🥔 The Natural Resource Renaissance

🧭 Executive Summary

We believe a long-term secular rotation into real assets is underway. After years of capital starvation and ESG underweighting, sectors like oil, uranium, copper, rare earths, and agriculture are reentering the spotlight - with policy, supply chains, and inflation acting as catalysts.

A new macro regime is emerging:

Capex droughts have throttled supply.

Geopolitics is reshaping commodity flows.

Policy is driving structural demand - not just price speculation.

Tangible assets with bottlenecked supply chains now offer convex upside and inflation resilience.

This post outlines the setup, sector theses, and exposure options across energy, metals, and food-linked commodities.

🌍 Macro Backdrop: Real Assets in a New Regime

Capex discipline has hollowed out production capacity across oil, uranium, and copper.

De-globalization and resource nationalism are forcing countries to secure their own supply - even at higher cost.

The energy transition is commodity-intensive: renewables, EVs, datacenters, and electrification all require massive metal inputs.

Geopolitical fragmentation and fiscal stimulus have created new structural demand for tangible, strategically important inputs.

Inflation and real yield volatility are renewing investor appetite for hard assets with supply constraints and cash flow today.

Policy Tailwinds (U.S. and Canada)

U.S.: The Inflation Reduction Act, Defense Production Act (DPA), and procurement programs have accelerated support for uranium, critical minerals, and energy infrastructure.

Canada: The Critical Minerals Strategy promotes domestic exploration and processing of uranium, rare earths, lithium, and more.

Export controls from China and Russia have turned these sectors into national security priorities across the West.

🔍 Sector Breakdowns & Trade Ideas

🛢️ Oil

Thesis: Demand remains resilient while supply is structurally constrained.

Catalysts: SPR refill, jet fuel recovery, petrochemical builds

Risks: Global slowdown, faster-than-expected EV penetration

Exposure: XLE, XOP, CNQ, CVE, oil LEAPS, calendar spreads

☢️ Uranium

Thesis: Utilities are racing to lock in fuel supply amid enrichment bottlenecks and geopolitical stress.

Catalysts: SMR approvals, reactor restarts, physical uranium stockpiles

Risks: Political sentiment, permitting lag

Exposure: URA, URNM, CCJ, SRUUF, junior miners basket

🧲 Copper

Thesis: Electrification is accelerating - copper intensity in EVs, AI datacenters, and power grids is only rising.

Catalysts: Grid expansion, copper deficit projections, mine delays

Risks: Substitution, recession, higher recycling

Exposure: COPX, FCX, PICK, copper futures or ETNs

🌐 Rare Earths

Thesis: China dominates REE supply - the West is in catch-up mode.

Catalysts: Export controls, DPA-backed magnet projects, new refining capacity

Risks: Substitution, regulation, recycling breakthroughs

Exposure: REMX, MP Materials, Lynas, select junior explorers

🌾 Agriculture

Thesis: Food systems face structural stress from land degradation, erratic climate, and protectionist trade policy.

Catalysts: Droughts/floods, fertilizer constraints, sovereign stockpiling

Risks: Yield breakthroughs, agtech deflation

Exposure: MOO, DBA, LAND/FPI, NTR, MOS

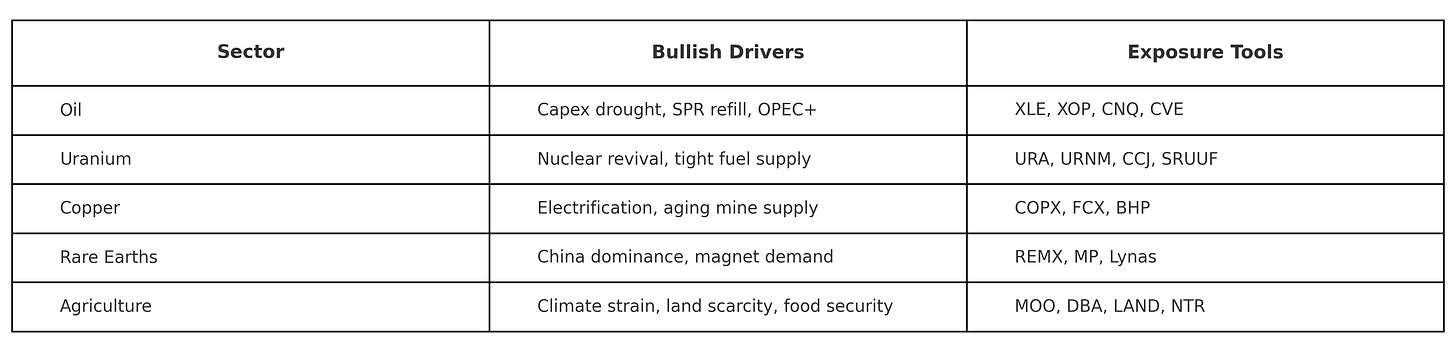

📦 Sector Summary Snapshot

🧠 Potato Capital View

We see this as a strategic macro rotation - not a tactical trade.

These are bottlenecked sectors with long-cycle supply dynamics and increasing policy alignment. That’s exactly where we want exposure: where supply can't be turned on overnight, and where demand is no longer purely price-driven.

This is why we model all resource themes with:

Scenario-weighted IRR frameworks

ROIC/ROCE vs WACC spreads

Convex payoff structures with defined downside

Macro lenses embedded - not bolted on

📌 Reminder: Research, Not Advice

This post is for research purposes only. It reflects our internal positioning logic - not investment advice.

Position sizing, risk tolerance, and suitability are investor-specific. We provide ideas, not instructions.