📦 US-EU Reciprocal Trade Framework

A $1.35 trillion handshake that binds Europe to America’s industrial revival.

🔑 Executive Summary

On July 27, 2025, the U.S. and European Union reached a landmark bilateral framework agreement that averted a full-blown transatlantic tariff war and reshaped the structure of economic alignment between the two blocs. The deal caps U.S. tariffs on most EU imports at 15%, excluding ongoing 50% duties on steel and aluminum, while unlocking $750 billion in European energy purchases and $600 billion in direct investment into the U.S. economy. The framework marks a defining shift in global trade policy under the Trump 2025 doctrine: market access in exchange for capital flows and strategic leverage.

🧠 Key Themes

U.S. Wins: Industrial export access, LNG dominance, inbound capital flows

EU Concedes: Tariff burdens, regulatory asymmetry, growing strategic dependence

📈 Macro Shift: From rules-based multilateralism to hardline bilateralism

📊 Market Lens: Bullish for U.S. capex, energy infrastructure, and semiconductor capital goods

🧭 Strategic Thesis: Trade policy retooled as a lever for industrial dominance

📜 Deal Terms

15% tariff ceiling on most EU exports to the U.S., including autos, semiconductors, and pharmaceuticals

Zero-for-zero tariff regime on priority sectors: aircraft, generic drugs, semiconductor equipment, and critical raw materials

50% tariffs remain on EU steel and aluminum, pending transition to quota-based negotiations in 2026

$750 billion EU commitment to purchase U.S. energy exports - LNG, crude oil, and nuclear fuels - over a 3-year window

$600 billion in EU FDI into U.S. industrial and defense-linked sectors, with targeted flows to the Midwest, Gulf Coast, and Mid-Atlantic regions

New policy alignment tracks established for:

Pharmaceutical labeling standards

Electric vehicle platform compatibility

Rare earth supply chain coordination and stockpiling

🌍 Macro Impact

Avoids inflation shock: Sidesteps major CPI spikes that would have resulted from the threatened 30–35% tariffs on EU goods

U.S. industrial acceleration: Supports increased factory utilization, capital goods orders, and LNG export volumes

Deflationary tailwind: High-volume export flows drive cost efficiencies for U.S. manufacturers and input producers

EU macro erosion: Strategic autonomy weakened as investment and purchasing commitments become quasi-binding

Capital reallocation effect: Accelerates reshoring and industrial policy leverage as capital flows shift from the EU to U.S. regions with high policy alignment

🏭 Sector Winners & Losers

🏆 Winners

U.S. energy – LNG exporters, midstream operators, and pipeline infrastructure benefit from guaranteed European demand

U.S. semiconductors – Export tailwinds for chip equipment, analog semis, and foundry services in capital-intensive segments

Industrials & defense – Strong upside for OEMs, capex beneficiaries, and arms suppliers tied to transatlantic procurement

🚩 Losers

EU autos & semiconductors – Locked into a 15% tariff floor on U.S.-bound exports, compressing margins and limiting competitiveness

EU policy leverage – Reduced ability to retaliate or renegotiate due to upfront capital and energy commitments

EU inflation dynamics – Ongoing imported input cost pressure as U.S. supply replaces domestic or Chinese sourcing

📈 Trade & Investment Flows

$750 billion in EU energy purchases from the U.S. through 2028 - averaging ~$250B/year across LNG, oil, and nuclear fuels

$600 billion in European capital inflows into U.S. sectors including industrial manufacturing, logistics infrastructure, agriculture, and defense systems

Strategic capital reallocation from EU-based production hubs to U.S. industrial regions aligned with policy incentives (Midwest, Gulf Coast, Mid-Atlantic)

🔮 Potato Capital Take

This isn’t just a trade agreement - it’s a capital transfer mechanism disguised as policy. The U.S. secured twelve figures in energy sales and investment commitments while locking in a hard tariff ceiling on inbound EU goods. It’s industrial statecraft executed at macro scale.

Trump’s trade doctrine is now unmistakable: “Access in exchange for capital.” The same structure is repeating with Japan, South Korea, and Vietnam. The message is clear: you don’t get into Fortress America unless you pay - in BTUs, in capex, or by relocating your factory footprint.

🧭 Strategic Context

First major template agreement under the Trump 2025 tariff regime - a playbook now repeating globally

Launches the “reciprocity + macro pledge” model, where tariff relief is exchanged for capital alignment and policy concessions

Lays the foundation for a semi-permanent U.S.-centric industrial alliance, spanning energy, defense, and manufacturing flows

Accelerates the erosion of multilateralism, as Europe shifts away from WTO-era norms toward bilateral power dynamics

Reinforces China+1 logic, with Europe increasingly absorbed into the U.S. value chain as a strategic co-producer and capital partner

⚠️ Flash Risk Flag

If the EU fails to deliver the full $600 billion in U.S.-bound investment by 2026, the Trump administration has explicitly reserved the right to raise tariffs to 35% unilaterally. While this clause is not codified in the written framework, it has been publicly confirmed by senior U.S. officials and Treasury advisors. The risk of snapback escalation remains a live policy tool - and a structural overhang for European exporters.

📆 Catalyst Timeline

Q3 2025: European Parliament begins formal ratification and policy harmonization process

Q4 2025: U.S. Treasury and Commerce Department initiate capital flow audits and investment compliance reviews

2026: USTR opens review window - potential for tariff snapback to 35% if EU fails to meet investment or energy purchase targets

💵 Watchlist (Macro-Aligned Plays)

U.S. Beneficiaries:

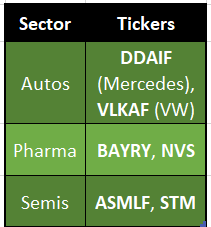

EU Exposure Risk:

📊 Visual

🥔 Final Take

The U.S. didn’t blink - it billed. Europe bought trade access with capital and energy dependency. This isn’t free trade. It’s leverage, monetized. And for now, America owns the invoice.

Sources: Reuters, Financial Times, Council on Foreign Relations, Eurointegration, NY Post, The Guardian, USTR, White House