📈 Weekly Market Recap and Preview - July 07, 2025

Markets paused after a strong June as CPI, jobs, and tariffs take center stage. Big tests now loom for the soft-landing story.

🗓️ The Week in Review

Markets cooled off following June’s powerful run, with the S&P 500 (–0.2%) and Nasdaq (–0.5%) easing slightly. The TSX rose +0.6%, lifted by energy stocks as crude rallied on supply concerns.

The U.S. June jobs report was the key event of the week - and while it didn’t shock, it showed cracks beneath the surface.

Headline payrolls came in at +175K, but private payrolls slowed to +136K, down from +193K the month prior. Government hiring (+39K) padded the total, while the unemployment rate ticked up to 4.2% and wage growth cooled to 3.7% YoY.

The report reinforced the soft landing narrative, but also highlighted a slowing labor market - enough to keep the Fed patient, not panicked.

Bond yields rose modestly, with the 10-year closing near 4.30%, as rate-cut expectations for September dipped slightly.

WTI crude oil surged to $87 midweek on geopolitical and hurricane risk headlines, but reversed after a bearish U.S. inventory build, closing near $83.

Gold remained firm, consolidating near $3,344/oz as inflation expectations stayed contained and volatility remained low.

👉 Last week’s preview flagged CPI, payrolls, and tariff risk as key watchpoints. While none triggered major dislocations, positioning remains stretched, and macro catalysts are front-loaded for July.

🔭 The Week Ahead: July 7–12

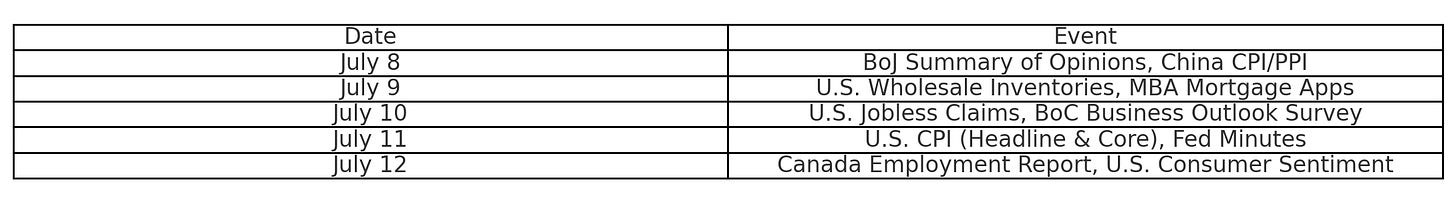

🧾 Macro Calendar Highlights

U.S. CPI (Thursday, July 11)

Headline est. +3.1% YoY, core +3.4%

One miss could move the entire macro curve

Canada Jobs (Friday, July 12)

BoC remains on pause, but this is the next big inflection point

Fed Minutes (Wednesday)

Markets want clarity on rate path divergence

China CPI/PPI (Wednesday)

Will reflation show up? Or more deflation drag?

Central Banks (RBA, RBNZ, BoK)

Watch tone - more dovish shifts would be EMFX-relevant

💼 Key Earnings Reports

Focus:

Consumer & Retail: pricing power, inventory dynamics, tariff exposure

Airlines: demand trends, unit margin health, fuel cost trajectory

Industrials: capex visibility, backlog strength, FX exposure

⚠️ Policy & Geopolitical Watch

U.S.–Canada Tariff Window: Reopened, no action yet - but risk elevated as digital services taxes remain under USTR review.

U.S.–China Trade Pause: July 9 deadline passed with no official extension - tariff rhetoric could resurface.

France Elections: Leftist coalition surprise may alter EU fiscal stance; fiscal policy tension back on the radar.

BoC & Fed: Both central banks remain in “pause mode” - CPI prints will likely shape the next move.

📉 Futures Snapshot

Futures were mixed to start the week, reflecting a cautiously optimistic tone ahead of Thursday’s CPI print and Friday’s Canadian jobs data.

S&P 500 E-Mini held near all-time highs, with little follow-through after last week’s stall.

Nasdaq futures pulled back slightly, reflecting rotation out of crowded tech names.

Dow futures slipped modestly, tracking global macro hesitation.

Crude oil eased below $68 as last week’s bullish energy impulse faded on inventory data.

Gold consolidated near record highs (~$3,340), still supported by soft real yields.

CAD/USD gained ground on carry and ahead of Canadian labor market catalysts.

Overall, futures reflect low-volatility positioning - but that can change quickly once inflation and jobs data hit.

🎯 Conviction Barometer

Current Tilt → 🟩 Neutral to Mild Risk-On

[🟦 Defensive | 🟩 Neutral | 🟥 Risk-On]The soft landing narrative remains intact, supported by cooling wage growth and benign credit conditions.

But this week’s CPI + earnings combo could challenge that comfort.Positioning is still crowded in megacap growth, and rate cut expectations are finely balanced.

We stay selectively risk-on - with rotation in play, not broad exposure.

📊 Valuation Snapshot

Valuation remains stretched - with only minor relief from last week's pullback.

S&P 500 trades at 22.9x forward earnings, near the 97th percentile of the past decade.

Nasdaq 100 holds above 29x forward, still sitting in the 98th percentile.

Russell 2000 offers more modest valuation at 14.1x, in the 56th percentile - but comes with cyclical risk.

TSX Composite trades at 16.4x, with a more balanced macro/sector profile.

No broad margin of safety. Stay selective - lean into companies that earn their multiple, and avoid those that rely on narrative over numbers.

🔄 Flow Watch

Key trends from the week:

Tech flows slowing: QQQ (+$1.9B) and XLK (+$950M) still positive, but pace moderating vs June.

Small caps and financials leaking: IWM (–$480M) and XLF (–$210M) reflect cautious positioning in value/cyclicals.

Gold ETF outflows (GLD –$300M): Not yet panic, but fading safe-haven demand post pullback.

Mutual funds: Still experiencing steady equity outflows - institutional bid remains soft.

Money markets: +$11B weekly inflow confirms continued demand for short-duration yield.

📈 Trade Tracker Follow-Up

NVDA trim still valid

NVIDIA traded flat this past week (~–0.7%), consistent with late‑June consolidation. No new entry - monitor for strong breakout or pullback trigger.Gold hedge

Position remains untriggered. It’s prudent to wait for CPI or a bout of volatility before adding as an optional hedge.CAD‑linked exporters

Tariff overhang still intact. With the BoC on hold and Canada jobs due Friday, this remains a valid hedge - reassess post‑data.Small‑cap rebound

Russell 2000 rose ~+3.4% last week, recovering from earlier weakness. Improved breadth suggests better odds for value and cyclical names.

🥔 Potato Capital View

🔄 Macro Takeaways

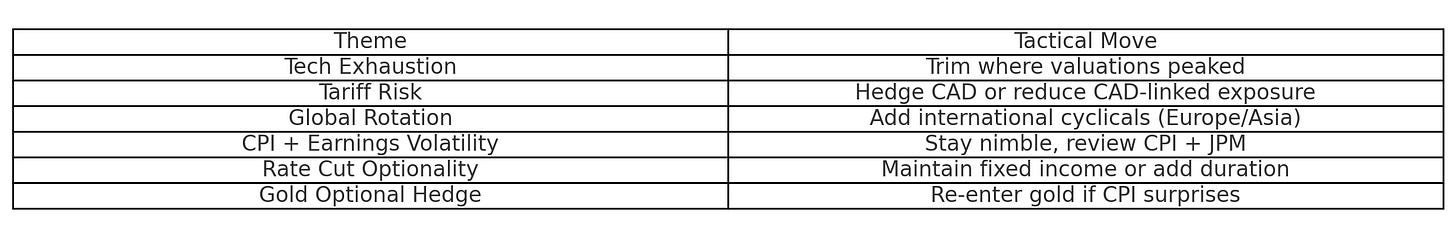

Soft landing is the base case - but it’s fully priced in and vulnerable to macro disappointment.

Disinflation trend continues, but not yet decisive enough to trigger imminent Fed cuts.

Positioning remains heavy in mega-cap growth and tech - setting the stage for rotation if CPI or earnings disappoint.

Q2 earnings season begins this week - it’s the next major test for sentiment and positioning.

💡 Sector Signals

Tech: Still leadership, but crowded and vulnerable to multiple compression.

Financials: Risk/reward improving ahead of big bank earnings - watch NIM, credit provisioning.

Energy: Quietly leading in Canada; attractive risk/reward on crude bounce.

Healthcare: Emerging as a quiet defensive rotation candidate.

Small caps: Warming up - watch CPI and rates for confirmation.

🌍 Asset Class Views

U.S. Equities: Richly valued - trim where overextended, rotate selectively.

Canadian Equities: Supported by energy and more reasonable valuations.

Europe & Japan: Remain attractive on valuation and FX tailwinds.

Bonds: 4.2–4.5% YTW is reasonable. Stay duration-neutral - wait for stronger cut signals.

Gold: Still a valid portfolio hedge, especially if CPI reaccelerates or volatility returns.

USD/CAD: Range-bound near 0.731 - Friday’s Canada jobs data is the key catalyst.

✅ Portfolio Playbook

We’re:

Holding core winners - but trimming froth

Adding cyclicals (energy, financials)

Watching CPI + JPM earnings to adjust bias

Ready to hedge fast if narrative breaks

🧠 Final Take

We said it last week: CPI + jobs + tariffs = inflection.

Now here we are.

This market still wants to go higher - but valuation gravity, geopolitical risk, and crowded trades are lurking in the shadows.

We’re not scared. We’re just awake.

At Potato Capital, we remain:

🔄 Rotationally active

📉 Valuation-disciplined

🧠 Macro-aware