📈 Weekly Market Recap and Preview - August 11, 2025

Reset, not regime change - volatility cools, real yields sticky, USD firm; September cut base case; alpha > beta.

🔑 Executive Summary

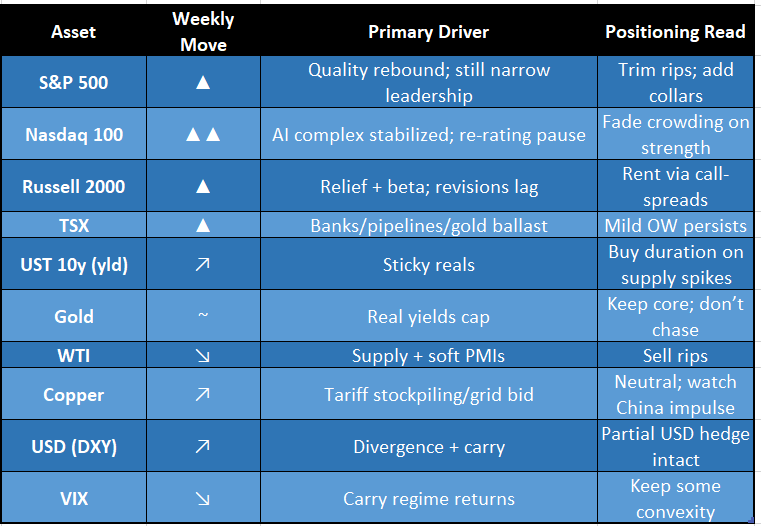

Equities rebounded, leadership stayed narrow. Mega-cap quality outperformed while cyclicals stabilized; breadth improved but isn’t decisive yet.

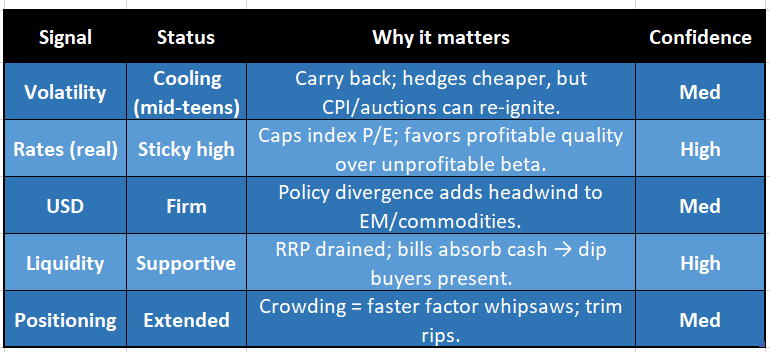

Volatility reset to the mid-teens. Carry is back on, but CPI/auctions/Jackson Hole loom; we keep explicit convexity on stretched leaders.

Macro is “soft-landing adjacent.” Labor is cooling and disinflation persists; manufacturing contracts, services hold up - the Fed has cover to start easing.

Policy path > first cut. Markets lean to a September start; forward curve & factor leadership hinge on pace and balance-sheet cadence.

Tariff frictions migrate to margins. Carve-outs/phase-ins help, but pass-through risk is building for semis tools, industrials, autos supply chains, and pharma inputs - likely surfacing in Q3/Q4 guidance.

House stance: 🟡 Cautious Neutral - quality-tilted equity exposure, duration on backups, IG > HY, and options overlays (collars/put-spreads) on crowded winners.

🧭 Signal Dashboard

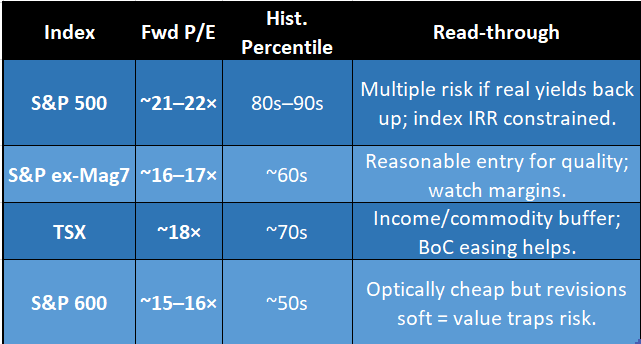

💵 Valuation Context (Forward P/E; %tile vs history)

Valuation governor: If 10y real yields push meaningfully higher from here, we’d haircut the S&P fwd P/E by ~1-2 turns absent a growth surprise.

🧮 Cross-Asset Weekly Moves (through Friday close)

📉 Macro Data Recap

United States - Cooling growth with cleaner inflation backdrop

Labor: Hiring slowed; UR edged higher; wage growth cooled - collectively easing pressure on the Fed.

Inflation: Core measures remain in disinflation mode; shelter stickiness easing at the margin.

Activity: Manufacturing in contraction; services steady expansion.

Read: The Fed has cover to start cutting; CPI is the near-term arbiter of pace.

Canada - Stagnation watch

Growth: Mixed prints hovering around zero; tentative stabilization after prior month’s dip.

Labor: Rebound skewed to part-time; unemployment elevated; wages moderate.

Read: BoC easing bias intact; TSX defensives and income carry remain attractive.

Flip triggers: Core CPI ≥0.3% m/m (hawkish tilt), sloppy auctions (funding tension), or services PMI rollover (<50).

🏛️ Policy & Geopolitics

Fed: September cut = base case; the pace and balance-sheet cadence will set curve shape (bull-steepener risk if guidance turns more dovish).

Tariffs/trade: Headline rates are higher with exemptions/phase-ins; exposures most acute for semis tools, base metals (Cu/Al), pharma inputs, and machinery/auto components. Expect Q3/Q4 margin nibbling as pass-through arrives unevenly.

Supply: Heavy Treasury issuance can re-tighten financial conditions even into a dovish Fed; auctions are the stealth macro catalyst.

What to listen for into Jackson Hole (Aug 22): r* discussion, balance-sheet runoff cadence, and any overt nod to asymmetric downside risks.

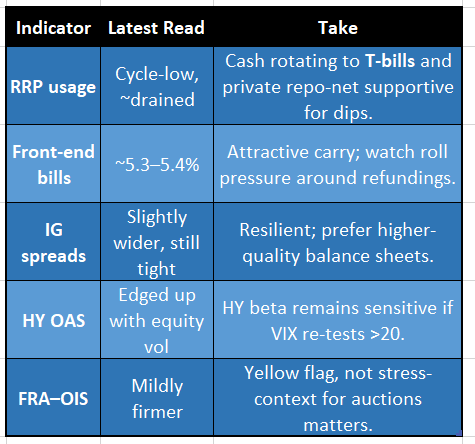

💧 Liquidity Watch

Plumbing: RRP ~drained; front-end bills ~5.3–5.4% keep cash migrating from RRP to USTs - a net support for dip-buying.

Credit: IG resilient; HY OAS widens when VIX > ~18–20 - keep high-yield beta light and favor BB/secured.

Funding: FRA-OIS modestly firmer - a yellow flag heading into heavy refunding, not stress.

Auction heat map (focus): Front-end and 10y reopenings; sloppy bid-to-covers/tails would pop vol and cheapen duration entries.

🌍 Macro Lens

Volatility reset = carry returns

Trade: Collars/put-spreads on stretched quality; monetize skew without surrendering upside.

Kill-switch: VIX > 22 on a breadth-negative down-day.

Sticky reals = valuation governor

Trade: Add 5s/10s duration on supply spikes; fade high-beta rips in unprofitable growth.

Kill-switch: 10y real < 1.5% on a dovish shock (we’d re-risk beta tactically).

Tariff pass-through = margin drag (lagged)

Trade: OW pricing power & strong balance sheets; UW mid-cap manufacturers/autos lacking pricing leverage.

Kill-switch: Material carve-outs/subsidies that neutralize input cost pressure.

🧭 Asset-Class Playbook (1–3 months)

🗓️ The Week Ahead - Key Catalysts

US CPI (Wed): Base: Core 0.2% m/m → cut cemented; likely mild bull-steepening. Alt: 0.3% → “skip-then-cut” chatter; curve flattens, vol pops.

US PPI (Thu) & Retail Sales (Fri): Pipeline prices + consumer pulse = Q4 margin setup.

Treasury auctions: Bid-to-cover/tails - weak demand = higher rates + stickier vol.

Tariff implementation details: Exemptions/phase-ins for critical inputs will drive sector dispersion.

Jackson Hole (Aug 22) setup: Any asymmetric-risk nod = duration bid.

🎯 Conviction Barometer

🟡 Cautious Neutral

[🟦 Defensive | 🟩 Neutral | 🟥 Risk-On]Upgrade if: Core CPI ≤0.2% m/m and auctions firm and HY OAS steady.

Downgrade if: Core CPI ≥0.3% or auctions tail badly or VIX > 22 with weak breadth.

Liquidity tailwinds persist, but valuation and positioning argue for hedged, quality-tilted exposure with explicit convexity. Add duration on backups; IG > HY; TSX defensives over U.S. cyclicals when risk tightens.

🥔 Final Take

Reset, not regime change. With real yields sticky, USD firm, and VIX back to the mid-teens, index-level upside is valuation-capped unless the macro turns more dovish. We stay selectively long, duration-friendly, and options-hedged.

On dips: Add 5s/10s duration, top up quality.

On rips: Trim crowded winners, roll/monetize collars, keep HY beta tight.

Sources: Cboe, CME/OIS, U.S. Treasury, BEA/BLS/ISM, StatsCan, ICE BofA indices, and Potato Capital internal dashboards.