The Great Multiple Mirage: How Liquidity Is Still Distorting Valuations

S&P forward P/Es are hovering near 22×. The Nasdaq is pushing 27×. Are investors paying up for real growth - or still surfing a wave of residual liquidity?

Multiples are high, but earnings growth isn’t. Liquidity - not fundamentals - continues to anchor the market regime. This is a follow-up to our original Liquidity Engine post, with fresh data, visuals, and a sharper lens on what’s really driving equity pricing in mid-2025.

🔍 Forward Multiples Are High, But Why?

Valuation multiples are rich. But earnings growth is not.

As of June 30, 2025, the S&P 500 trades at a forward P/E of 23.2×, well above its 10-year average of ~17×.

The Nasdaq-100 has surged to 27.13× forward earnings.

Yet S&P forward earnings are projected to grow just ~8.5%, and Nasdaq ~17% - strong, but not enough to justify these multiples alone.

This disconnect raises a critical question: if not earnings, what’s driving equity pricing?

💡 The Answer Lies in Liquidity

In our previous post, we argued that liquidity is the regime-defining force behind modern equity markets. That thesis holds even more weight now.

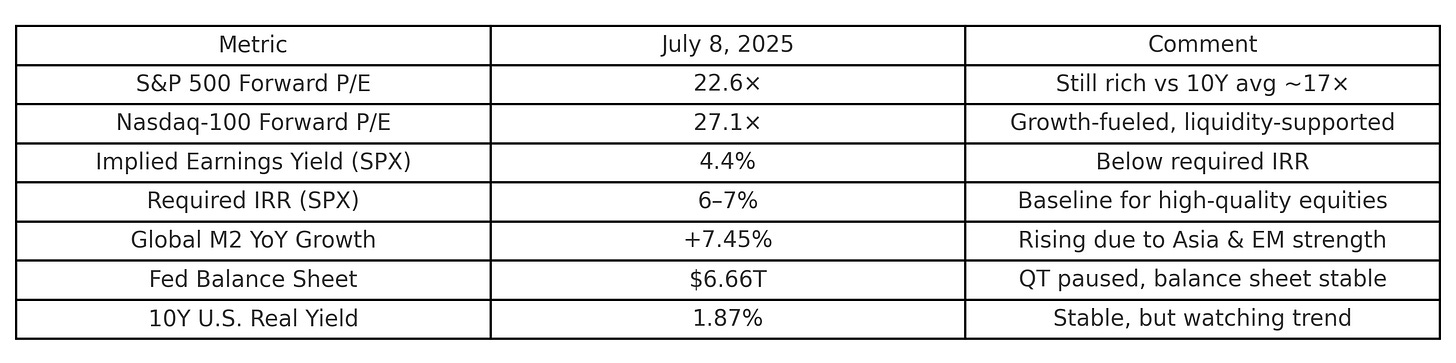

Updated macro-financial conditions (as of June 30, 2025):

Fed Balance Sheet: $6.66 trillion - modest decline, but QT remains partial and politically constrained.

Global M2 Growth: ~+7.45% YoY - expanding sharply in Asia and EMs, offsetting North American tightening.

10Y U.S. Real Yield: 1.87% - rising off cycle lows, but still below pre-COVID norms.

The Fed hasn’t added liquidity - but it hasn’t removed it at the promised pace either. Meanwhile, global easing and capital recycling have kept the system flush.

Result? Forward P/Es rise even as earnings growth moderates.

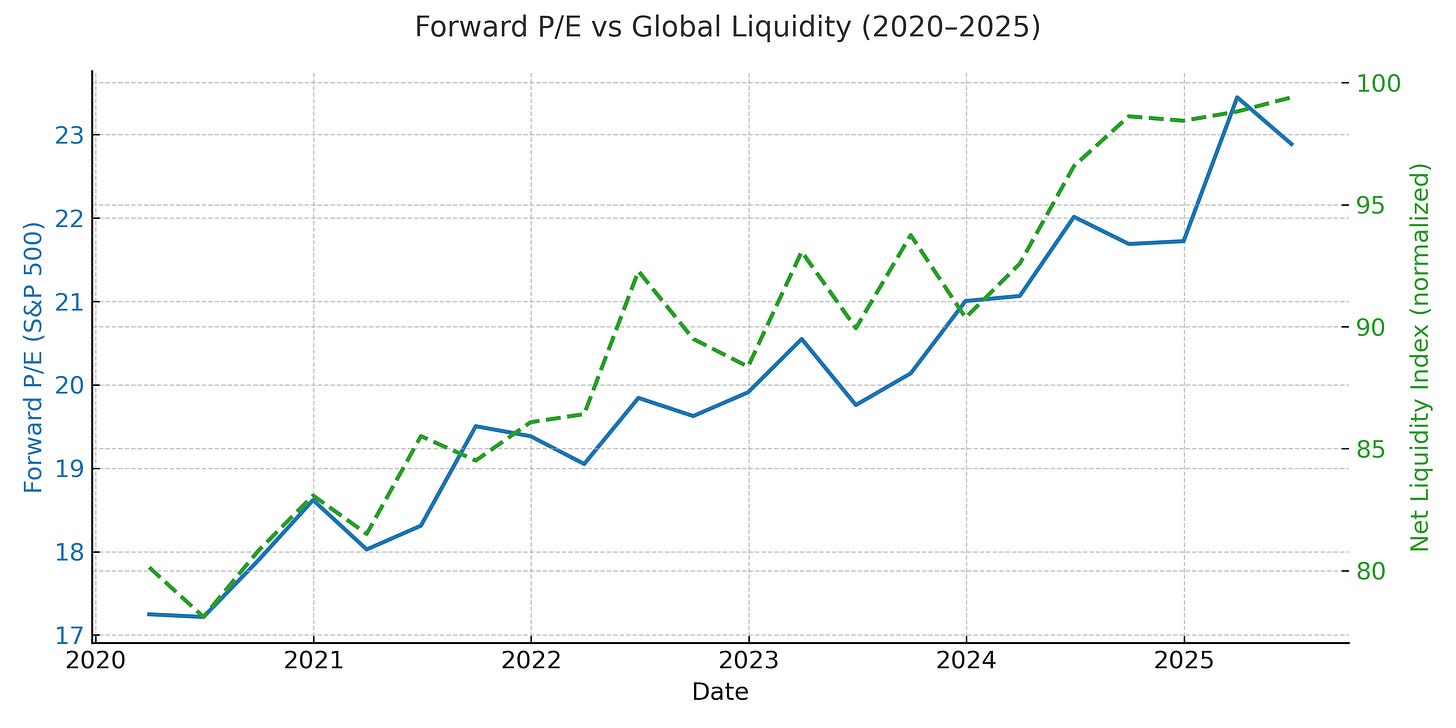

📊 Macro Valuation Dashboard: The Visual Evidence

Three key takeaways:

P/E multiples expanded even as earnings momentum slowed

Earnings yields fell to multi-year lows - compressing forward IRRs

Valuations decoupled from earnings and instead tracked net liquidity more tightly

This reinforces the core idea: multiples are liquidity-driven, not earnings-driven.

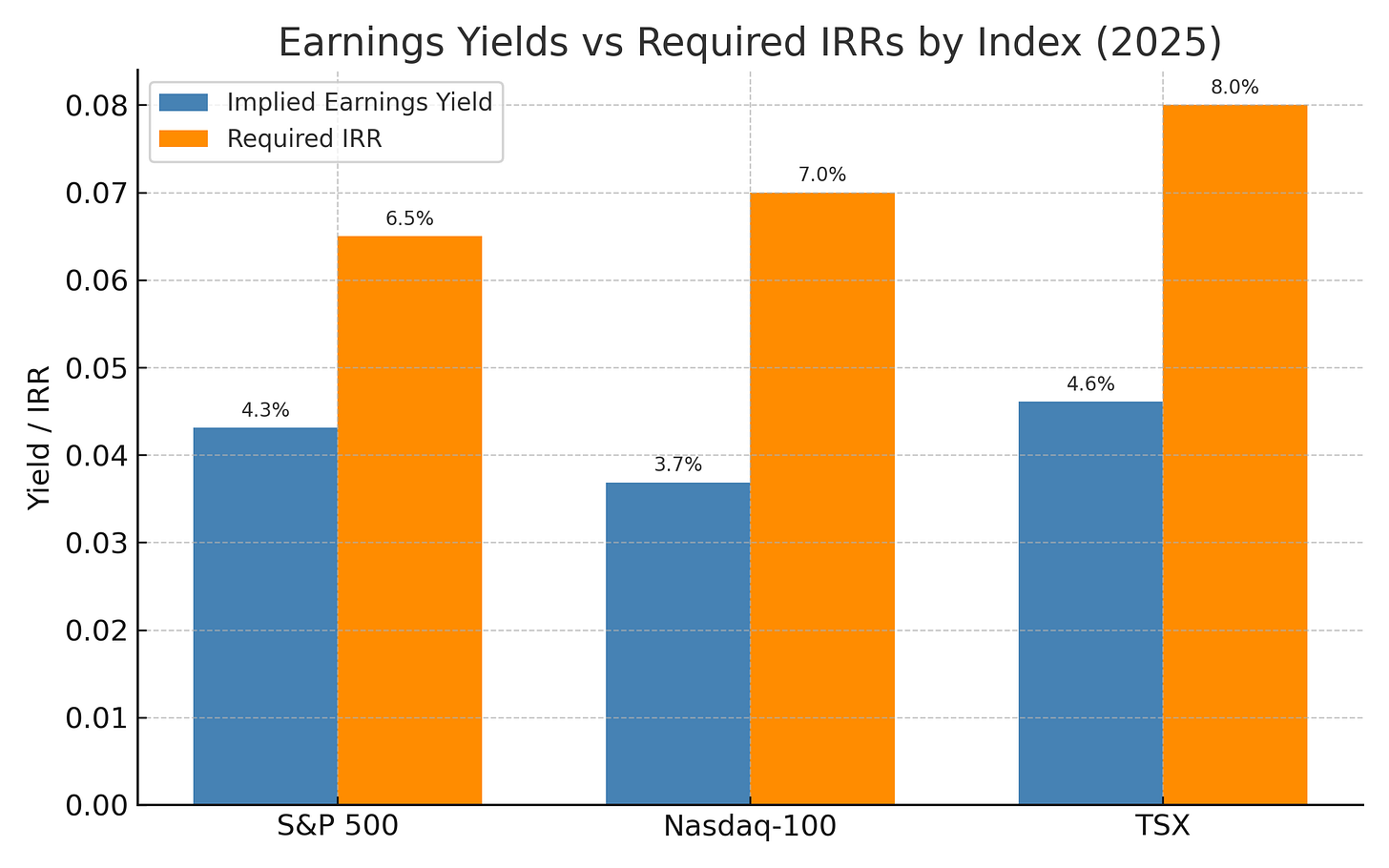

📉 IRRs vs Market Pricing: Mind the Gap

We target scenario-weighted IRRs. Here’s how they compare:

Required IRRs (based on risk & quality):

High-quality compounders: 6–7%

Cyclicals or special situations: 8–10%+

Long-duration options/LEAPS: 18%+

Current index-level implied earnings yields:

S&P 500: 4.4% (inverse of 22.6×)

Nasdaq-100: ~3.7%

TSX: ~4.6%, with lower growth

⚠️ These earnings yields fall short of required IRRs - especially after adjusting for risk, margin volatility, and capital intensity. This is why we say the market is being floated by liquidity, not fundamentals.

⚖️ Liquidity Scenarios: Valuation Outcomes

1. Base Case: Stable Liquidity

Fed pauses QT; balance sheet drifts sideways

Global M2 keeps rising, led by Asia/EM

SPX forward P/E stabilizes around 22.6×

IRRs remain thin → upside must come from reinvestment, capital return, or tactical overlays

2. Bear Case: Tightening Shock

Fed resumes active QT or real yields spike above 2.2%

Global M2 stalls or reverses

SPX P/E compresses to ~18×

Valuation-driven drawdown risk: –15% to –20%

3. Bull Case: Liquidity Surge

Macro shock (e.g., slowdown, election chaos) drives renewed easing

Real rates fall and balance sheets expand again

SPX P/E expands to 24–25×

Price upside, but IRRs compress further - valuations inflate faster than fundamentals

Every outcome ties back to one factor: net system liquidity.

📋 Potato Capital Final Take

This post is the natural sequel to our original Liquidity Engine thesis.

That piece asked:

“Why are valuations this high?”

This one answers:

“Because liquidity never really left.”

We’re not in a growth-driven bull market.

We’re in a liquidity-defined valuation regime; asset prices are anchored more by central bank behavior and money supply trends than by earnings fundamentals.

Valuations aren’t irrational.

They’re floating on policy inertia, global capital flows, and suppressed real yields.

This environment demands discipline:

IRR-based frameworks over narrative-chasing

Scenario thinking over binary forecasts

Macro awareness at every turn

🧠 Bottom Line

Liquidity isn’t a catalyst.

It’s the foundation of modern market pricing.

It sets the range for valuations.

It frames risk tolerance.

It determines what “expensive” even means.

Ignore liquidity, and you’re mispricing risk, duration, and return expectations - across the entire capital stack.