📈 Weekly Market Recap and Preview - August 04, 2025

Markets Flinch as Revisions Bite: The Fed Gets Cover, Tariffs Get Real, and Volatility Returns

🔑 Executive Summary

The first week of August marked a critical inflection point across asset classes:

Equities broke lower, led by sharp pullbacks in AI-linked mega-caps

Volatility surged, with the VIX spiking above 20 - its highest close YTD

Labor data disappointed, and back revisions erased 258k jobs from prior months

Core PCE cooled again, reinforcing the disinflation narrative

As a result, rate cut odds for September surged from ~30% to >80% within 48 hours

Meanwhile, the August 1st tariff deadline struck - but contrary to early headlines, no U.S.–Canada deal was reached. Instead, tariffs rose, with Canada facing a headline 35% rate, partially blunted by CUSMA exemptions. Tariffs on copper, semiconductors, and pharma inputs now range from 15–25%, injecting margin risk into global supply chains.

Macro momentum is no longer on autopilot. Flows are thinning. Policy friction is rising. And forward earnings visibility is fading. The easy beta rally is behind us - now begins the age of precision positioning.

📉 Macro Data Recap

U.S. - Cracks in the Façade

Jobs:

July Nonfarm Payrolls: +73,000 - smallest gain in nearly 5 years

Revisions:

May: revised down by −125k (from +144k to +19k)

June: revised down by −133k (from +147k to +14k)

➤ Total downward revision: −258,000

Unemployment Rate: ↑ to 4.2% (highest since Nov 2021)

Average Hourly Earnings: +0.3% m/m | +3.9% y/y - cooling but still above core inflation

Inflation:

Core PCE (June): +0.1% m/m | +2.8% y/y

🧊 Lowest annual print since March 2021 - disinflation trend remains intact

Activity:

ISM Manufacturing (July): 48.0

→ Fifth straight month of contraction, led by employment and new orders weaknessISM Services (July): 52.7

→ Solid expansion driven by new orders and business activity

The July jobs report was a jolt. A mere +73k payroll gain - plus 258k in downward revisions - signals substantial labor market deterioration. The 4.2% unemployment rate and easing wage growth further confirm the slowdown. On the inflation front, core PCE is back to 2.8%, providing the Fed with air cover. And while services remain resilient, manufacturing is firmly in contraction.

➡️ Markets now see a September rate cut as base case - with 1.7 cuts priced in by year-end.

Canada - Soft Growth, Modest Labor Recovery

Growth:

May GDP: −0.2% month-over-month - second consecutive decline

Preliminary June GDP: +0.1% m/m (advance estimate)

Labor Market:

June Employment: +83,100 jobs (+0.4%) - first net gain since January, dominated by part-time hiring

Unemployment Rate (June): 6.4%, down from 7.0% in May

Employment Rate: Increased to 60.9%

Average Weekly Wages (June): +3.2% y/y, tapering from stronger readings earlier in the year

Canada’s economy is teetering at a precipice of stagnation: GDP remains weak - just enough rebound in June to neutralize May’s decline. Employment rebounded modestly, but full-time hiring remains weak. The unemployment rate remains elevated, and wage growth is slowing. While the labor market showed resilience in June, the overall balance is increasingly fragile. This mixed tone could give BoC room to hold in September, but further easing remains possible if the final GDP and CPI figures continue to soften.

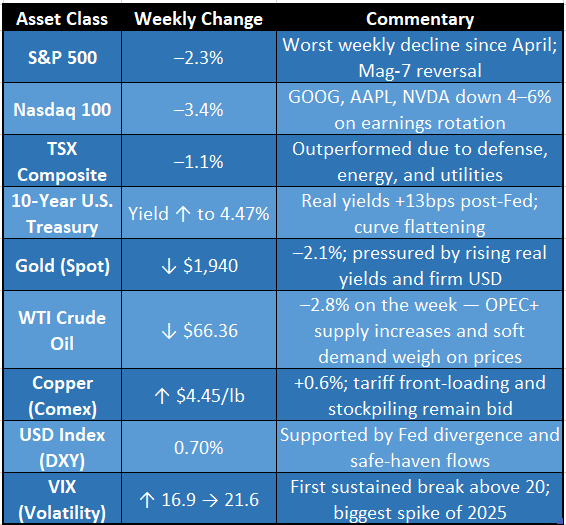

🧮 Market & Commodities Snapshot

The first week of August brought a decisive break in market momentum. AI leaders rolled over, dragging indices sharply lower. Weak jobs data and rising Treasury issuance pushed real yields higher, triggering a rotation out of rate-sensitive assets. Meanwhile, global macro frictions - including trade tensions and OPEC+ supply signals - drove sharp cross-asset repricing.

The selloff wasn’t just about earnings - it was a synchronized macro repricing. Volatility spiked. Real yields rose. Oil cracked. Copper held up - but the commodity bid is being tested. The regime is shifting from flows and FOMO to policy and positioning.

🏛️ Policy & Geopolitical Developments

🟢 Fed Watch:

FOMC held at 4.50% on July 31, as expected.

Powell’s tone: Emphasized data-dependence and cited "encouraging signs of disinflation."

Market reaction:

July jobs miss (73k) and Core PCE cooling triggered a dovish repricing.

September rate cut odds surged from ~30% → over 80% within two days.

Futures now price in ~1.7 cuts by year-end, with November seen as a near-lock if September is skipped.

🟠 Tariff Watch (as of Aug 1):

No U.S.- Canada deal was reached.

→ Canada’s tariff rate increased from 25% → 35%, but CUSMA exemptions still apply.

→ Effective tariff rate remains lower due to rising compliance and exemptions on energy and critical minerals.U.S. - EU deal reached, reducing tariffs from 30% → 15% on select industrial goods.

Japan & Mexico: Received 90-day exemptions (extended through October).

China: Deadline set for August 12. Talks remain stalled; escalation likely.

Targeted tariffs now apply to:

Semiconductors

Copper and other base metals

Pharmaceutical intermediates

Industrial machinery & select auto components

⚡ Other Geopolitical Headlines:

U.S.–Japan semiconductor accord signed:

Bilateral tech deal includes IP protections and joint R&D support for 3nm chip manufacturing.Venezuela sanctions eased:

Chevron authorized for limited operations - expected to bring ~200k–250k bpd of crude online by Q4.Digital Services Tax (Canada): Scrapped in late July after U.S. pressure - likely a condition in future trade talks.

Taiwan Strait tensions simmering:

Minor naval maneuvers reported - no immediate escalation, but risk premium remains embedded in Asian FX and shipping.

The post-August 1 trade regime is highly fragmented. Even “exempt” countries face conditional access. Canada’s situation is nuanced - headline tariffs are punitive, but CUSMA still offers broad free trade for compliant goods. Meanwhile, the Fed has room to cut - but must now navigate a world of fraying trade networks and rising policy volatility.

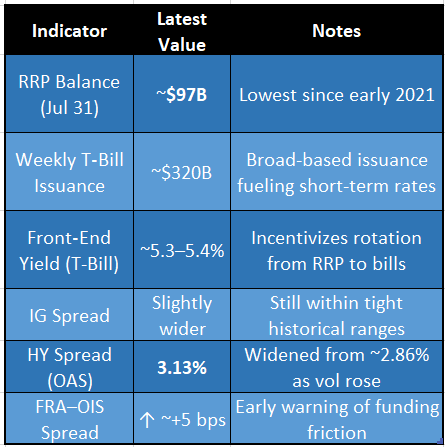

💧 Liquidity Watch

🏦 Reverse Repo (RRP) Facility

Outstanding RRP balances dropped to ~$97.4B on July 31, 2025 (the lowest in over three and a half years)

As of August 4, balances remain low at ~$125B. This sharp drawdown confirms strong rotation of excess cash into T-bills and private repo markets.

💵 T‑Bill Supply & Yields

U.S. Treasury issued ~$320B in short-dated T-bills in the past week (raising repurchase capacity and funding the deficit)

Front-end T-bill yields remain anchored at ~5.3–5.4%, still attractive amid geopolitical and market uncertainty.

📉 Credit & Funding

IG credit spreads widened modestly but remain tight, signaling stable credit conditions.

High-yield spreads (ICE BofA US High Yield Master II) ticked up from ~2.86% → 3.13% OAS as of Aug 1, reflecting modest repricing alongside equity volatility

FRA–OIS spread widened roughly +5 bps this week - suggesting slightly elevated short-term interbank funding tension

RRP drainage and record-setting T‑bill issuance confirms a shift of liquidity from Fed facilities into short-term Treasury instruments.

This dynamic supports rate-sensitive assets (like duration), but raises funding risks ahead of large August auctions and legislative refinancing demands.

Credit markets remain resilient, but FRA–OIS widening suggests growing caution - especially if repo funding tightens into the quarter-end maturity wall.

🌍 Macro Lens

🔹 Services Resilience, Goods Decay

ISM Services (July) held strong at 56.3, with new orders rising - showing consumers are still spending on experiences and services.

ISM Manufacturing remained in contraction at 48.9, confirming a continued recession in the goods-producing economy.

Macro Implication: Companies exposed to services (tech, financials, communication) are still supported - but at risk if services sentiment rolls over post-summer.

🔹 Tariff Pass-Through = Margin Risk

Tariff implementation on Aug 1 is pressuring input costs. Key sectors include:

Semiconductors (upstream machinery, rare earths)

Pharma & medical tech (APIs, equipment)

Copper & aluminum (used in EVs, power grids, electronics)

Copper remains firm at $4.45/lb, partially supported by pre-tariff stockpiling.

Macro Implication: Input cost pass-through will likely dent Q3/Q4 margins, especially for manufacturers and cyclicals with less pricing power.

🔹 Canada Tilting Into Recession

May GDP contracted –0.2% m/m; July jobs print came in at +73,000, but entirely driven by part-time gains.

Unemployment climbed to 6.5%, the highest since 2021.

Consumer confidence has deteriorated sharply, and business surveys (CFIB, BoC) show worsening outlooks.

Macro Implication: A third BoC cut is increasingly likely by September or October, especially if inflation continues decelerating.

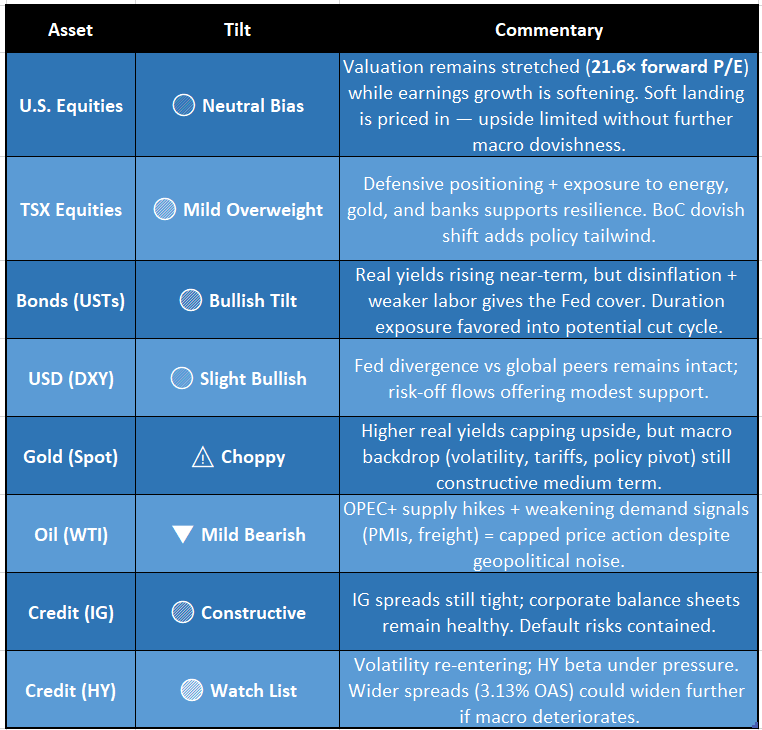

🧭 Asset-Class Playbook

The barbell of quality equity + duration + modest credit risk remains intact - but the passive beta regime is fading. Active tilts, duration overlays, and volatility-aware credit exposure are critical in this new crosscurrent macro.

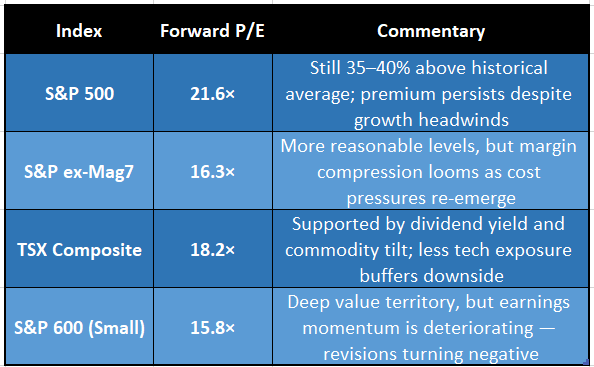

📊 Valuation Context

Valuations remain stretched at the index level, especially for mega-caps. With earnings beats narrowing and macro headwinds building, valuation discipline and factor rotation (e.g. into quality and defensives) are key in this regime.

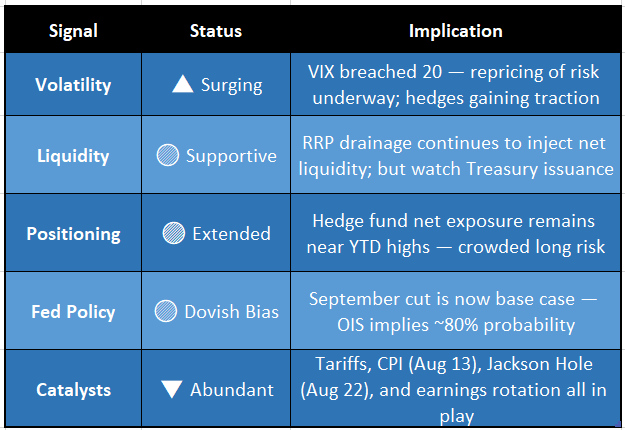

🎯 Conviction Barometer

🟡 Stance: Cautious Neutral

[🟦 Defensive | 🟩 Neutral | 🟥 Risk-On]While liquidity remains net-supportive and the Fed is pivoting, volatility and positioning excess limit risk appetite. This is not a clear green light for aggressive upside bets - the environment favors selective long bias with embedded convexity or hedged barbell exposure.

🥔 Final Take

The macro tide has turned - decisively.

Jobs are weakening.

Inflation is cooling.

Policy is pivoting.

But volatility is rising, and tariffs are rewriting the global flow map.

This is no longer a market carried by passive liquidity and momentum beta.

The next phase demands precision - in allocation, duration, and narrative exposure.

🔁 Selective rotation is now the name of the game:

✅ Into quality duration (long bonds, bond-like equities, rate-sensitive assets)

✅ Into policy beneficiaries (BoC easing plays, U.S. small-caps, infrastructure, dividend tilt)

❌ Out of overcrowded narratives (AI mega-caps, pricing power myths, liquidity mirages)

This is not the time to panic - but also not the time to coast.

We are entering a phase where crosscurrents will define outcomes.

Risk-adjusted alpha will be earned, not gifted.

Potato Capital’s stance: Stay alert. Stay tactical. Stay ahead -

Because macro matters again.