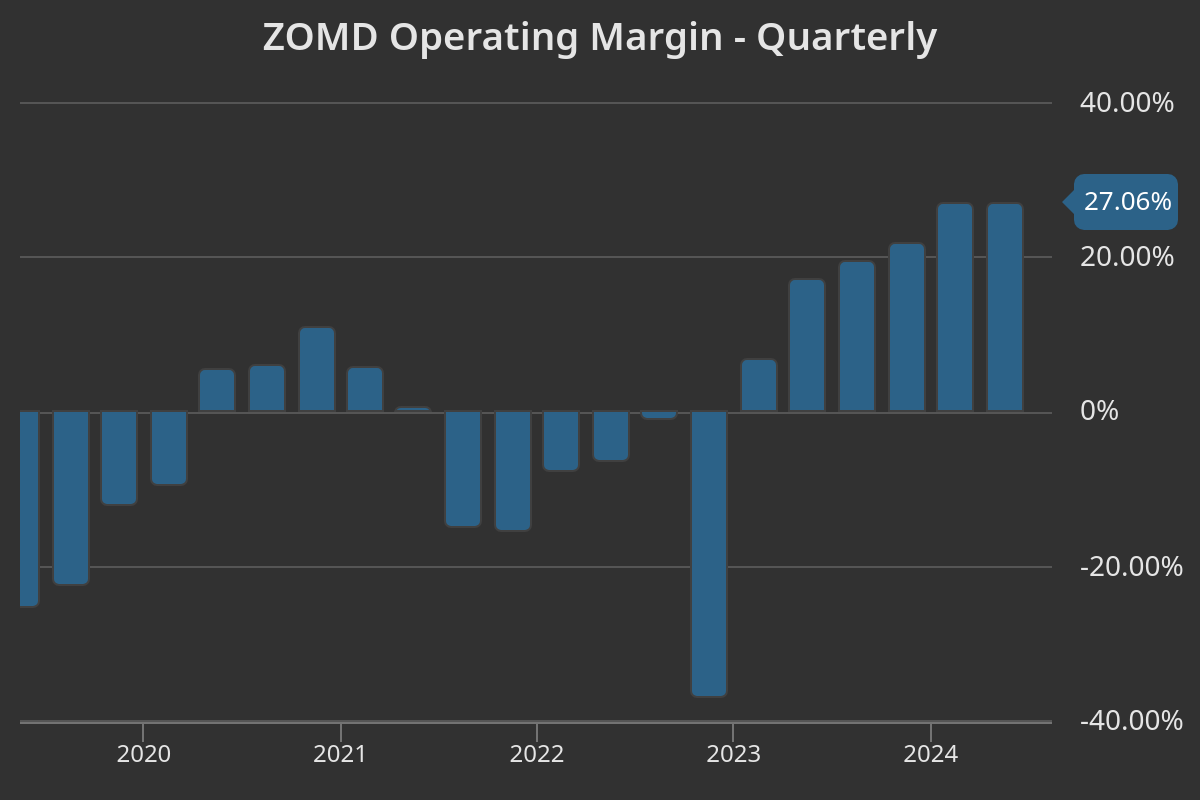

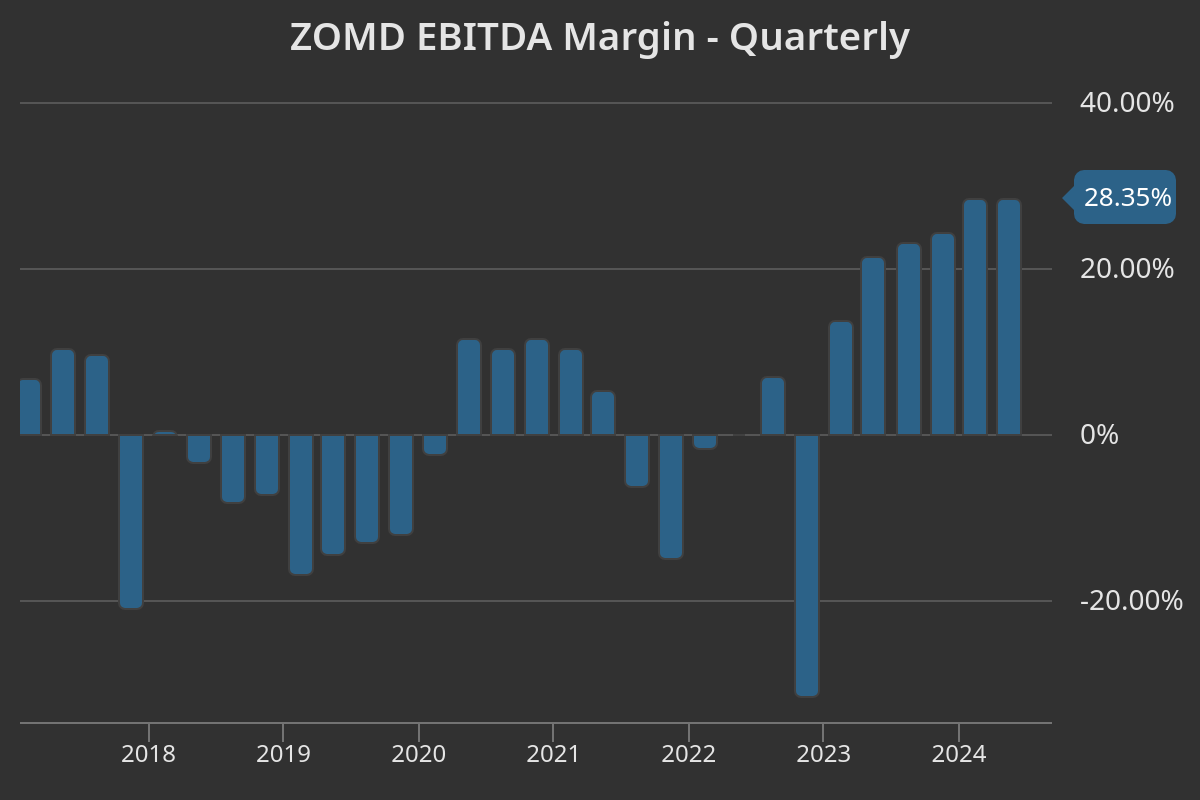

Margins are operating-leverage, not cost-starvation.

EBITDA margin approaching 30% is coming from flat opex against rising revenue - not one-off opex cuts. That’s the right kind of leverage: repeatable and scalable.

Cash conversion validates earnings quality.

OCF > NI and FCF ~C$6.9M in Q2 with negligible capex (~1% of revenue) implies low capital intensity and limited working-capital drag. This is the best refutation of non-cash EBITDA risk.

Balance sheet creates time and options - C$22.4M cash; no financial debt.

That protects against macro shocks, reduces equity dilution risk, and allows selective bolt-ons at distressed valuations if the ad cycle wobbles.

This was not a one-off; it was the second straight quarter of ~30% operating profitability with strong cash conversion.

🌍 Macro Lens

Liquidity & spreads:

Microcaps trade with a higher ERP; in practice, ±100 bps move in HY/OAS maps to ±15-20% EV/EBITDA rerating for names like ZOMD. On our base EV/EBITDA, that’s roughly ±C$0.40-0.50/sh of fair value torque. This is the biggest non-fundamental driver of 6-12 month returns.

Ad spend elasticity:

Open-internet ad spend (ex-walled-gardens) is cyclical but structurally growing. ZOMD’s revenue beta is ~1.3×. A +1% upside surprise in global digital ad spend adds ~C$0.20-0.30/sh to FV; a -5% shock trims ~C$0.40-0.50/sh.

AI adoption:

As AI automation penetrates campaign management, we underwrite an incremental +200-300 bps EBITDA uplift over 12-24 months, contributing ~C$0.25-0.40/sh to FV in our sensitivities. This is a structural lever, unlike spreads.

Geopolitics:

Israel domicile introduces a 10-15% headline discount despite global operations and CAD reporting. This is a slow-moving drag on the multiple - a reason to demand margin of safety, but not a thesis killer while net cash persists.

🏢 Company Overview

ZOMD lives in the fragmented open-internet - everything outside the Google/Meta/Amazon walled gardens. Fragmentation creates discovery and optimization work; this is where a combined DSP + SDK + AI stack can add measurable lift.

SDK stickiness and accumulated campaign data scale are the moat. SDKs deepen integration and make switching costly; data scale improves model performance, creating a positive feedback loop (better targeting → better ROI → lower churn).

Moving from pure campaigns toward SaaS licensing stabilizes revenue and raises gross margins. This is the path by which a microcap execution platform becomes a higher-quality, repeatable cash generator.

📈 Segment KPI Dashboard

KPI behavior here looks like a quality transition: cyclicality remains (ad budgets), but the earnings engine is increasingly self-funding.