📈 Weekly Market Recap and Preview - August 18, 2025

Grinding Higher into Jackson Hole: Liquidity Rich, Leadership Narrow

✅ TL;DR Desk View

Indices held up despite rotation → SPX +0.4%, Nasdaq –0.3%, Russell +0.9%, TSX +0.6%.

Healthcare ripped (LLY +12%, UNH +22%) while megacap tech cooled.

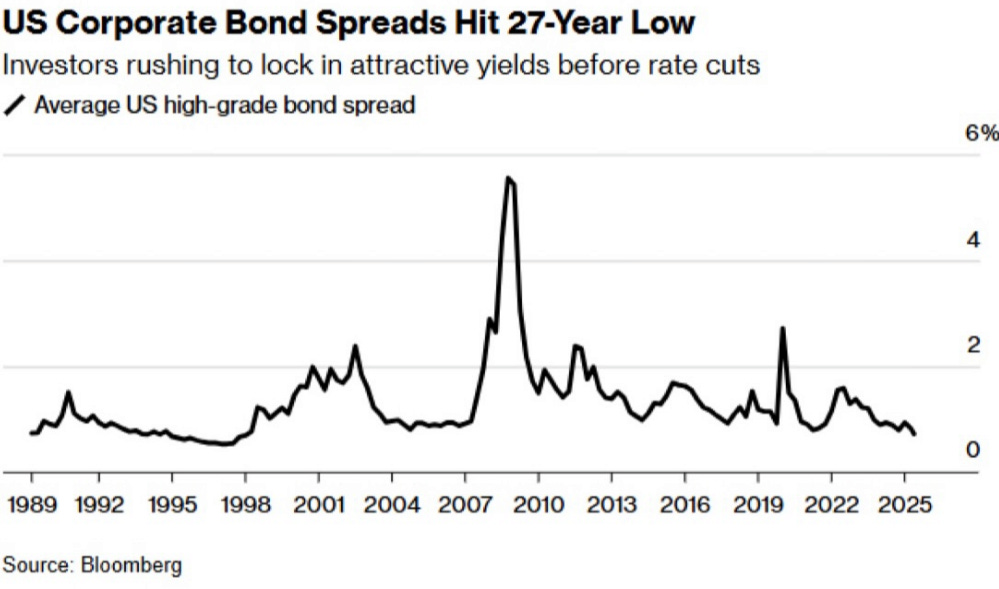

Credit spreads at 27-year tights, valuations stretched, but positioning still light.

This week = Powell @ Jackson Hole (Fri 10am ET) + retail & tech earnings.

🔑 Executive Summary

Markets at highs, but fragile underneath: S&P hit fresh records, yet breadth weakened sharply - only ~25% of constituents beat the index last week.

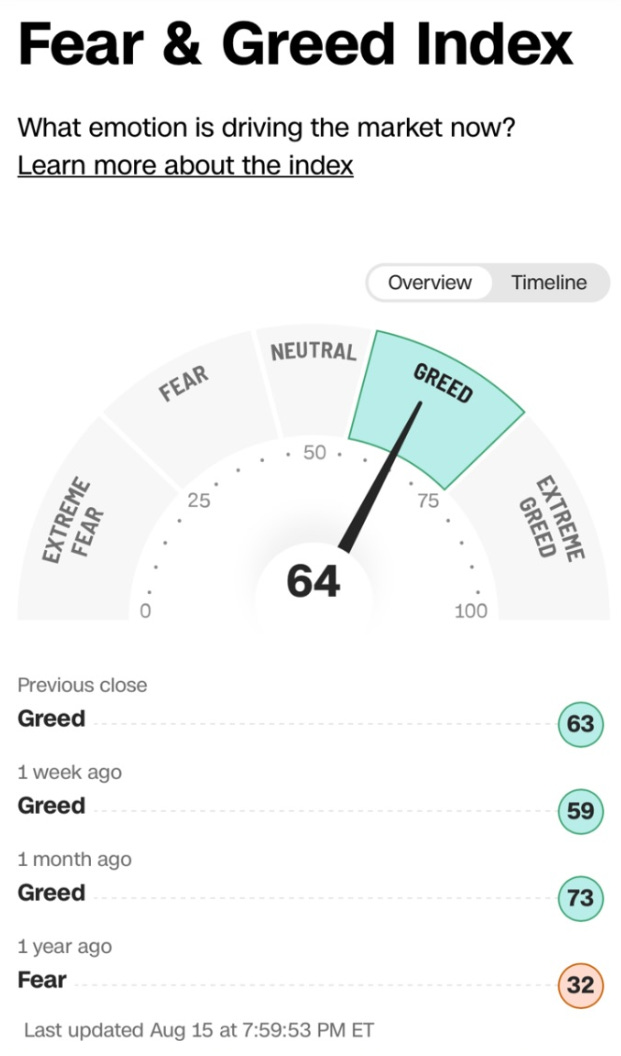

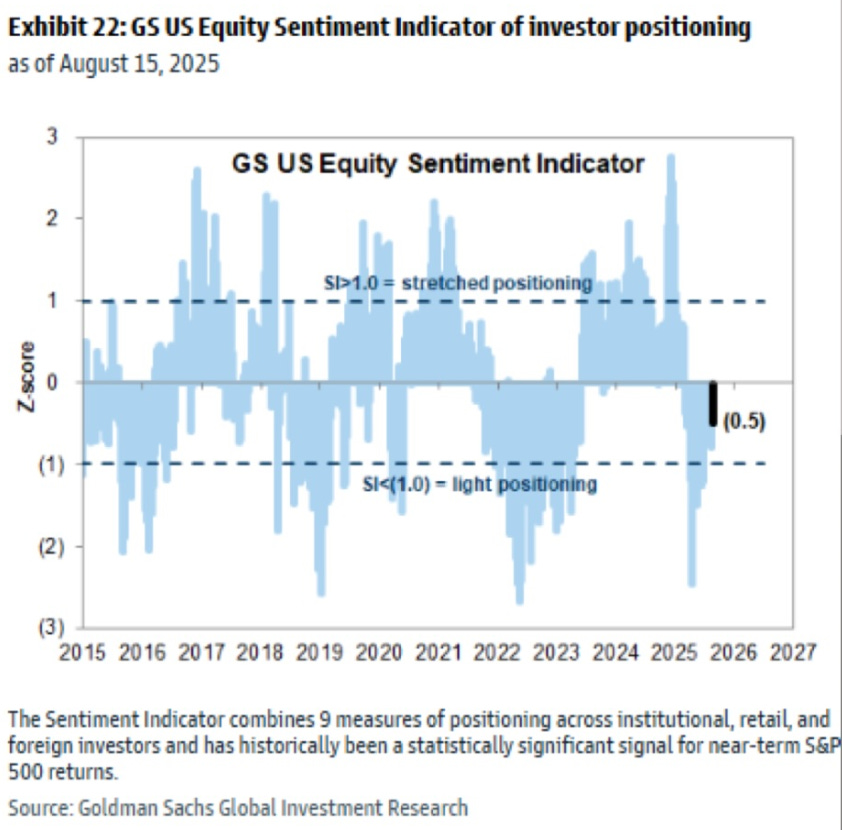

Sentiment heating up: Fear & Greed at 64 (Greed), bond spreads at 27-year tights, GS Sentiment rising.

Macro lens: U.S. CPI cooled modestly; Treasury auctions absorbed smoothly. Fed cuts in September remain priced at ~65%.

Global pulse: China’s July retail & industrial data confirm slowing momentum. EM flows mixed, Europe lags.

Earnings calendar heavy: Big box retailers (Walmart, Target, Lowe’s, TJX) plus software (Intuit, Palo Alto, Workday) set the tone.

Seasonality warning: 2H August historically one of the weakest two-week stretches of the year. SPY trades at upper Bollinger band.

Bottom line: Near-term risk skewed toward consolidation/digestion. Watch Jackson Hole and Treasury supply as volatility catalysts.

📉 Market Recap

Equities: S&P 500 +1.1%, Nasdaq 100 +1.5%, TSX flat, Europe modestly negative.

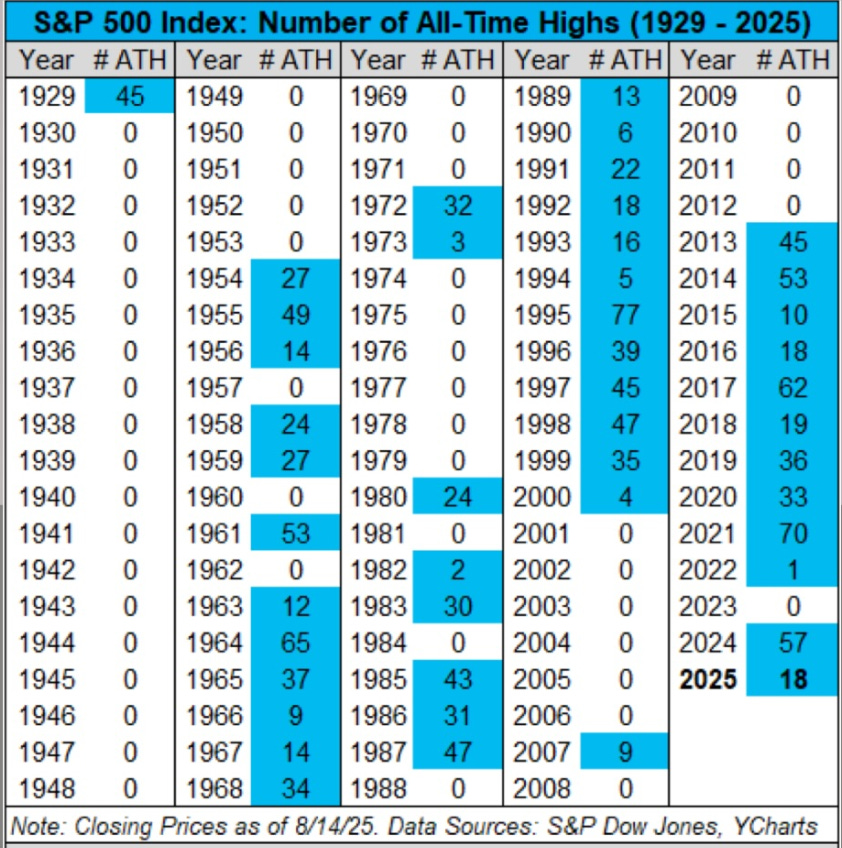

Breadth: 18 new S&P ATHs YTD, far below 2021’s pace. Outperformance concentration worsening.

Sentiment: Fear & Greed Index → 64 (Greed), up from neutral a month ago.

Credit: U.S. IG spreads at tightest since 1997; high yield issuance active.

Commodities: Oil steady ~$81, gold +1.5% on softer USD.

🏛 Macro Lens - Regime & Flows

Positioning:

GS US Equity Sentiment –0.5, neutral but rising.

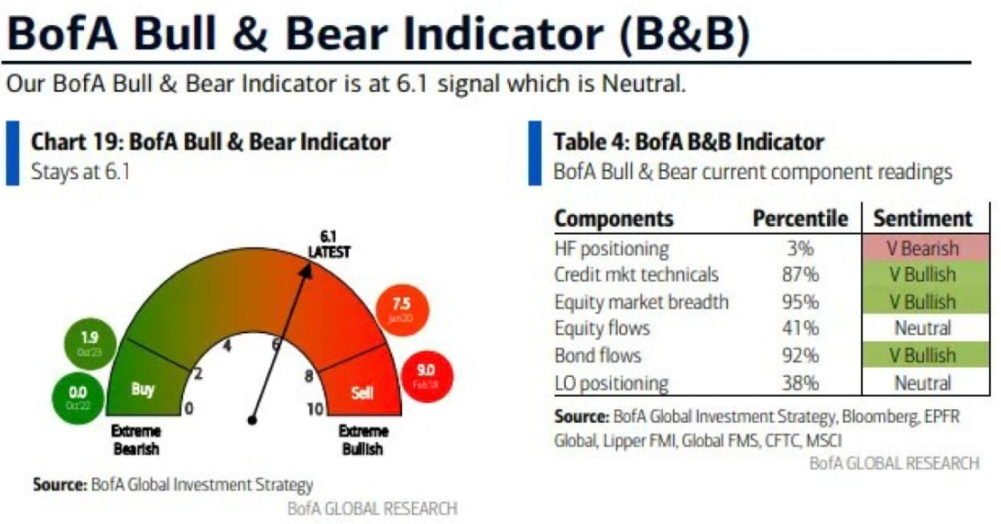

BofA Bull & Bear at 6.1 (Neutral).

Hedge fund equity beta still low.

Rates & Liquidity: 10Y yield ~3.75%; September Fed cut ~65% priced. RRP balances still draining, liquidity backdrop supportive.

Credit: Spreads at 27-year tights suggest reach-for-yield ahead of easing cycle.

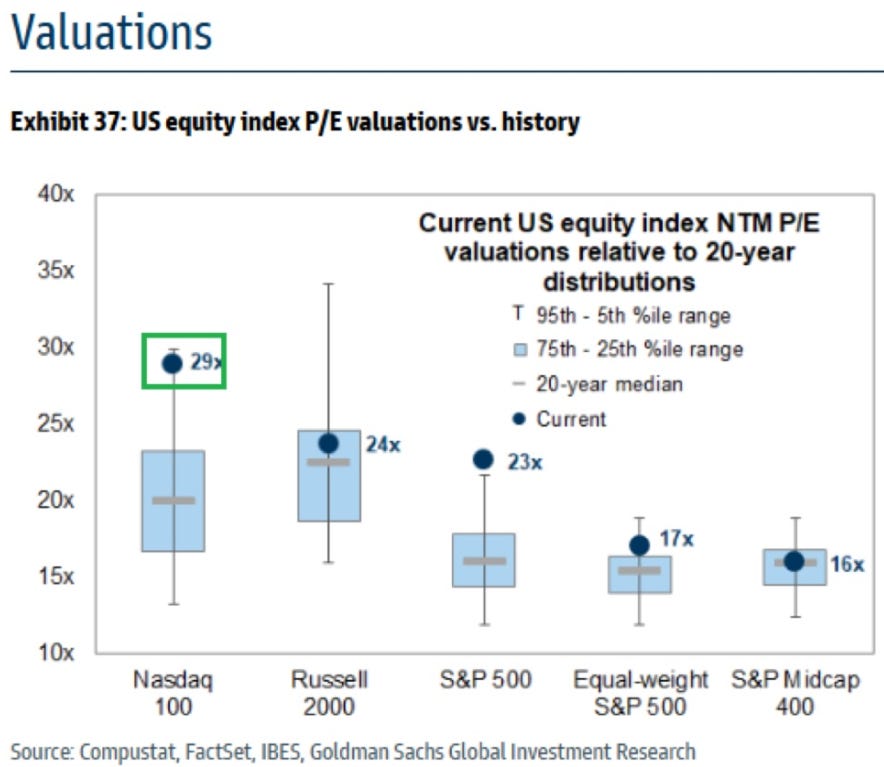

Valuations: S&P 500 23x NTM earnings, Nasdaq 29x - both >90th percentile vs history.

🌍 Global Macro Pulse

China: July retail sales slowed to ~4% YoY, industrial production ~6% - both weaker vs June. Policy response limited so far.

Europe: German PMI contraction continues; ECB commentary dovish but euro weakens.

EM: Brazil cut rates again; flows into LatAm ETFs remain positive.

💡 Technicals & Seasonality

Seasonality: 2H August historically negative, with median S&P returns among the weakest of the year.

SPY: testing top Bollinger band (~645); prior episodes have seen near-term pauses.

Breadth: % of members outperforming index remains depressed.

💼 Earnings & Corporate Updates

This Week’s Key Reports:

Retail: Walmart, Target, Lowe’s, TJX, Ross, BJ’s - critical reads on U.S. consumer strength.

Tech & Cyber: Palo Alto, Zoom, Workday.

Software: Intuit (tax, SMB exposure).

China/EM: Baidu, Bilibili, XPeng.

💰 Valuation & Risk Snapshot

US: S&P 500 23x NTM EPS; Nasdaq 29x - both in top decile vs 20-year history.

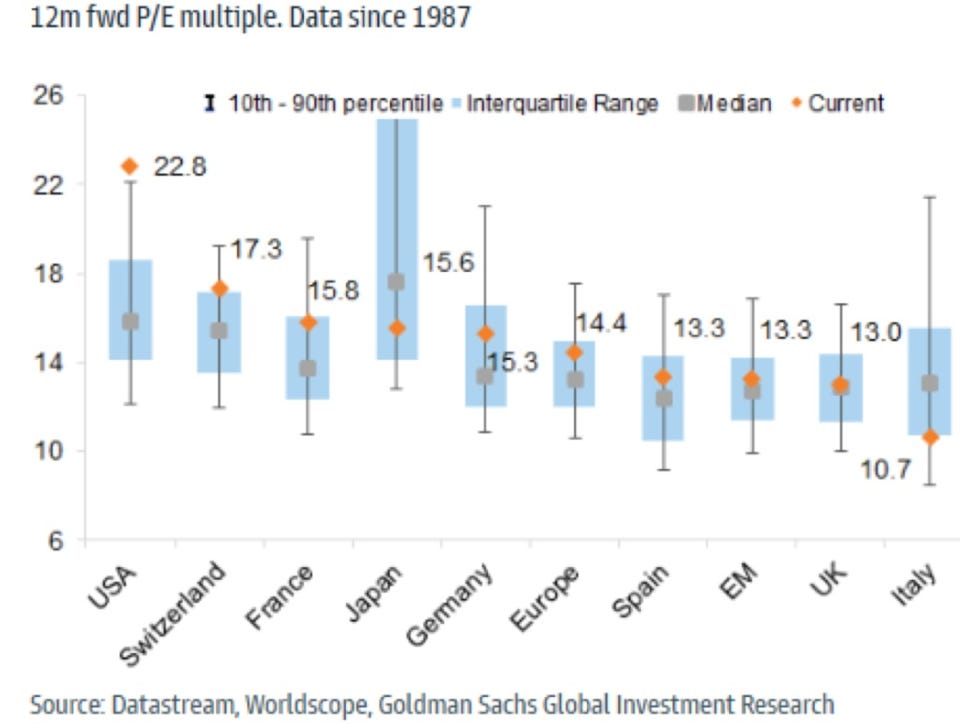

Global: U.S. at ~22.8x, Europe 14.4x, EM 13.3x.

Risk flags: spreads extremely tight, equities stretched, breadth weak.

⚡ What Moves Markets This Week

Macro:

Treasury auctions mid-week (20Y, 30Y).

FOMC minutes (Wednesday).

Jackson Hole symposium begins Friday.

Earnings: Walmart, Target, Palo Alto carry asymmetric surprise risk.

Positioning pain trade: Any rates back-up could pressure crowded growth/tech longs.

🥔 Final Take

The setup is classic late-cycle summer:

Liquidity supportive, policy easing near.

But valuations, sentiment, and technicals all stretched.

Seasonality points to chop into September.

Potato Capital View: Stay selective. Trim crowded beta, add defensive convexity (VIX calls, put spreads). Retail earnings will guide consumer resilience; Jackson Hole headlines may swing macro narrative.

⚖️ Conviction: Neutral/defensive tilt near-term, with optionality overlays for volatility breakouts.

Sources: Bloomberg, Charles Schwab, Barchart, StockAnalysis.com, CME, FRED, Market Radar