🏛️ Powell’s Tightrope: Inside the Fed’s July Decision

Why the next move isn’t about inflation vs growth - it’s about credibility vs chaos

🔒 Rates held steady at 4.25%–4.50%

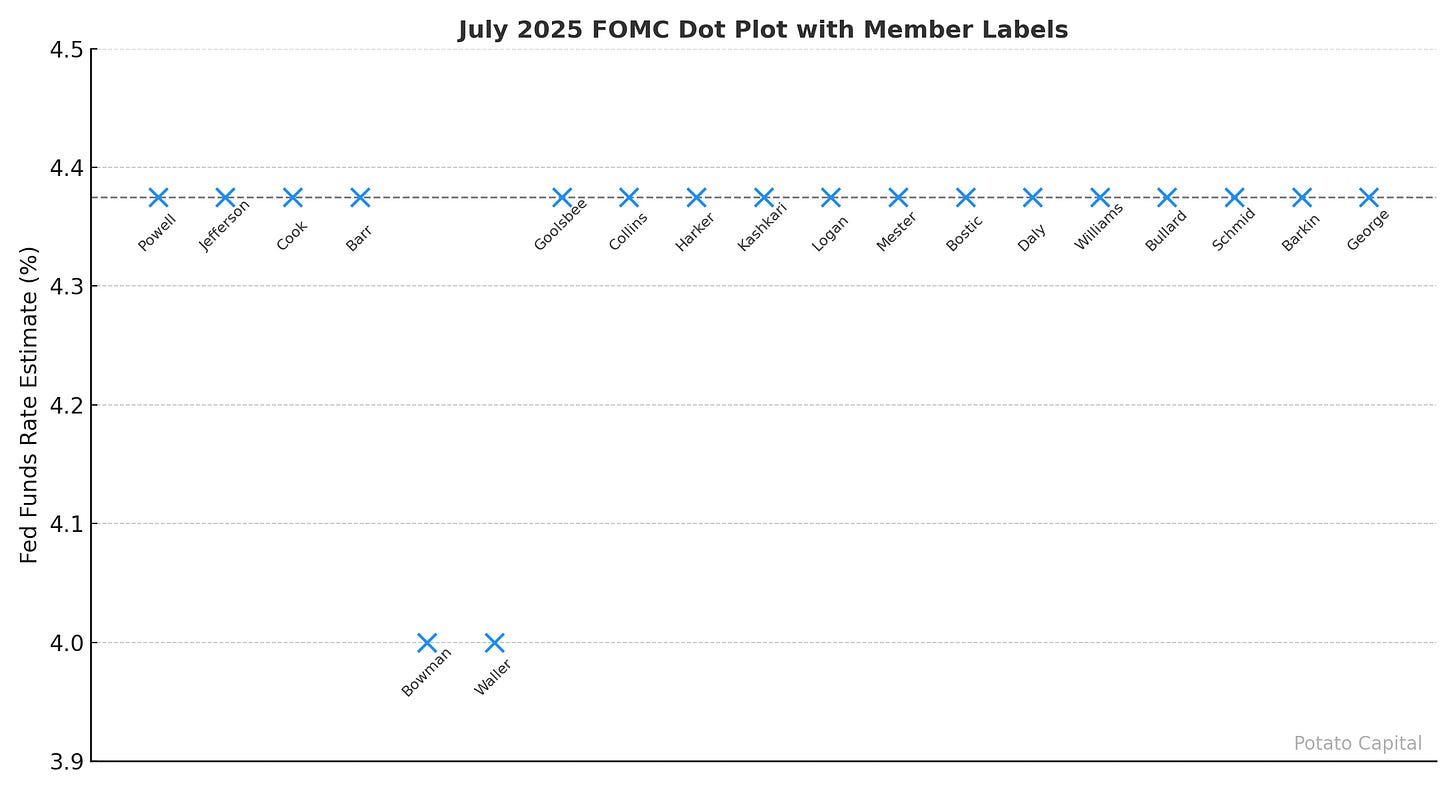

📉 Two rare dissents: Bowman and Waller backed a cut

📦 Tariffs complicating inflation readings

🎯 Markets betting on a September cut

🔑 Executive Summary

The Federal Reserve held rates unchanged for the fifth consecutive meeting, keeping policy tight despite mounting evidence of economic softening. But a rare double dissent - from governors Michelle Bowman and Christopher Waller - cracked the illusion of consensus. For Powell, the challenge is no longer just dual mandate balancing. It’s reputational risk management in a regime where data, politics, and tariffs are pulling in opposite directions.

📉 The Decision: A Hold with Cracks

Policy status:

Fed held rates at 4.25%-4.50% for the fifth straight meeting.

Inflation has cooled from 2022 peaks but remains above target.

Growth is fading: GDP softening, private job creation near stall speed.

Headline wasn’t the hold - it was the dissent:

Two Fed governors - Michelle Bowman and Christopher Waller - voted to cut rates by 25bps.

First dual dissent of the cycle, signaling a break in internal cohesion.

Bowman’s pivot is pivotal:

Former policy hawk now calling for preemptive easing.

Cites normalization in inflation and growing labor market slack.

Marks a philosophical shift, not just tactical disagreement.

Waller’s stance adds confirmation:

Had previously warned that current rates are “well above neutral.”

His dissent was expected - but validates Bowman’s break as part of a broader turn.

Macro implication:

The Fed’s center of gravity is shifting toward easing.

Debate is no longer about if to cut, but how late is too late.

Powell’s position is narrowing:

Now juggling:

Mixed data signals

Political pressure

Fracturing consensus within the Fed

Risk: Losing control of the policy narrative before the data makes the decision for him.

📦 Tariffs Are a Wild Card, Not a Red Herring

Tariff-driven inflation is now visible:

Businesses are starting to pass through import costs.

Core goods inflation has ticked higher after months of deflationary trend.

Fed Governor Waller attributes ~20–30bps of recent inflation to tariffs.

Fed’s internal debate is unresolved:

Key question: Are tariffs a one-time tax or a structural inflation driver?

Most policymakers still assume front-loaded effects that fade over time.

Powell appears to lean cautious - open to risks but not ready to act.

Historical playbook may be obsolete:

In 2018–19, tariff shocks were dampened by global disinflation and flexible supply chains.

In 2025, inflation buffers are gone:

Global trade is fragmenting.

Inventories are thin.

Domestic labor markets remain tight.

Margin compression vs passthrough:

Early effects absorbed by firms protecting market share.

Now shifting: importers with thinner margins (retail, industrials, autos) are re-pricing.

If passthrough accelerates, second-round effects (wages, services) could emerge.

Powell’s dilemma:

Cutting too early could reignite inflation expectations.

Waiting too long risks overtightening into demand destruction.

This uncertainty explains the Fed’s refusal to pre-commit to cuts - even as growth slows.

Key macro lens takeaway:

Tariffs are no longer transitory noise - they’re a monetary regime variable.

Inflation forecasting under current conditions is a credibility risk, not just a data puzzle.

🔔 Jackson Hole Watch

The Fed’s next real communication moment isn’t the September meeting - it’s Jackson Hole, August 22–24.

If Powell plans to reframe the regime (e.g., redefine neutral, re-anchor inflation risk, or justify cuts despite fiscal expansion), he’ll preview it there - not in a post-meeting statement.

Markets will be parsing every syllable for: Signals on tolerance for tariff-driven inflation; Justification for easing into fiscal stimulus; Updated views on r-star or policy asymmetry.

⚖️ Powell’s Dilemma: Two-Sided Risk in a Three-Sided War

Growth is decelerating:

Private sector hiring is softening.

Real final sales and capex have slowed.

Recent GDP beat masks internal weakness (1.2% demand growth vs 3.0% headline).

Inflation is still sticky:

Core services remain elevated.

Tariff passthrough adds uncertainty.

Long-term inflation expectations remain stable - for now.

Political pressure is intensifying:

Trump administration openly criticizing Fed restraint.

Treasury Secretary Bessent: “They should be cutting already.”

White House framing Powell as the bottleneck for mortgage relief and economic stimulus.

The trap Powell faces:

Cut too soon → risks:

Reigniting inflation expectations

Appearing politically compromised

Undermining the Fed’s inflation-fighting credibility

Cut too late → risks:

Hard landing or policy-induced recession

Being accused of overtightening into slowdown

Fracturing internal Fed unity further

The Fed’s current path = strategic ambiguity:

Statement: “Risks to both sides of the mandate.”

Powell’s press conference tone:

Dodged commitment on September

Emphasized flexibility and data dependence

Reiterated vigilance on inflation trend

Jackson Hole is now the real policy signal:

Powell may use the August 22–24 symposium to:

Float a lower r* (neutral rate) estimate - implying policy is already too tight

Justify cuts without conceding to politics

Reset the narrative without altering formal guidance

Markets will parse every word for framework shifts, not just data comments.

Bottom line:

The “muddle-through” path buys Powell time - but reduces optionality.

Each new data point now acts as a gatekeeper to policy movement.

With 6 meetings left in his term, Powell isn’t just managing macro risk - he’s managing institutional survival.

📌 Quick Note: What’s r*?

r* (r-star) is the Fed’s estimate of the “neutral” real interest rate - the level where policy is neither stimulative nor restrictive.

If Powell signals a lower r* at Jackson Hole, it could justify rate cuts without admitting policy failure - reframing easing as a return to neutral, not a pivot.

🧨 Trump, Rates, and the New Fiscal Wildcard

Political pressure on the Fed is no longer subtle:

Trump’s advisors are publicly criticizing Powell for keeping rates high.

Treasury Secretary Bessent and Commerce Secretary Lutnick have gone on-record:

“They should be cutting already.”

Trump himself visited the Fed last week - a direct, visible signal of influence.

The fiscal floodgates are opening:

A $3.4 trillion tax cut package just passed.

Additional proposals on deck:

Tariff rebate checks for consumers (essentially fiscal easing via trade war offsets).

Expanded incentives for reshoring and infrastructure.

These programs inject demand into an economy already near full capacity.

The Fed’s old problem resurfaces:

Monetary policy must now respond to fiscal expansion, not just inflation.

If the Fed cuts into this stimulus wave, it risks:

Overheating demand

Re-anchoring inflation expectations higher

Appearing politically compromised

Narrative risk is rising:

Markets are already calling this the “Trump Fed” - implying Powell is bending to political will.

Even if cuts are justified on macro grounds (e.g. r* > real rate), the optics are fraught.

If inflation ticks higher, the story shifts from data-driven easing to a credibility unwind.

Historical echo:

Powell now faces a similar challenge to Arthur Burns in the 1970s:

Accommodating fiscal stimulus under political pressure

Risking long-term inflation credibility to buy short-term stability

📉 Market Reaction: Countdown to September?

Markets are pricing in a cut - but not with conviction:

Futures now imply ~65% probability of a rate cut by September 18.

Two full cuts priced in by year-end, down from three earlier this summer.

The front end has rallied, but the curve remains inverted, signaling growth fears aren’t fully resolved.

Treasury yields reflect conditional easing expectations:

2-year yield: dipped slightly, anticipating Fed action.

10-year yield: mostly unchanged - market expects cuts, but not a collapse in inflation.

Real yields still elevated, suggesting markets expect policy to stay restrictive for now.

Equity markets reacted with cautious optimism:

S&P 500 closed modestly higher; remains near all-time highs.

VIX remains suppressed, reflecting faith in a soft landing + easing combo.

Risk-on flows in rate-sensitive sectors (e.g., tech, small caps) suggest traders expect easing soon - not eventual.

Mega-cap earnings reinforce soft landing narrative:

Strong results from Microsoft and Meta helped validate equity resilience.

Markets interpret upcoming easing as supportive - not crisis response.

Volatility risk is underpriced:

A single upside surprise in CPI or NFP could:

Reprice the entire easing path

Push back expectations to November or later

Jolt the curve steeper, triggering a selloff in duration-sensitive assets

Key framing for allocators:

The market is treating September as a binary event:

Soft data → policy confirmation rally

Hot data → volatility reawakens, forward guidance gets re-tightened

Positioning is fragile, not complacent - and the risk/reward is asymmetric at this point in the cycle.

🧭 Macro Lens: Tariffs, Capex, and a Volatile Monetary Regime

Tariffs signal structural inflation:

Global supply chains are fracturing. The old deflationary tailwinds from cheap imports are gone. Tariffs are just the first layer - reshoring raises costs, reduces efficiency, and pressures margins.Capex is the potential offset - but needs rate relief:

Fiscal tailwinds (IRA, CHIPS Act) are real. AI, energy, and manufacturing capex are ramping. But high rates remain a bottleneck. No cuts → slower buildout.The monetary regime is unstable:

Every Fed move is now filtered through politics. Powell isn’t just managing inflation - he’s managing optics. Forward guidance doesn’t anchor like it used to.

In this regime, volatility isn’t a shock.

It’s the starting condition.

🥔 Final Take

This wasn’t just a rate hold. It was a fault line.

Two Fed governors broke ranks. The White House escalated pressure. Markets tilted toward easing. And yet Powell remains on the wire - suspended between conflicting forces, hoping the data resolves what the committee cannot.

The September decision won’t just be about payrolls or CPI.

It’ll be a test of institutional gravity.

Can the center still hold - or is the regime already tilting?