🧠 The AI Mirage: When Everyone’s Betting the Same Horse

Why the real risk isn’t missing the next Nvidia - it’s being part of the stampede.

🔑 Executive Summary

Everyone’s chasing the same AI trade - Nvidia, data‑center capex, accelerated compute. But when positioning becomes consensus, the reward/risk flips - not because the story is wrong, but because the price assumes perfection.

This post frames the current market through the lens of game theory, valuation saturation and macro fragility. Nvidia isn’t a short - it’s a crowding risk. Our solution is the Potato Capital Nash Barbell: owning underpriced optionality while avoiding reflexive trades everyone else is in.

Importantly, this does not contradict our long‑term AI Capex Supercycle thesis. It complements it - highlighting how to express that view without getting steam‑rolled in the near term.

🔍 Herd Logic and the Mirage of Outperformance

In investing, as in strategy games, the most dangerous place to be is with the crowd. When every portfolio manager, quant fund and retail trader is chasing the same narrative - AI hyper‑growth, Nvidia dominance, infinite data‑center demand - it stops being a trade.

It becomes a liability.

At Potato Capital we call this the Mirage Effect: assets appear to offer extraordinary upside, but only because everyone is pricing in the same flawless future. The illusion breaks not with a crash but with the first sign of imperfection.

Right now, the Mirage is Nvidia. And the setup has become textbook bubble behavior.

🧮 Data Check: Valuation Reality Has Left the Building

Let’s look at where we are today:

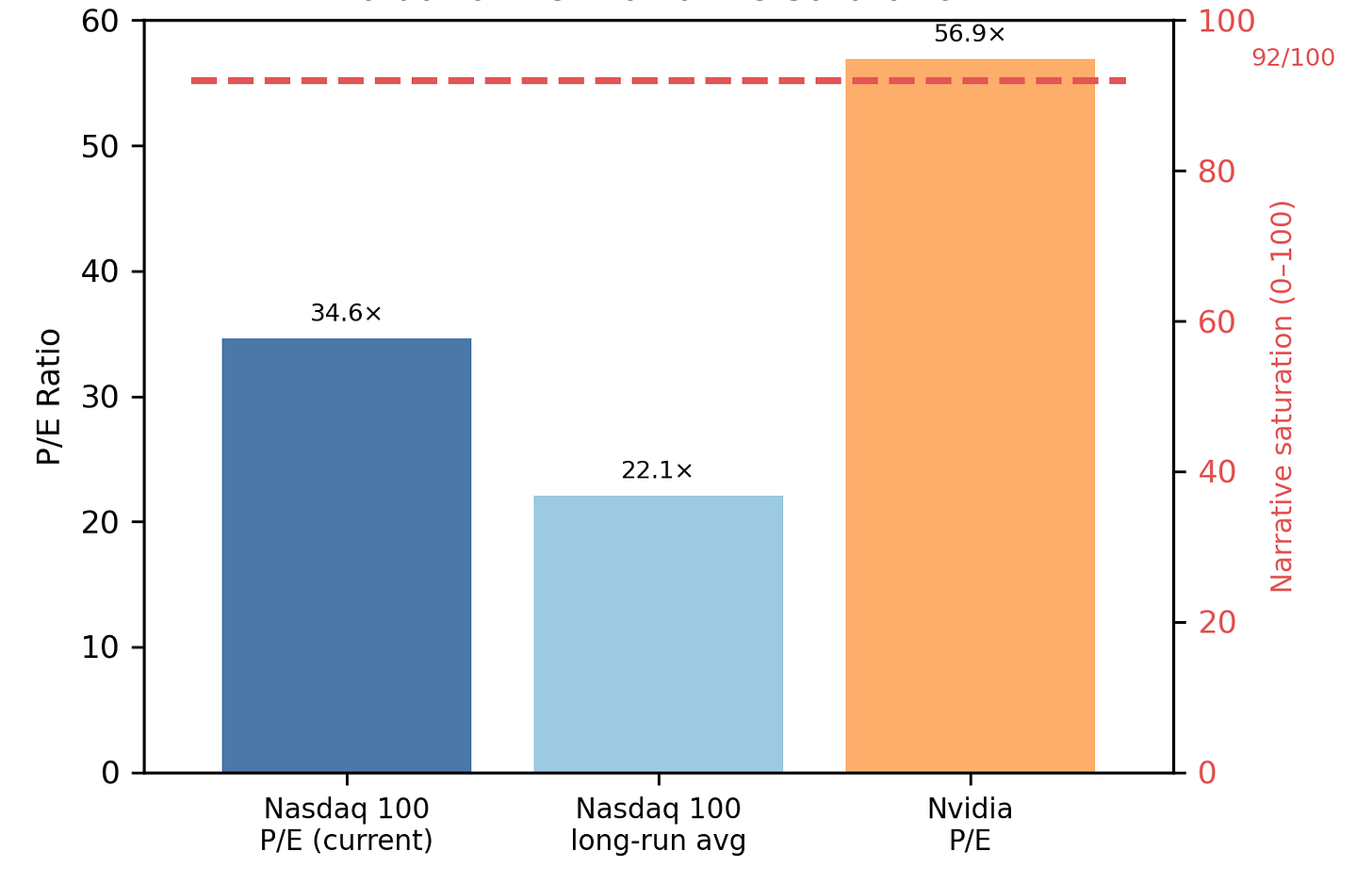

Nasdaq 100 P/E ratio: ~34–41× (depending on the provider) versus a long‑run average of ~22×. Either way, valuations are near dot‑com‑bubble levels.

Nvidia P/E ratio: ~56.9× trailing earnings, implying 30 %+ CAGR through 2030.

0DTE options: Zero‑day‑to‑expiry contracts accounted for over 61 % of S&P 500 options volume in May 2025 - a sign of rampant short‑term speculation.

Q2 S&P 500 earnings: Tracking roughly –3.5 % below original estimates (inflation‑adjusted EPS is essentially flat).

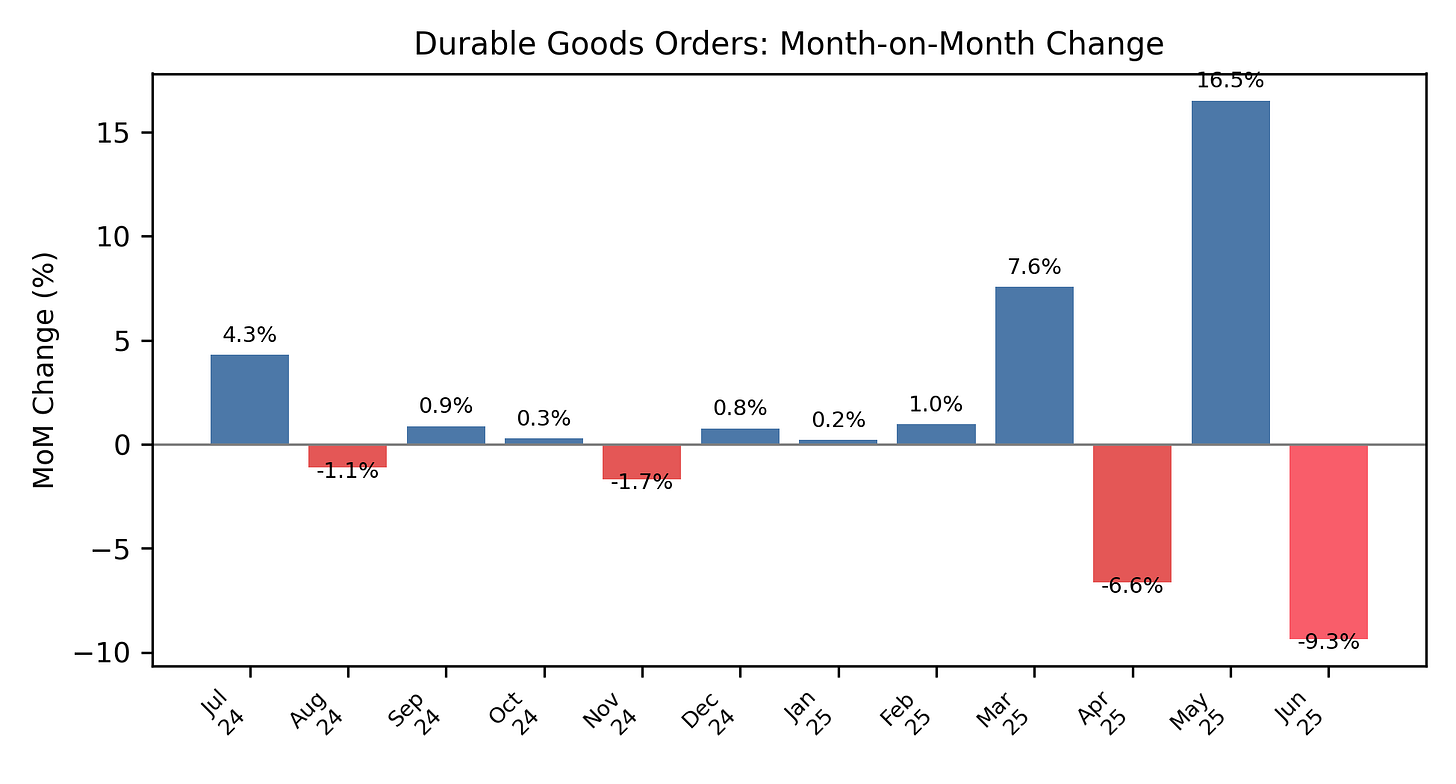

Durable goods orders: Fell –9.3 % month‑over‑month in June, the largest drop since 2020.

Inventory ballooning: Firms like Texas Instruments and Intel are seeing days‑inventory‑outstanding spike while free cash flow deteriorates.

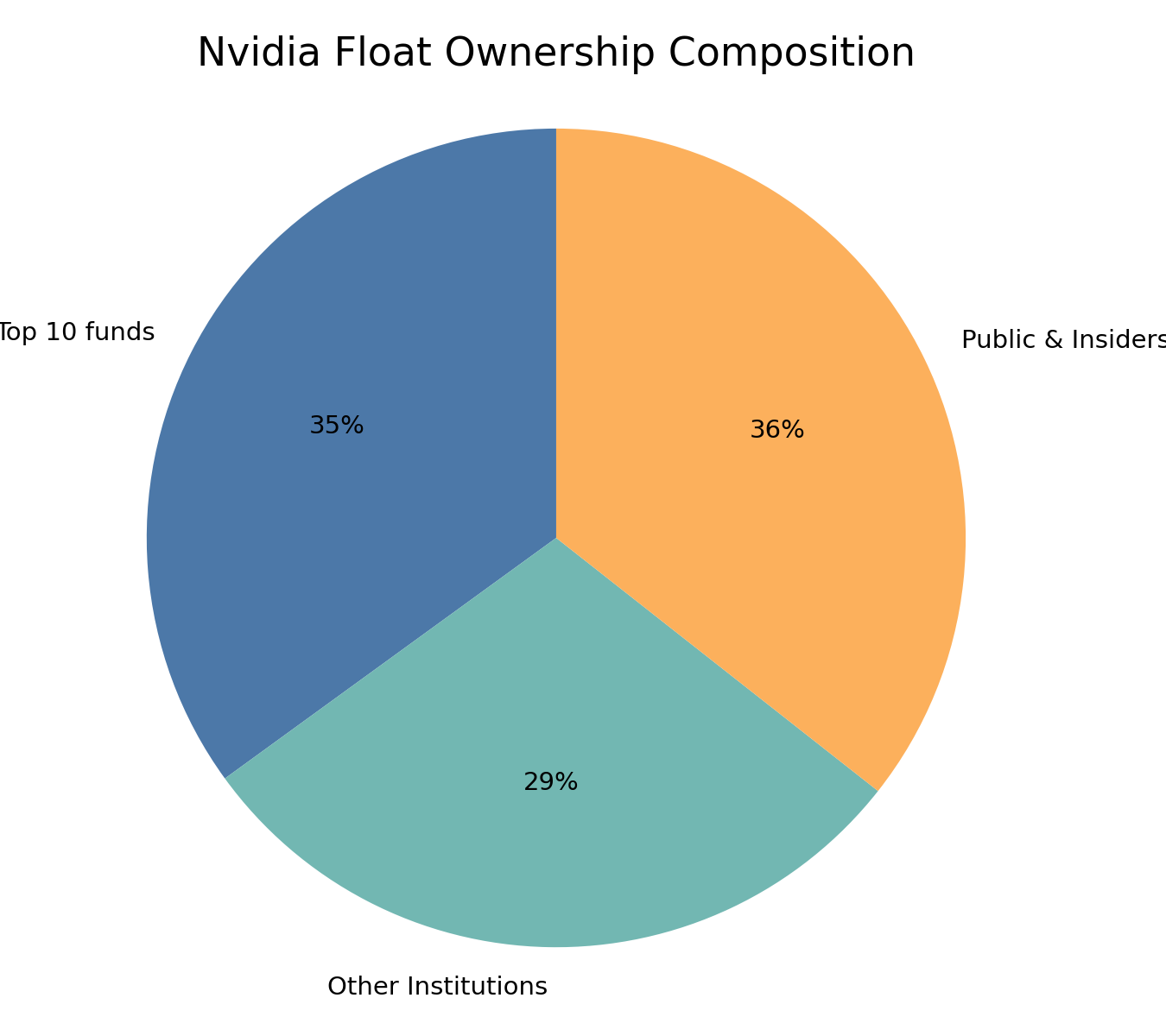

Institutional ownership: About 64 % of Nvidia’s float is held by institutions; the top 10 holders control just over half of that, meaning roughly one‑third of the float is tied up in a handful of funds.

Valuation & Sentiment Chart

Durable Goods Orders MoM

Institutional Ownership

♟️ Game Theory 101: Everyone Can’t Win the Same Trade

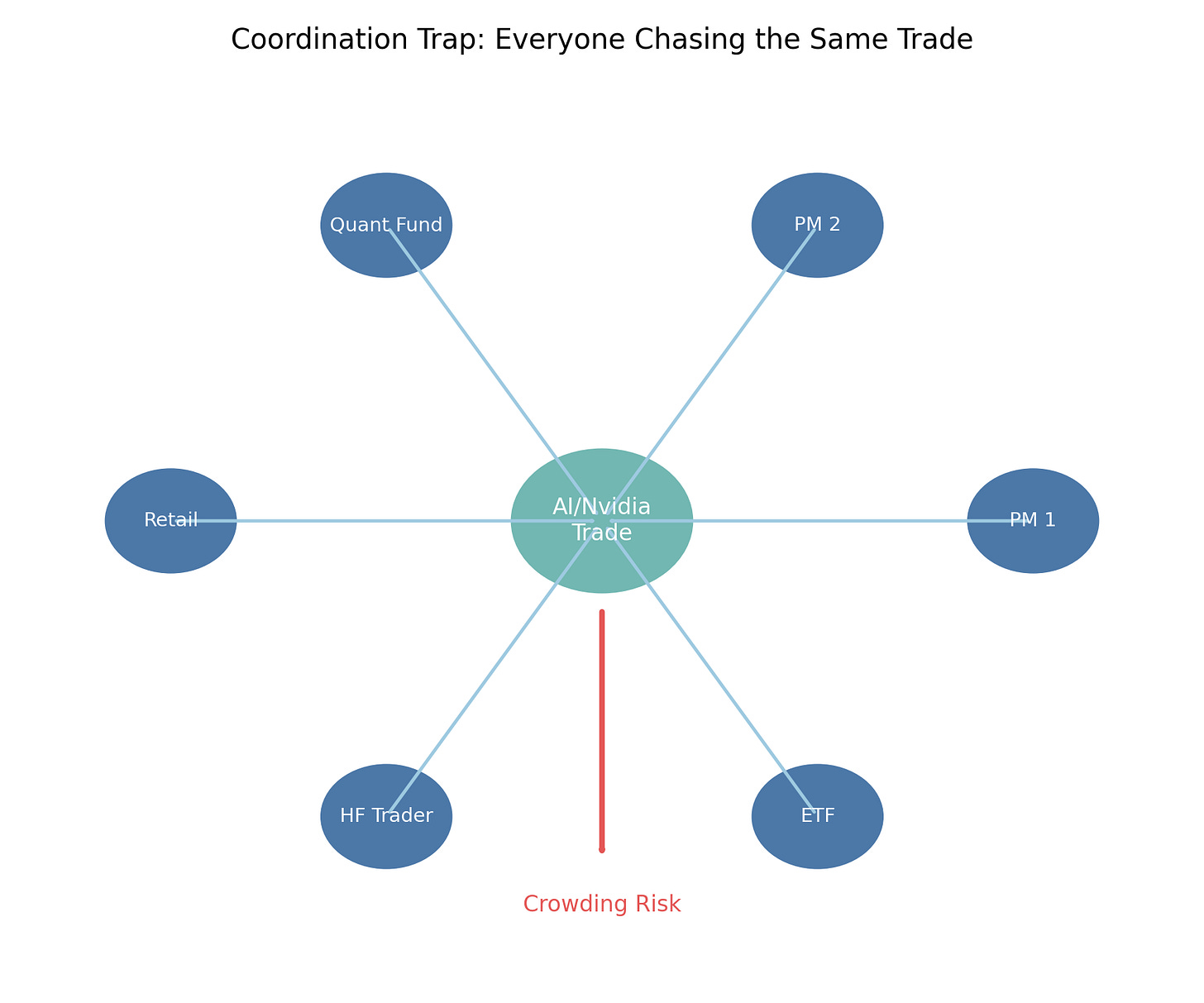

In game theory, this setup is called a coordination trap: every investor thinks the optimal outcome is being long the AI boom - and Nvidia is the easiest proxy. As each player piles into the same trade, the collective outcome worsens.

Each participant lowers their own expected return because future growth is fully priced in.

A single disappointment - soft quarterly results or weak guidance - causes a non‑linear correction.

The trade becomes reflexive: higher prices attract more buyers, which fuels more crowding… until someone blinks.

This is a classic Nash disequilibrium: no single participant can improve their outcome by exiting unilaterally, yet collectively the system is unstable.

In Keynesian beauty‑contest terms, investors aren’t buying what they believe is best; they’re buying what they think everyone else will think is best. The game becomes self‑referential - and fragile. At Potato Capital we call this information fragility: when everyone agrees on upside, the next new piece of information has asymmetric downside. That’s where convexity matters most.

🧰 The Potato Capital Playbook: Mirage‑Aware Positioning

We don’t short the Mirage - we sidestep it.

1. Nash Barbell Portfolio Construction

Left side: Gold, silver, short‑duration cash (yielding ~4–5 %), long volatility.

Right side: Selective tech names with underpriced optionality, high ROIC and non‑crowded narratives.

Middle: Avoided entirely - crowded mega‑cap AI names are un-investable at current implied expectations.

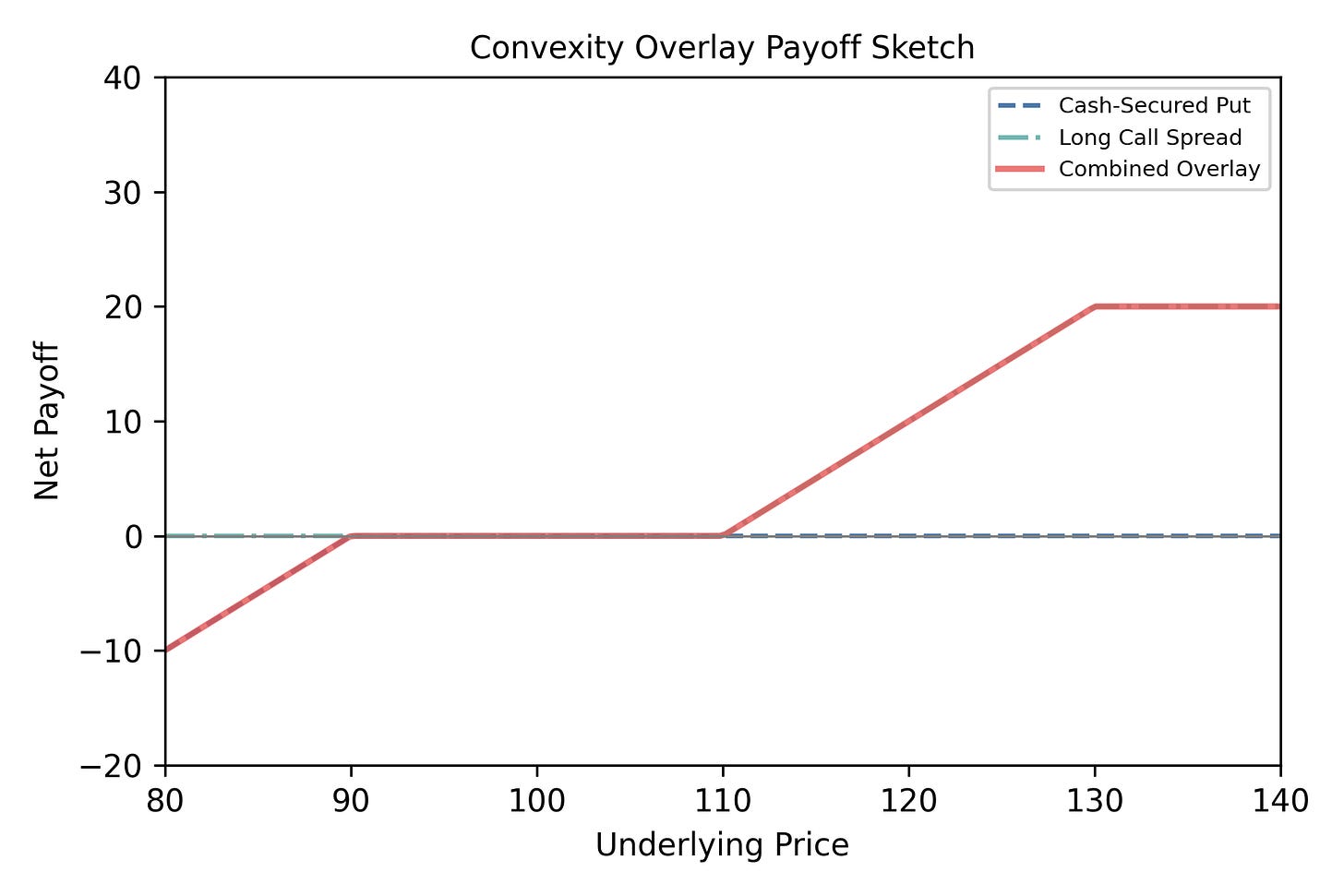

2. Convexity Overlays - Getting Paid to Wait

Cash‑secured puts on names we want to own (GOOGL, QCOM, ON, AMAT) with wide buffers.

Long‑dated call spreads on SLV and GLD for stagflation or rate‑cut regimes.

Tail hedges on QQQ or SMH - not because we predict a crash, but because convexity is underpriced.

With skew flattened and VIX pinned near 13–14, tail risk is cheap - just as crowding risk is rising.

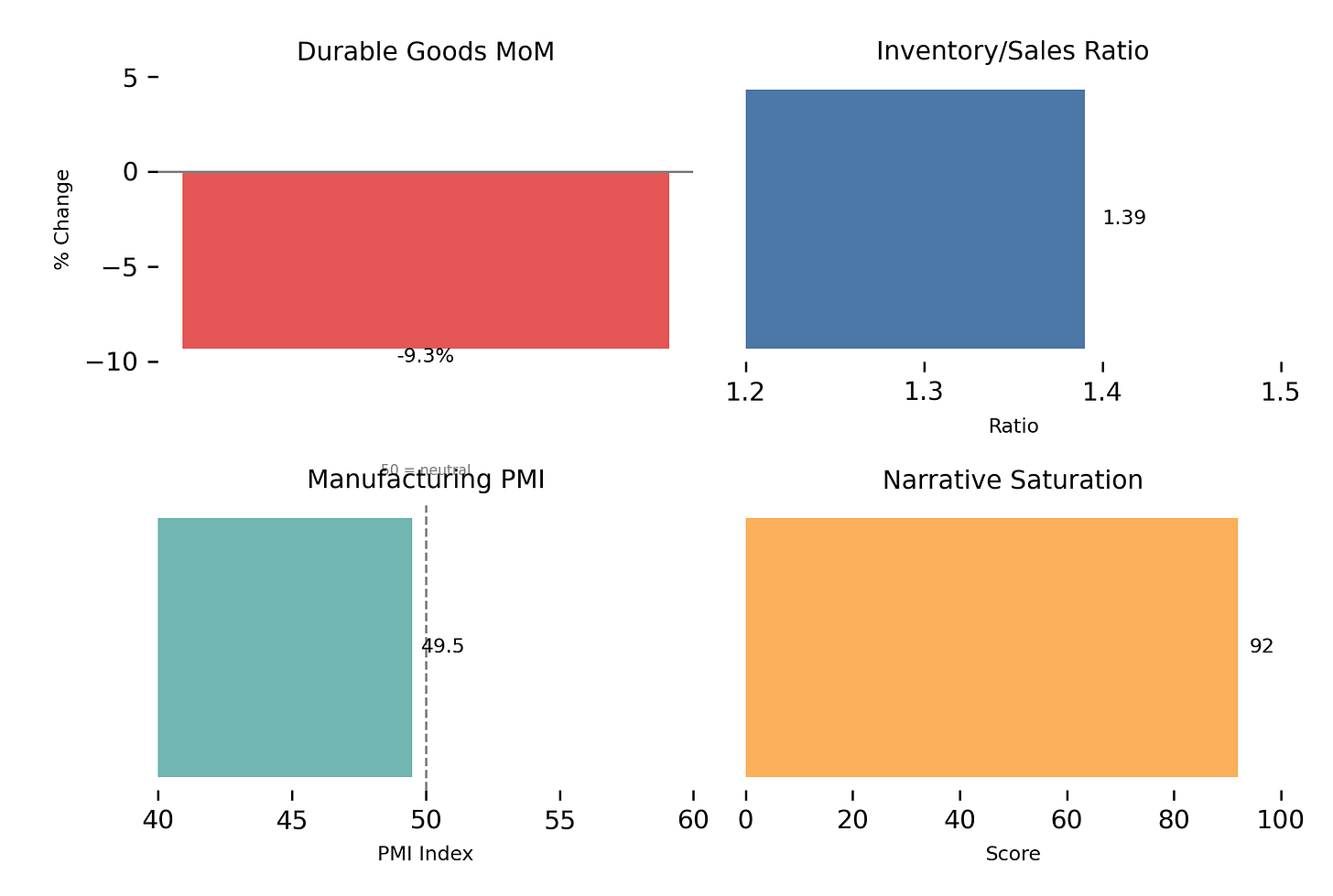

3. Macro Divergence Monitors

We’re now actively tracking:

Durable goods weakness (–9.3 % MoM).

Inventory/sales imbalances (total business inventory‑to‑sales ratio ≈1.39).

Goods disinflation vs. sticky services.

Global manufacturing PMIs around or below 50 for multiple months; S&P Global US manufacturing PMI dipped to 49.5 in July 2025.

Nvidia narrative saturation score = 92/100.

These signals break the Mirage. When earnings and macro start to slip, the narrative shield vanishes.

🤖 Does This Contradict Our AI Capex Supercycle Thesis?

Not at all.

The Mirage ≠ the Supercycle. One is short‑term hype; the other is a decade‑long structural capex wave. We remain long‑term bullish on AI infrastructure and its enablers. But the current Nvidia chase violates our risk/reward discipline.

Supercycle = strategic allocation thesis.

Mirage = tactical crowding risk.

We can hold both truths.

🧠 Optionality > Narrative

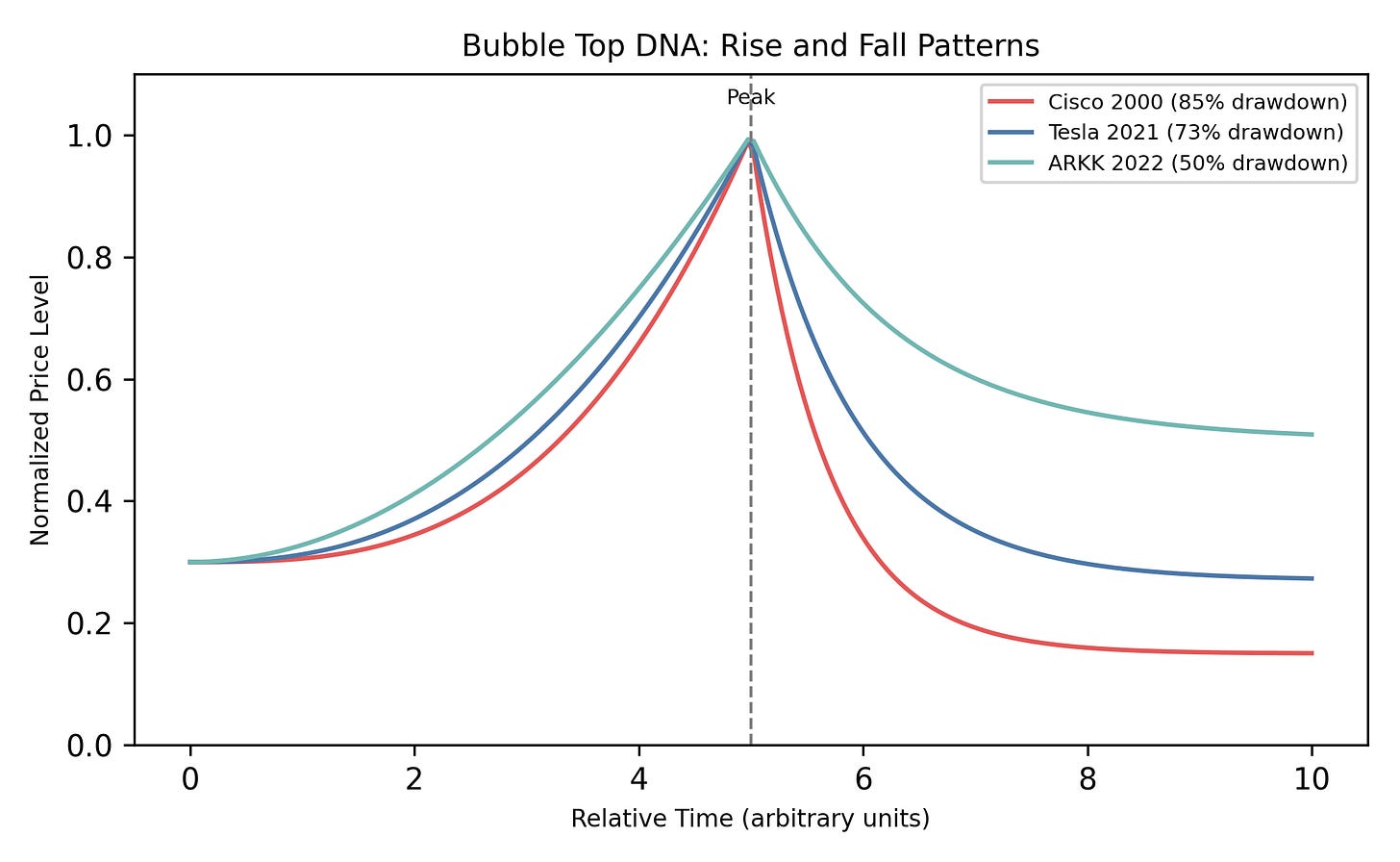

Markets reward capital that sees optionality early - not late capital chasing the loudest story. Every major bubble top has the same DNA: exponential backward‑looking growth, narrative saturation, options froth and institutional crowding. When growth merely normalizes, drawdowns of 30–50 % can happen in a blink.

🥔 Final Take: You’re Not Late to AI - You’re Early to the Exit

This isn’t about calling a top. It’s about identifying crowding, fragility and reflexivity before they matter. The Mirage always looks brightest right before it vanishes.

At Potato Capital, we choose the asymmetric, not the popular. The trade that feels lonely - not the one everyone on CNBC is shouting about.

We’re still AI bulls, just not crowd chasers. The Mirage isn’t the enemy - being trapped in it is.