📈 Weekly Market Recap and Preview - July 21, 2025

Tariff Inflation & Liquidity Chess

🔑 Executive Summary

Markets held their ground despite headline inflation pressure, Treasury issuance, and tariff noise. With CPI now behind us, focus shifts to demand-side resilience - Flash PMIs (Wednesday), Core PCE (Friday), and megacap earnings from Tesla and Alphabet all serve as key litmus tests.

Liquidity is fading as the Treasury rebuilds its cash buffer, but rotation potential is quietly building beneath the surface.

We remain tactically flexible - not fearful.

🗓️ The Week in Review (July 12–19)

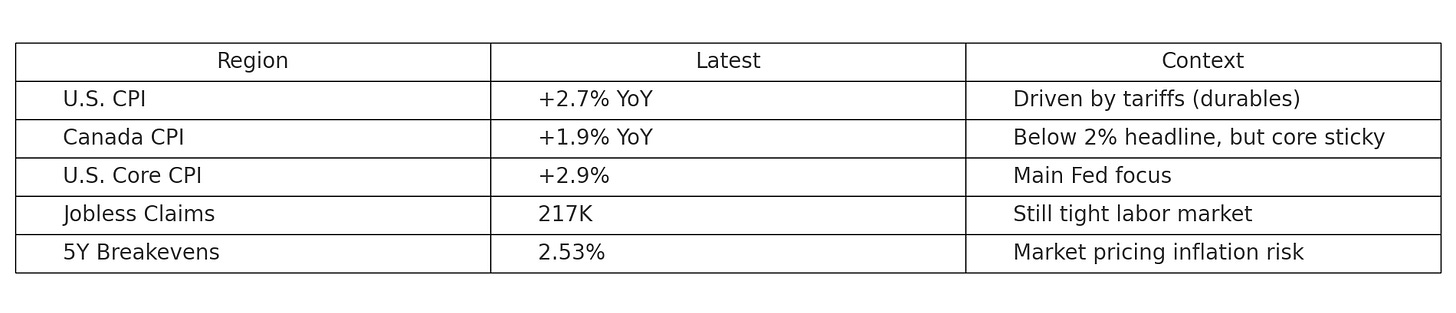

🔹 Macro Data Recap

U.S. CPI:

Headline: +2.7% YoY (+0.2% MoM)

Core: +2.9% - unchanged, but beneath the surface, tariff-driven goods inflation is heating up.

→ Biggest MoM gains: furniture, appliances, used vehicles

Canada CPI:

Headline: +1.9% YoY - well below target

Core Trim & Median: Still ~3.1% - stubborn

→ Mixed BoC signal: headline is soft, but sticky core tempers cut urgency

Labor & Market Signals:

Initial Jobless Claims: Fell to 217K - no sign of labor softness

5Y Breakevens: Rose to 2.53% - market is re-pricing inflation risk

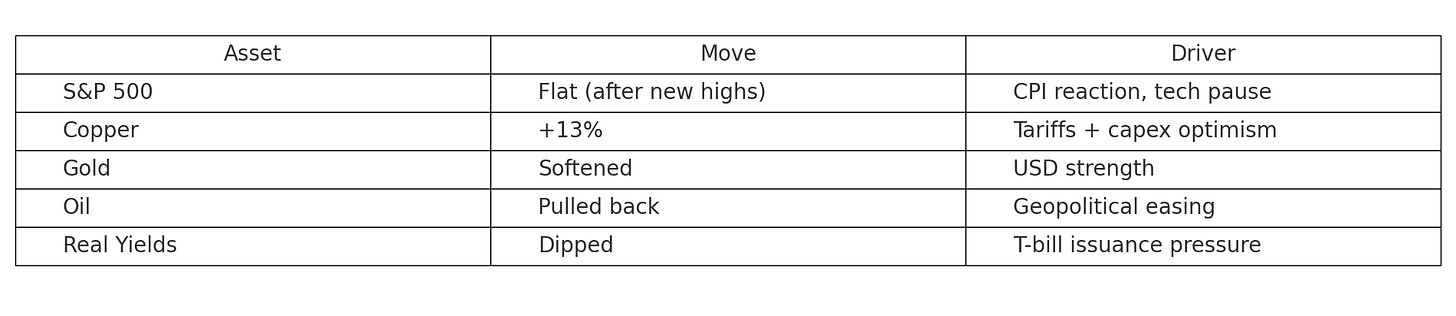

🔹 Market & Commodities Snapshot

S&P 500: Hit new record early in the week, then faded → flat on week

Copper: +13% - driven by tariff threats and capex cycle optimism

Crude Oil: Pulled back as Middle East tensions cooled

Gold: Softened on dollar strength, despite underlying demand as inflation hedge

Real Yields: Dipped slightly - but front-end rates rose with bill supply flood

🔹 Policy & Geopolitics

Trump Tariffs: Campaign floated new copper & electronics duties - 2018 playbook redux

Fed Commentary: Speakers leaned dovish: “Core PCE is the true compass”

G20: Stalemate over digital taxes and subsidy frameworks - no joint trade statement

Middle East: Israel–Lebanon tensions eased, but risk premia remain embedded

🔹 Liquidity Watch

TGA Rebuild: ~$500B in fresh Treasury bill issuance since early July

RRP Decline: Reverse repo balances dropping - excess liquidity being drained

Credit Markets:

IG spreads widened ~80bps YTD

HY spreads flat

Senior loans outperforming on floating-rate exposure

Signal: Liquidity cracks are forming - and could deepen into August if issuance pace holds

🔭 The Week Ahead (July 21–27)

This week shifts the macro lens from inflation back to growth and demand. With CPI in the rearview, markets now turn to PMIs and Core PCE to gauge whether disinflation is translating into real economic softness - or just price normalization.

The second test? Earnings season heats up - and megacaps like Tesla and Alphabet will show whether profit strength justifies equity multiples at current levels.

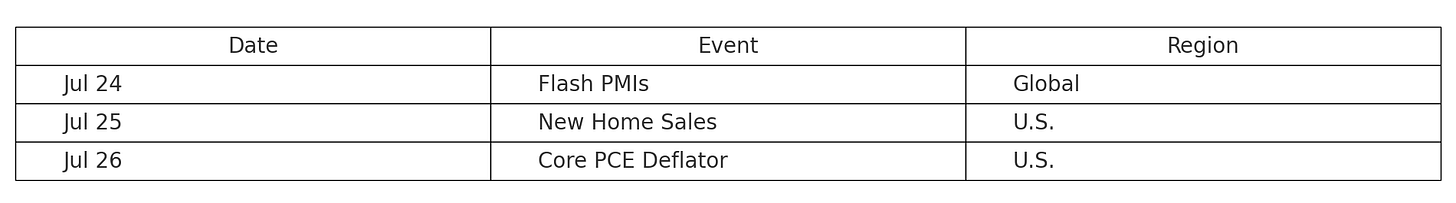

🧭 Key Macro Events:

Jul 24: Flash PMIs (Global) - early pulse on manufacturing and services activity

Jul 25: U.S. New Home Sales - housing resilience check amid rate pressure

Jul 26: U.S. Core PCE - the Fed’s preferred inflation gauge

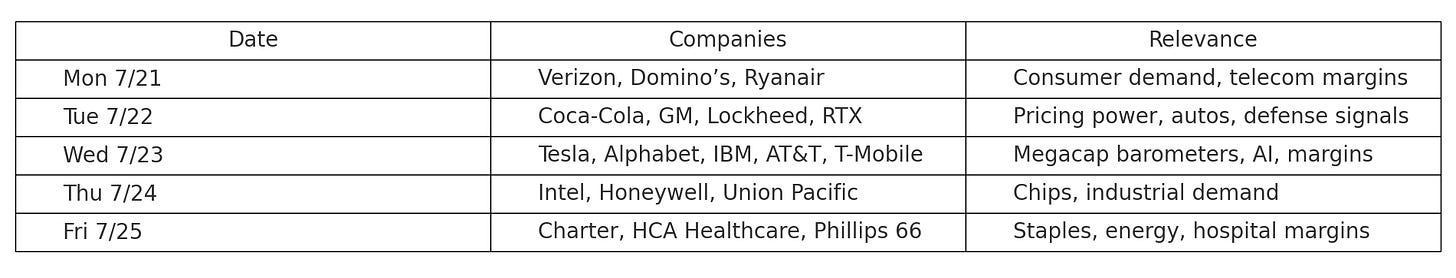

💼 Earnings Calendar

Wednesday (Jul 23) is the main event - Tesla and Alphabet will set the tone for risk appetite, margins, and tech leadership

Autos, chips, and healthcare round out the rest of the week - giving breadth to the earnings test

🌐 Macro Lens: Tariff Inflation ≠ Sticky Inflation

Markets absorbed the latest CPI prints without panic - but beneath the surface, the nature of inflation is shifting.

Headline CPI rose due to tariff-induced goods inflation, especially in durables like furniture and vehicles. This isn’t classic demand-pull inflation - it’s politically engineered cost-push.

Core services inflation remains stable, suggesting no broad-based overheating. That’s key for the Fed, which remains focused on Core PCE, not headline noise.

Why it matters: Political inflation - unlike cyclical inflation - tends to be sticky at the margin. It can lift breakevens, feed into wages, and pressure forward curves, even without an overheating economy.

Bond markets are responding ahead of the Fed, with real yields dipping and the curve coiling. The risk now isn't rate hikes - it's that liquidity tightens through issuance, not policy.

Bottom line: Inflation is evolving from a cyclical threat into a structural irritant. The Fed is still in "wait-and-see" mode, but the bond market is already adjusting. PMIs and Core PCE this week will decide whether that shift gains traction - or stalls.

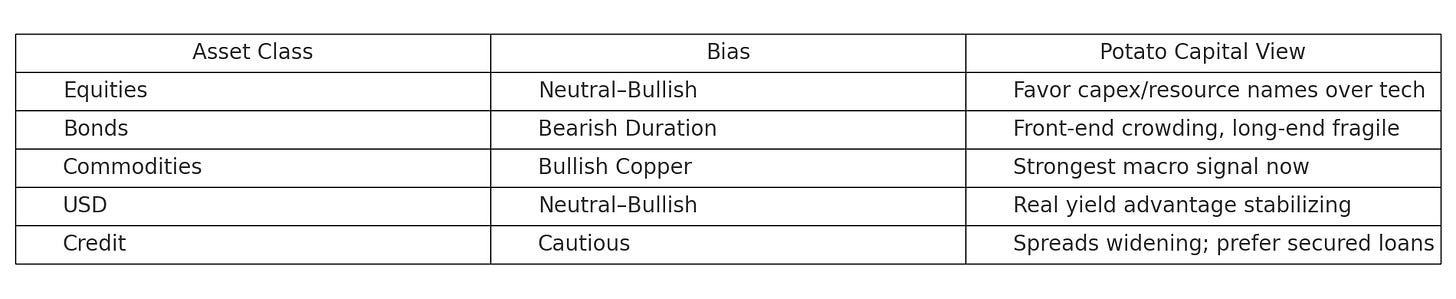

💼 Asset Class Playbook

Cross-asset signals are diverging. While equities remain firm, undercurrents in credit and rates suggest tightening stress beneath the surface.

Equities: Still grinding higher, but breadth remains narrow. We prefer capex/resource names over richly valued megacaps, especially with copper and energy signaling real demand.

Bonds: Curve is showing tension - front-end flooded by Treasury issuance, long-end anchored by growth fears. We remain bearish on duration into Core PCE.

Commodities: Copper is the clearest macro signal right now - surging on tariff policy, capex tailwinds, and supply tightness.

USD: Strength remains subdued but real yield advantage is stabilizing. Watching USD/CAD closely for CPI-driven moves.

Credit: Cracks are forming - IG spreads widening, while senior loans outperform. Stick with quality; avoid unsecured exposure.

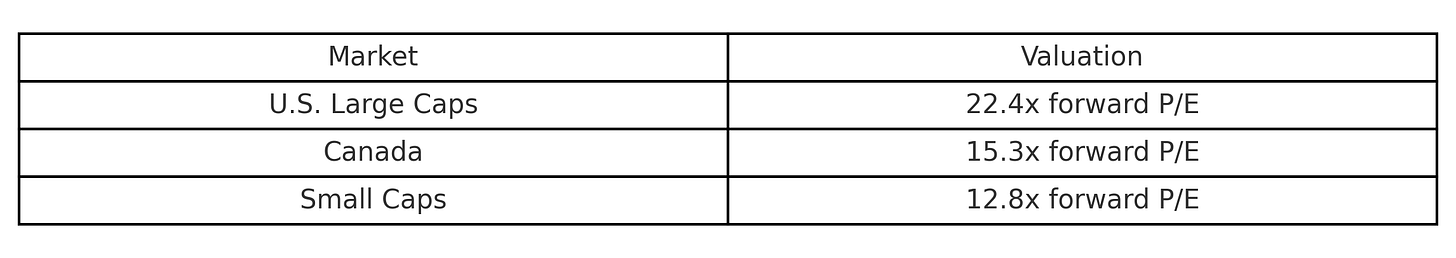

📊 Valuation Context

Valuations are diverging across regions and styles - with U.S. megacaps stretched, and small caps offering the clearest upside if macro data cooperates.

U.S. Large Caps

Forward P/E: ~20.9× (90th percentile)

PEG (5Y EPS CAGR): ~1.9×

FCF Yield: ~3.4%

Still pricing in perfection - growth and margins must deliver. Any earnings stumble risks multiple compression.

Canada (TSX Composite)

Forward P/E: ~14.4×

PEG: ~1.2×

FCF Yield: ~5.5%

More reasonably priced, especially in energy and infrastructure. Needs capex or commodity tailwinds to outperform.

U.S. Small Caps (Russell 2000)

Forward P/E: ~14.0×

PEG: ~0.9×

FCF Yield: ~4.9%

Deep value relative to history - but remains rate-sensitive. If inflation and policy stabilize, upside is unlocked.

🎯 Conviction Barometer

Current Tilt → 🟩 Neutral to Mild Risk-On[🟦 Defensive | 🟩 Neutral | 🟥 Risk-On]Volatility: VIX remains suppressed near 12, but implied vol skew is rising - early signs of fragility beneath the surface.

Rates & Liquidity: T-bill issuance is draining reserves, but credit spreads are still tame. No panic, but pressure is building.

Positioning: CTA flows have plateaued, retail sentiment is mixed, and institutional beta is average - no sign of crowded risk-taking.

Catalyst Window: Rotation is possible - but dependent on soft PMIs and benign Core PCE. Until then, we stay balanced but alert.

We’re not all-in bullish. But the risk/reward is improving if macro confirms. This is a time for selective exposure, not complacency.

🧠 Final Take

We are entering a macro stress window - not driven by panic, but by mounting pressure:

Liquidity is thinning: $500B+ in new T-bills are soaking up reserves faster than RRP can replenish.

Inflation is political: CPI pressures stem from tariffs, not overheating - but that still pushes up breakevens and rate volatility.

Data matters again: Flash PMIs and Core PCE will determine whether a soft landing narrative holds or cracks.

Leadership on the line: Earnings from Tesla (TSLA), Alphabet (GOOGL), and GM this week will shape the next move in equity leadership - tech dominance or cyclical rotation.

We’re not chasing stretched trades - we’re stalking the inflection point.

At Potato Capital, we remain:

🔄 Rotationally active

📉 Valuation-disciplined

🧠 Macro-aware