📈 Weekly Market Recap and Preview - August 25, 2025

Powell Opens the Door, Positioning Still Light

✅ TL;DR

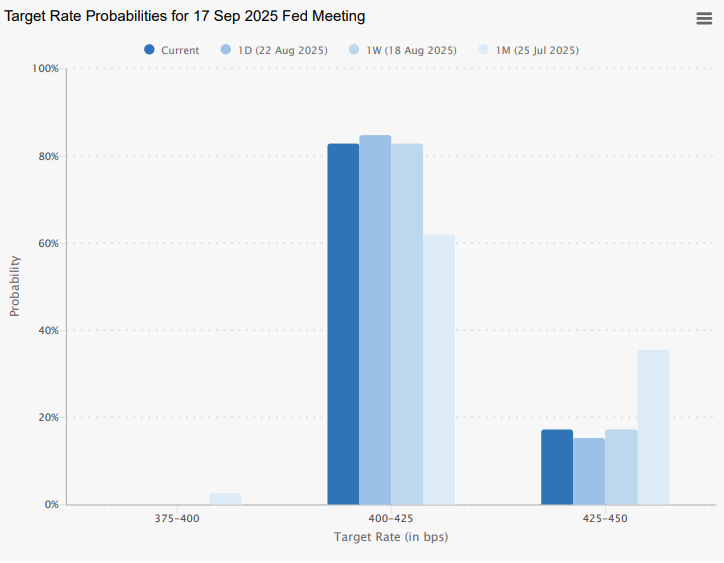

Powell @ Jackson Hole: Signaled risk balance shifted toward easing; markets now price ~84% odds of a September cut.

Weekly tape: S&P 500 +0.3%, Nasdaq −0.6%, Dow +1.5%; rotation into cyclicals/financials.

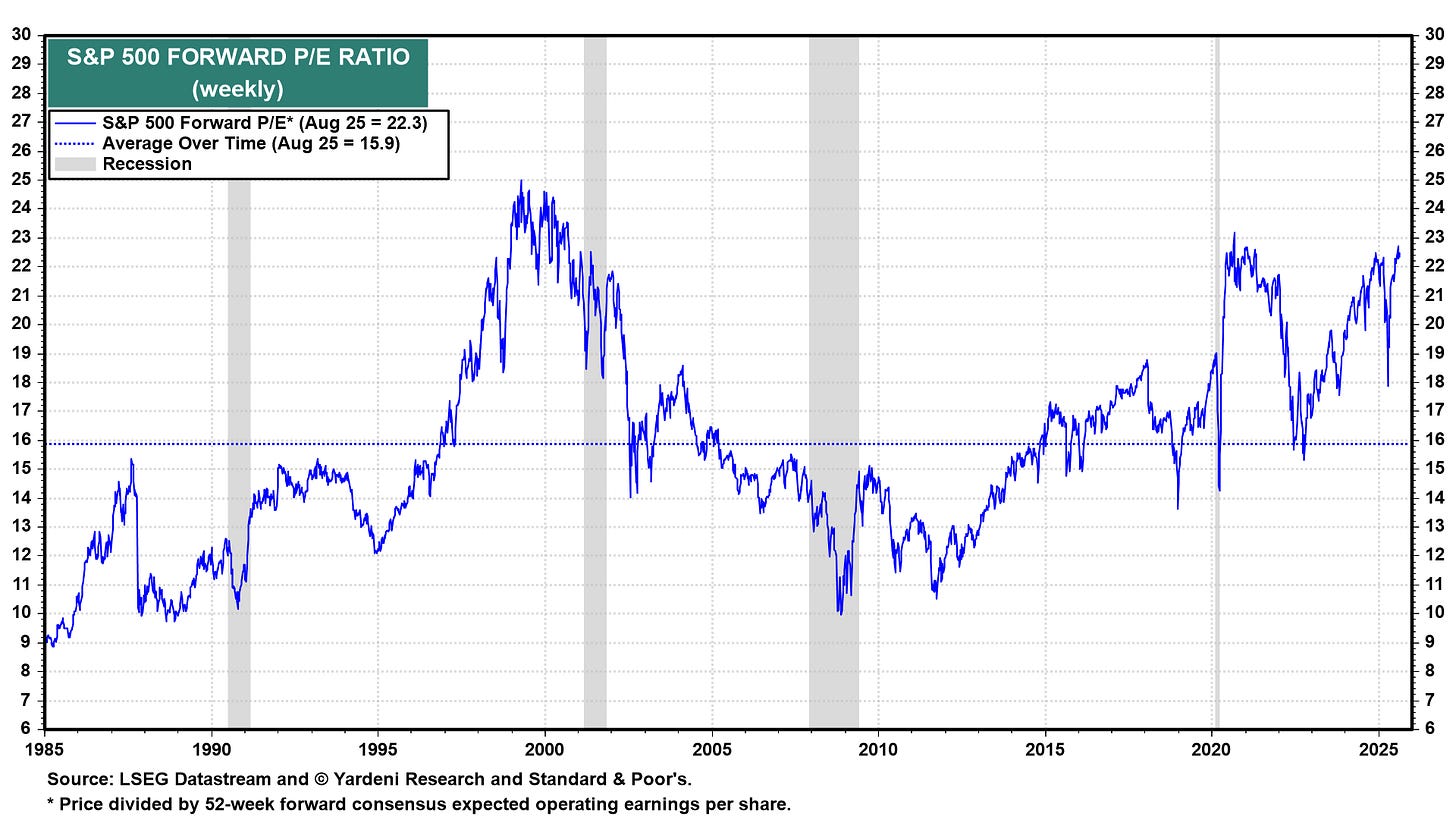

Valuation: S&P forward P/E ≈22.1x (top-decile vs history).

Credit: IG OAS ~0.77% = ultra-tight, complacency risk.

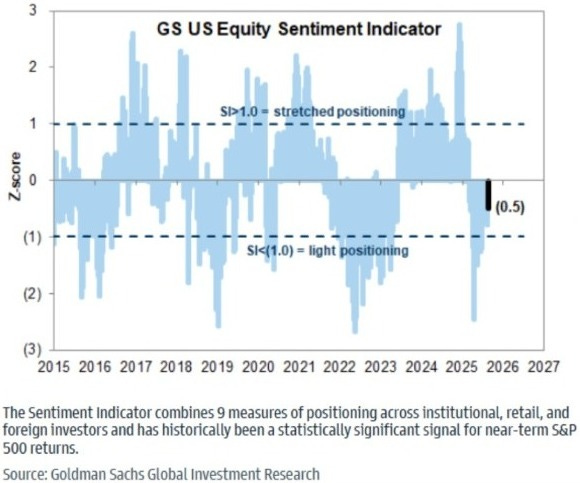

Positioning: GS Sentiment –0.5 (light), vs valuations stretched.

Conviction Tier: Neutral/Defensive with convexity overlays.

🔑 Executive Summary

Markets ended the week mixed after Powell’s Jackson Hole speech tilted dovish: S&P +0.3%, Nasdaq −0.6%, Dow +1.5%. Futures now imply ~84% odds of a September cut, with Powell reframing risk around labor softness rather than inflation persistence.

This relief rotated leadership into financials, energy, and healthcare, but valuations remain rich (SPX forward P/E ≈22.1x) and credit spreads (IG OAS 0.77%) imply complacency. Breadth is still weak (<35% of SPX constituents beating index).

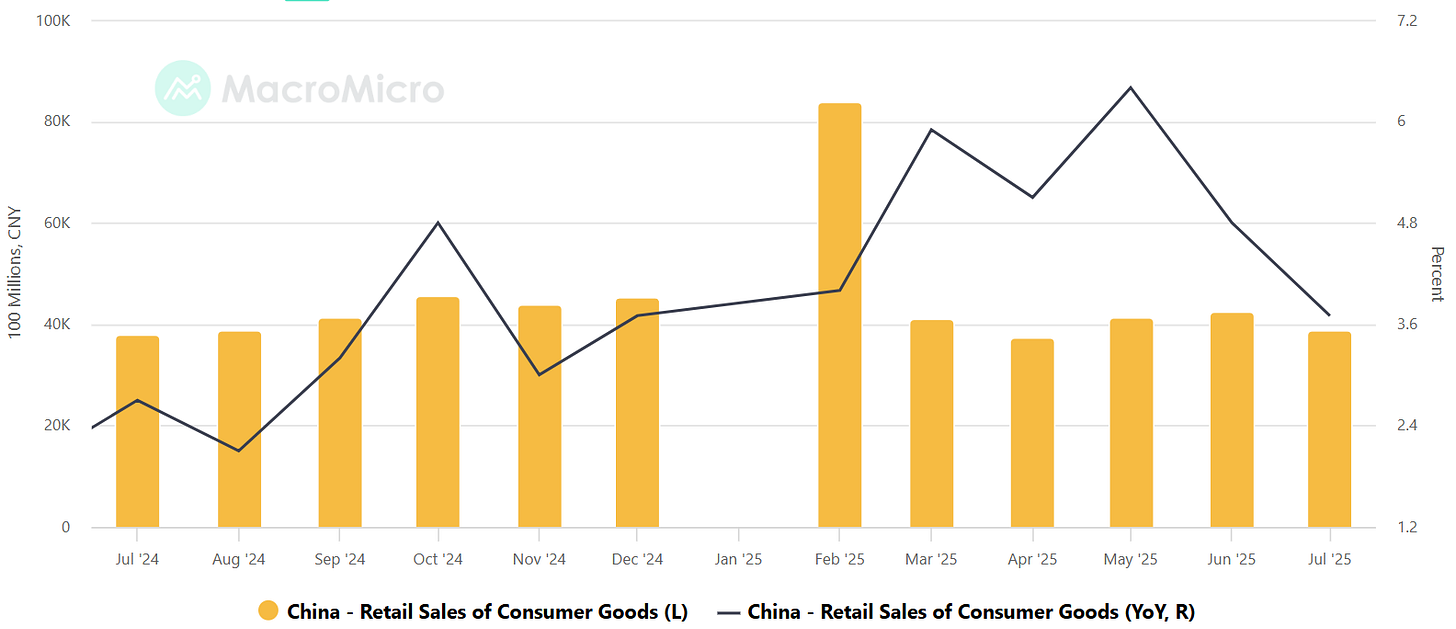

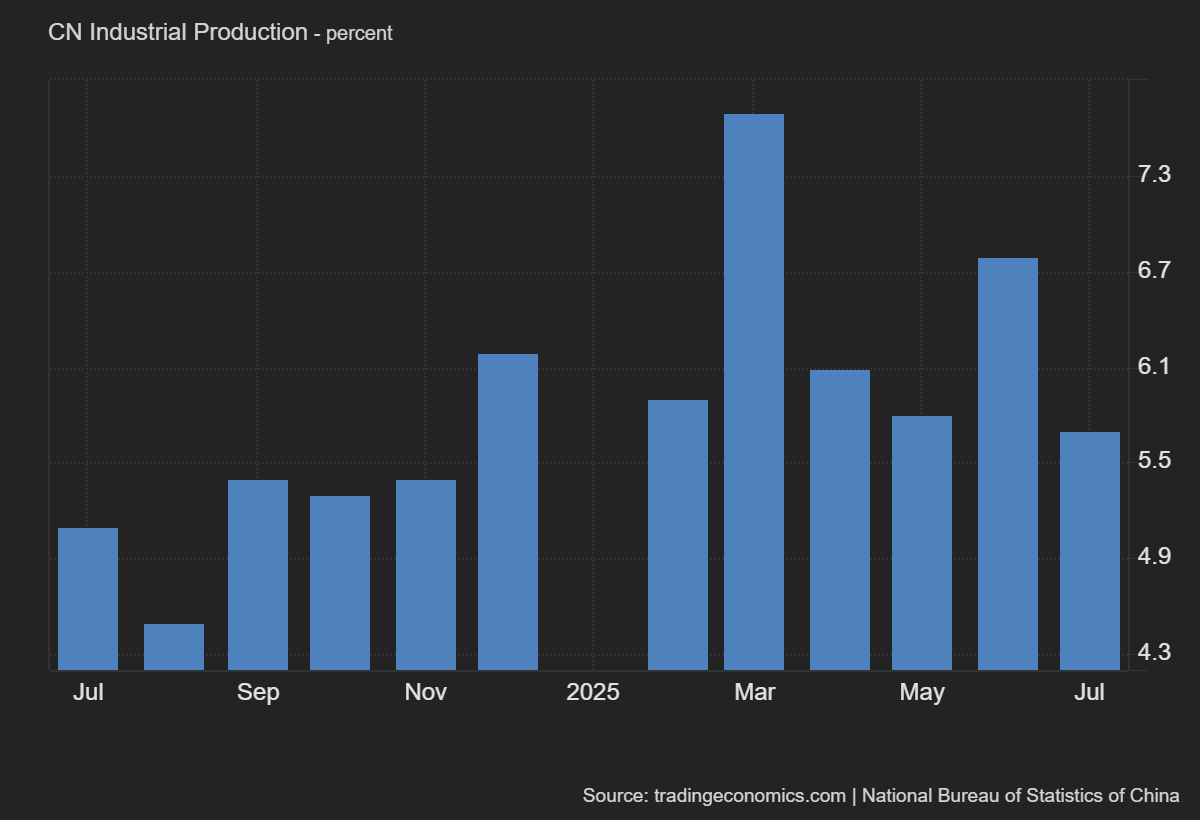

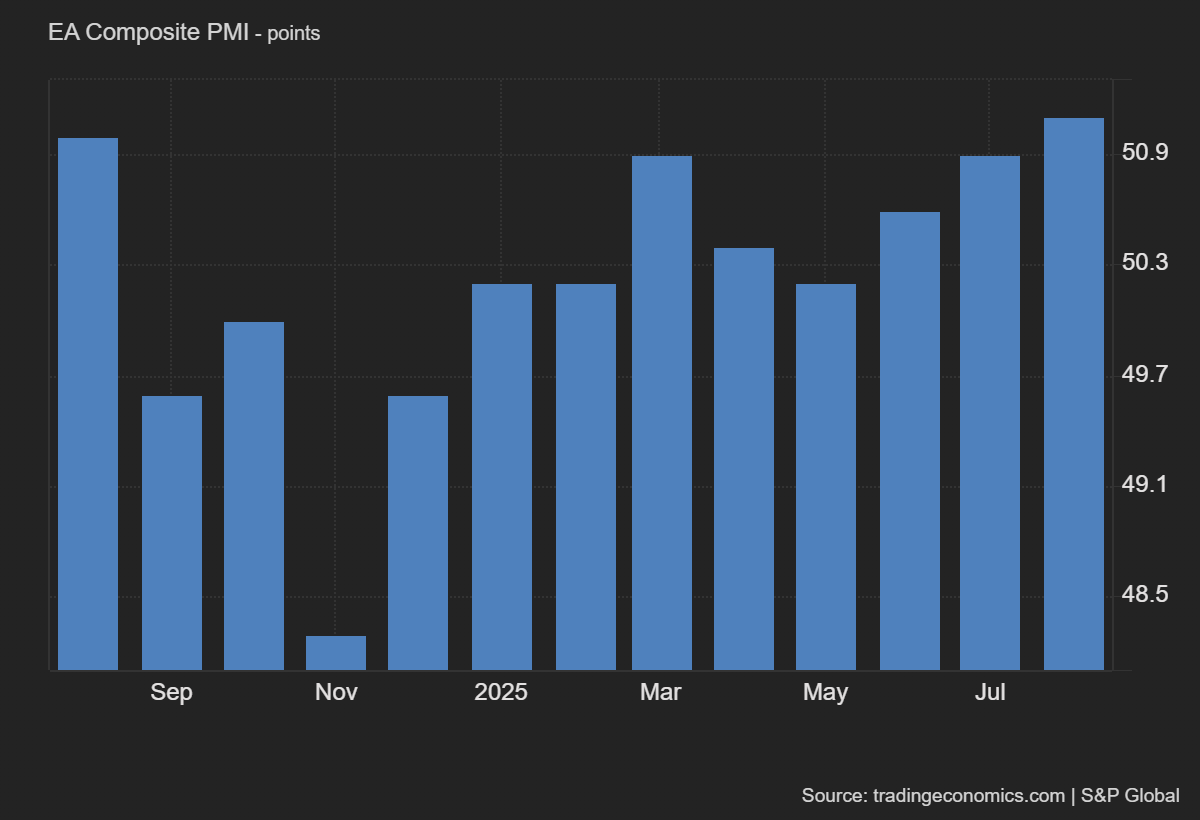

Globally, China remains fragile (retail sales +3.7% YoY, industrial output +5.7% YoY) and Europe is only marginally expanding (Composite PMI 51.1) while LatAm continues easing. The setup is classic late-cycle liquidity transition: supportive flows vs stretched multiples.

This week’s twin catalysts are NVDA earnings (Wed) and core PCE (Fri) - micro then macro.

📉 Market Recap

Indices: SPX +0.3%, Nasdaq −0.6%, Dow +1.5%, Russell +0.5%, TSX −0.2%.

Rotation: Tech/semi weakness (AVGO −4%, AMD −5.5%, NVDA −1.4%, ORCL −4.8%, PLTR −10.4%) vs strength in financials (BAC +5.4%, JPM +2.0%), energy (XOM +4.5%), and healthcare (MRK +3.8%, LLY +1.5%).

Breadth: <35% of SPX constituents beat the index. Equal-weight SPX trailed, confirming leadership remains top-heavy.

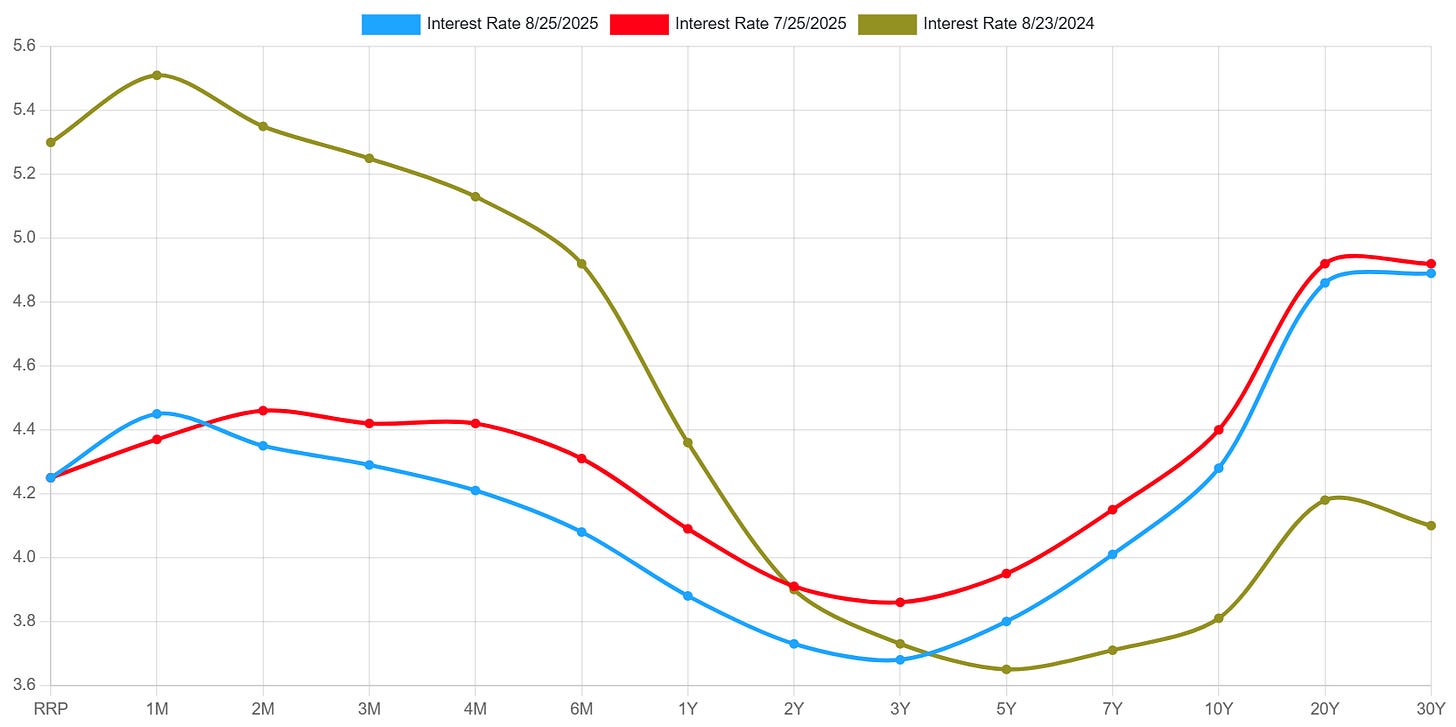

Takeaway: Sector rotation reflects higher yields (10Y ~4.33%) and Powell’s pivot; cyclicals bid while tech multiples compressed.

🏛 Macro Lens

Powell’s Jackson Hole message reframed risk: policy is restrictive, cuts may be needed. September cut odds ~84%; 10Y yields at 4.33%.

Framework update: Powell confirmed the Fed has ended its 2020 “flexible average inflation targeting” (FAIT) framework and reverted to a simple 2% annual target. This was widely misreported online as “abandoning” 2%. In reality, Powell explicitly reaffirmed 2% multiple times.

Liquidity: RRP continues to drain; TGA stable → net liquidity still positive.

Credit: IG OAS at 0.77%, HY issuance robust → conditions ultra-easy.

Valuation: SPX forward P/E ~22.1x, Nasdaq ~28x - top-decile.

Historical lens: A cut after a 9-month pause has historically been bullish (SPX up in 10/11 cases one year later).

🌍 Global Pulse

China: Retail sales +3.7% YoY, industrial production +5.7% YoY (July). Yuan near lows; policy support limited. Pressure on commodities.

Europe: Composite PMI 51.1 (flash, Aug) - mild expansion, services patchy.

EM: Brazil cut rates again; LatAm flows positive. Divergence = supportive for EM credit, neutral for USD risk.

🧭 Positioning & Sentiment

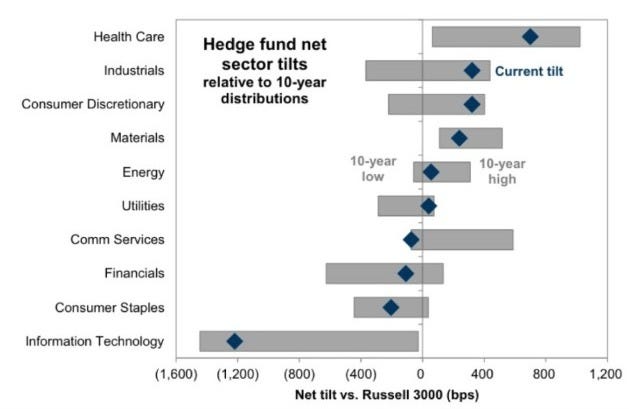

Hedge Funds: Net UW tech (~−1,300bps), OW healthcare/industrials.

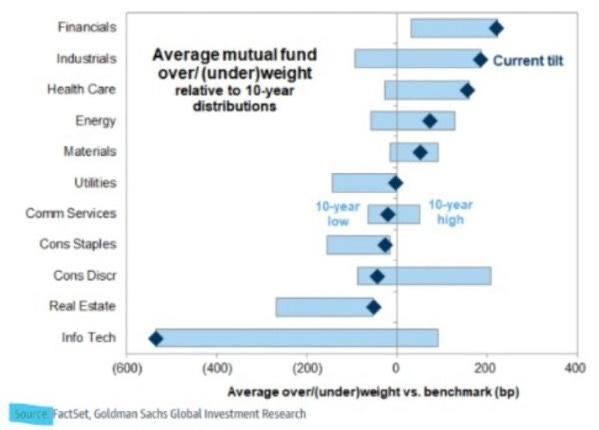

Mutual Funds: OW financials/industrials, UW tech/real estate.

GS Sentiment: −0.5 z-score, still “light.”

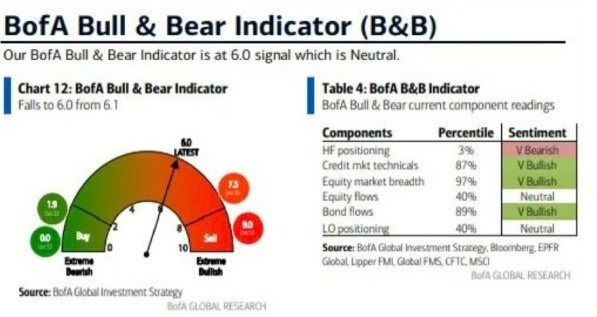

BofA Bull & Bear: 6.0 (Neutral), down from 6.1.

With valuations stretched but positioning light, the tape is vulnerable to short-cover rallies on good news and sharp drawdowns if macro data disappoints.

💼 Earnings Calendar (Week of Aug 25)

Mon (Aug 25): PDD, Semtech.

Tue (Aug 26): Okta, Box, PVH, MongoDB, Bank of Montreal, Scotiabank.

Wed (Aug 27): Nvidia (AI fulcrum), CrowdStrike, Snowflake, HP, NetApp, Pure Storage, Kohl’s, URBN, ANF, RBC.

Thu (Aug 28): Dollar General, Best Buy (consumer resilience), Marvell, SentinelOne, Autodesk, Affirm, Ulta, Gap, Hormel, Brown-Forman, TD, CIBC.

Fri (Aug 29): Alibaba (China internet bellwether).

💡 Technicals & Seasonality

SPY: ~642, RSI ~64 (not overbought), MACD marginally positive.

Support: 635; Resistance: 645.

Seasonality: Late August = historically weak; chop into Labor Day.

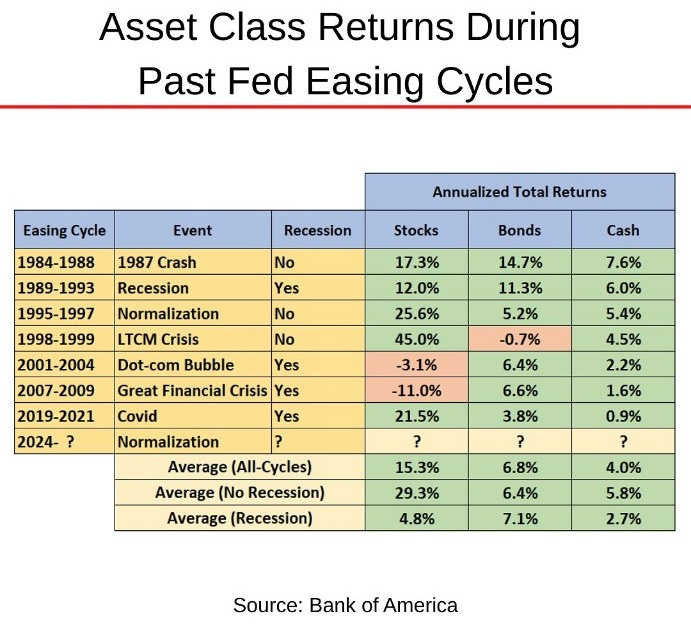

📊 Asset Class Playbook (Fed Easing Cycles)

Non-recession cuts: Equities strongest (+29% annualized).

Recession cuts: Bonds lead (+7% vs stocks +5%).

Implication: Binary skew - equities if insurance cut, bonds if growth crack.

💰 Valuation & Risk Snapshot

Forward P/E ≈22.1x; Nasdaq ~28x.

Credit spreads ultra-tight.

Sentiment: GS light positioning vs BofA neutral.

Risk skew: Upside if normalization cut, downside if growth fades.

⚡ What Moves Markets This Week

Macro Data:

Mon: New Home Sales (Jul).

Tue: Durable Goods (Jul), CB Consumer Confidence (Aug).

Thu: Q2 GDP (2nd est.), Claims, Pending Home Sales (Jul).

Fri: PCE/Core PCE (Jul), U. Michigan sentiment (final).

Earnings: Nvidia (Wed), Dollar General (Thu), Best Buy (Thu), Alibaba (Fri), Salesforce (Sep 3), Broadcom (Sep 4).

🥔 Final Take

We are in the late-cycle liquidity transition: Powell opened the door to cuts, but risk/reward depends on whether this is a normalization cut (bullish) or recession cut (bearish). Breadth remains weak, valuations expensive, credit complacent.

Playbook:

Tilt Defensive/Quality (balance sheet, FCF).

Own convexity overlays (VIX calls, put spreads).

Selectively lean into energy & financials.

Watch PCE + claims as trigger points.

⚖ Conviction Tier: Neutral/Defensive, convexity optionality in play.

Sources: Federal Reserve; CME FedWatch; FactSet Earnings Insight; ICE BofA Indices; BEA; BLS; Census Bureau; Conference Board; University of Michigan; Company IR calendars; Bloomberg, Reuters, MarketWatch, Barron’s.