📈 Weekly Market Recap and Preview - July 28, 2025

Earnings Soar, Tariffs Loom: Navigating a Market Balancing Resilient Services, Fragile Goods, and Key Macro Triggers

🔑 Executive Summary

Markets largely maintained a positive tone in the second-to-last week of July. Major U.S. equity benchmarks set fresh records every day as earnings season and hopes that new trade deals could avert broad tariff hikes supported risk appetite. Macro data pointed to continued resilience in services and labour markets but showed renewed weakness in manufacturing: U.S. new home sales edged higher in June but remained soft, durable‑goods orders tumbled as the volatile aircraft category reversed, initial jobless claims fell to the lowest level since April, and the S&P Global composite PMI hit a seven‑month high while manufacturing slipped back into contraction. Markets also cheered the newly finalized U.S.–EU trade deal, which cuts the proposed 30% tariffs to 15% - reducing headline risk while preserving moderate policy friction.

Canada’s May retail sales fell sharply and both the Business Outlook Survey and Consumer Expectations Survey fell to multi‑year lows. Commodities were mixed: copper prices hovered near record highs ahead of a looming U.S. tariff; gold drifted lower as tariff fears eased; and WTI crude retreated on weaker demand signals.

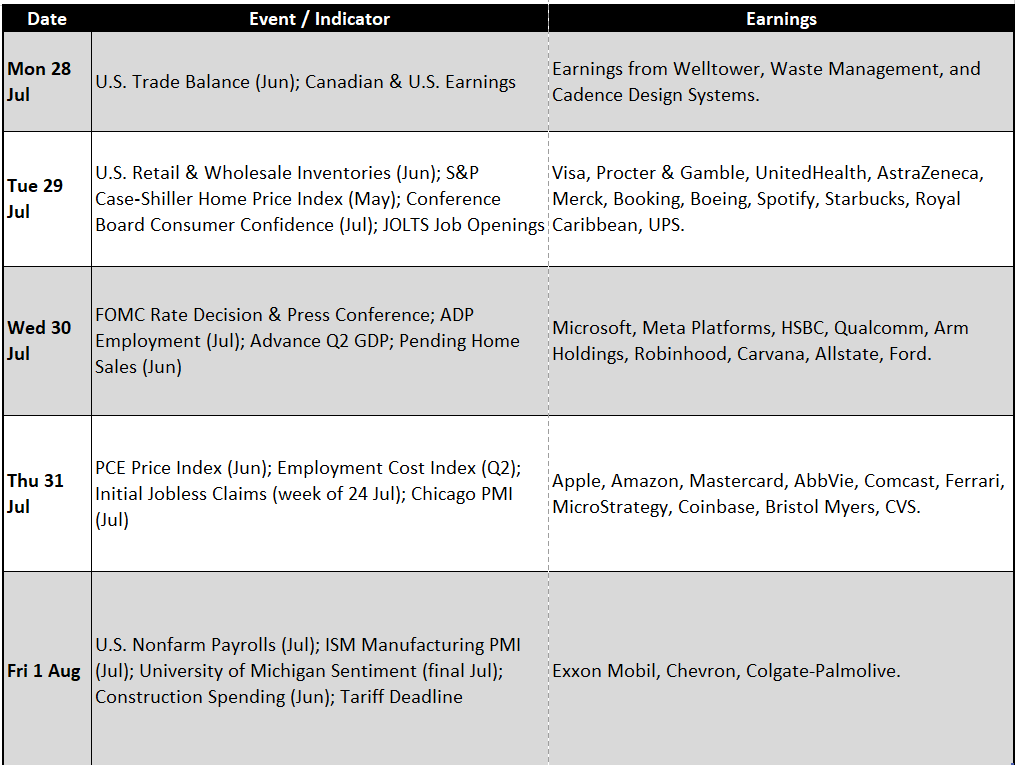

Looking ahead, the last week of July brings a Federal Reserve meeting, Q2 GDP, PCE inflation and payrolls data, while a tariff deadline on August 1st and a deluge of Big‑Tech earnings could trigger volatility.

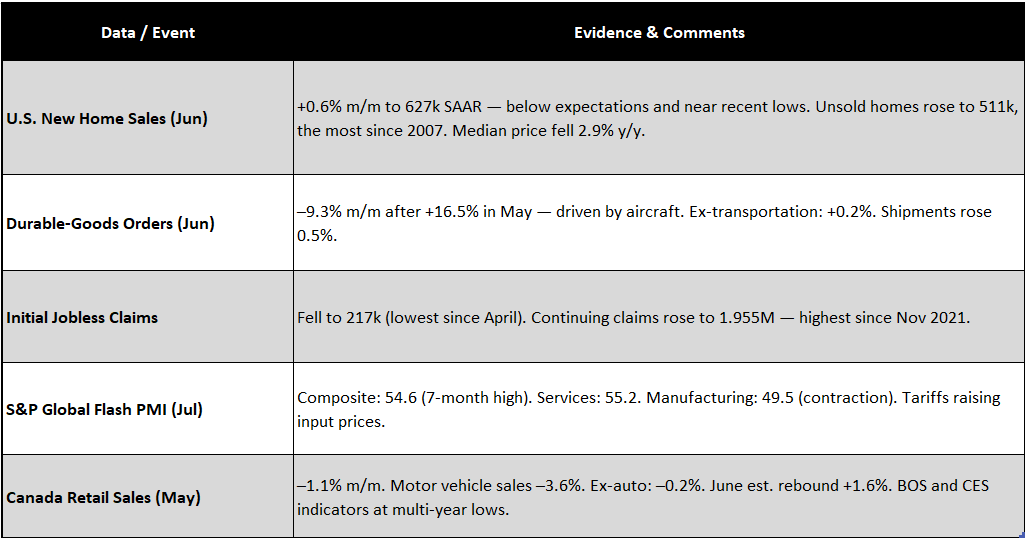

📉 Macro Data Recap

The latest U.S. data sends a mixed but nuanced message. New home sales ticked up slightly but remain depressed near post-pandemic lows, with supply surging to nearly 10 months of inventory - a sign of cautious buyers and builders. Durable-goods orders fell a steep 9.3% in June, though the drop was aircraft-related; core orders excluding transportation actually rose, underscoring stable business investment. Jobless claims continued their downtrend, hitting a three-month low - suggesting no meaningful softening in the labor market yet. Meanwhile, the S&P Global flash PMI showed the strongest composite reading since December, driven by a strong services rebound even as manufacturing slipped back into contraction.

In Canada, however, the tone was more downbeat. May retail sales plunged, especially in auto-related categories, and sentiment surveys pointed to deepening consumer and business pessimism - raising the odds of further BoC easing. Commodities reflected the tariff-driven narrative: copper prices remained elevated ahead of U.S. import levies, while crude and gold both softened amid easing fear and rising supply concerns.

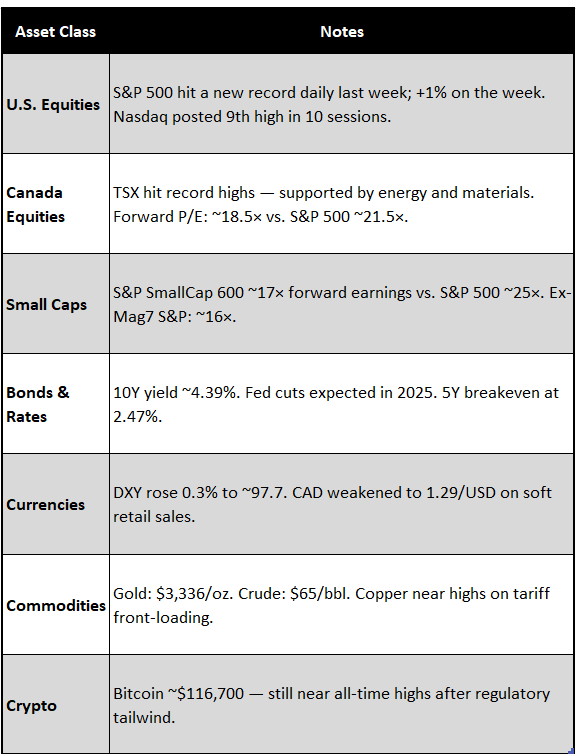

🧮 Market & Commodities Snapshot

Futures Preview: S&P 500 E‑Mini futures rose ~0.3% to 6,450 ahead of the Monday open - suggesting positive tone heading into the Fed and data gauntlet.

🏛️ Policy & Geopolitical Developments

Tariffs & trade: With a self‑imposed 1 August deadline, President Trump has warned that Canada, Mexico, the European Union and other partners will face tariffs of 30 % or more if trade agreements are not finalized. Negotiations continued last week, and officials signaled progress toward deals with the EU and Japan. Markets are watching whether deadlines are extended (China’s deadline has already been pushed to 12 August).

U.S. monetary policy: The Federal Reserve meets July 29–30. Given the recent upturn in services activity and still‑sticky inflation, policymakers are widely expected to keep the federal funds rate unchanged at 4.25–4.50%. Strong jobless‑claim data and resilient PCE inflation are likely to keep a September cut in play but not assured.

Geopolitics: The U.S. announced an agreement with Japan on advanced semiconductor cooperation and signaled progress toward an EU deal. In the energy sphere, the U.S. is preparing to allow Chevron and other firms to restart limited operations in Venezuela, potentially boosting heavy‑grade crude supply by >200k bpd.

💧 Liquidity Watch

Treasury bill issuance and TGA: The U.S. Treasury continues to rebuild its cash balance as tax receipts flow in and spending slows around the tariff deadline. The influx of auction supply has kept front‑end yields near 5.3%.

Reverse repo balances: Though daily data are not available for late July, the overnight reverse repo facility has shrunk dramatically since its $2.6 trillion peak in late 2022 to well under $150 billion by late 2024. Money‑market funds have been reallocating cash into higher‑yielding T‑bills and private repo transactions, easing the facility’s importance.

Credit spreads: Investment‑grade spreads remain near 2024 lows, while high‑yield spreads have tightened modestly amid strong risk appetite.

📆 Key Macro Events & Earnings (Week of 28 July – 2 Aug)

🌍 Macro Lens – Analysis & Themes

🔹 Goods weakness vs. services resilience

The week’s economic releases illustrate the ongoing divergence between the goods and services sectors. Durable‑goods orders plunged 9.3% in June owing to aircraft volatility, but orders excluding transportation actually rose 0.2%, suggesting underlying demand for capital equipment remains stable. Meanwhile, the S&P Global services PMI surged to 55.2, its highest since late 2023, while manufacturing slipped back into contraction at 49.5. The contrast underscores how consumer and business spending continues to tilt toward services and experiences, a trend that has kept employment and wage growth buoyant even as goods‑producing sectors cool.

🔹 Tariff‑driven price pressures

The PMI report flagged rising input and selling prices linked to tariffs. Copper futures remain elevated ahead of the impending 50% U.S. copper tariff, with importers front‑loading shipments. New home sales showed supply building and median prices falling, but the imminent tariffs threaten to raise material costs later this year. Markets are therefore keenly focused on whether the Biden administration will finalize trade agreements or extend deadlines.

The late-week U.S.–EU deal trims tariffs to 15%, easing worst-case fears but still imposing meaningful friction - especially for autos, pharmaceuticals, and semiconductors. While it removes near-term tail risk, it reinforces the ongoing re-pricing of cross-border supply chains. Tariff-sensitive inputs like copper and select industrials remain in focus.

🔹 Canadian softness and policy implications

Canada’s sharp 1.1% drop in May retail sales and weak business and consumer surveys suggest domestic demand is under pressure. The Bank of Canada has already cut rates twice this year; deteriorating sentiment may prompt further easing, particularly if next week’s GDP and employment data disappoint. The Canadian dollar may therefore stay under pressure.

🔹 Commodities and liquidity gyrations

Commodities are sending mixed signals. Copper prices remain buoyant on tariff‑driven supply concerns, while oil has pulled back amid worries about slowing global demand and expectations of rising supply. Gold is drifting lower as risk appetite improves. On the liquidity front, the decline in the Fed’s reverse‑repo facility - from $2.6 trillion peak to under $150 billion - shows excess cash is being absorbed by T‑bill issuance and risk markets, supporting risk assets but leaving markets susceptible to funding‑rate spikes as large Treasury auctions and tariff deadlines approach.

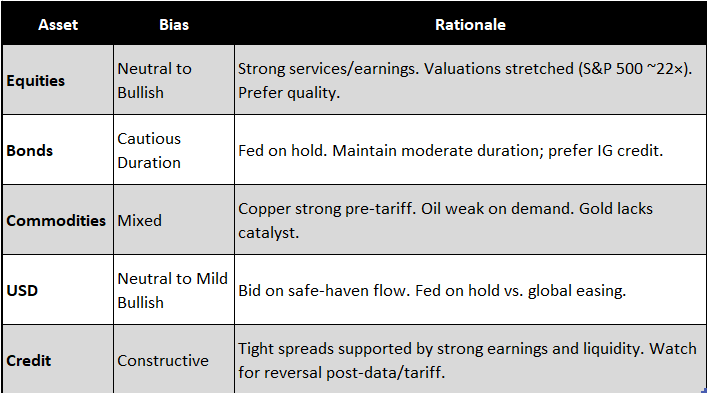

🧭 Asset‑Class Playbook

📊 Valuation Context

U.S. large‑cap valuations: The S&P 500 trades above 22× forward earnings, a level it has reached only about 7% of the time over the past 40 years. As of mid‑July, its forward P/E ratio of ~22.2 is 40% above the 40‑year average (15.8) and 20% above the 10‑year average (18.6). Current valuations are heavily skewed by the Mag 7; excluding these, the rest of the S&P 500 trades around 16× forward earnings.

Canada: The TSX trades around 18.5× forward earnings, about 3 points lower than the S&P 500. Its dividend yield (~2.8%) far exceeds the U.S. yield (~1.3%).

Small caps: The S&P Small Cap 600 trades at roughly 17× forward earnings, a meaningful discount to the large‑cap market, and regional banks trade near 14×. These discounts could offer opportunities if economic growth remains steady.

With dispersion widening, allocation discipline is essential - we favour sectors with earnings visibility and relative valuation support.

🎯 Conviction Barometer

Current Tilt → 🟩 Neutral to Mild Risk-On

[🟦 Defensive | 🟩 Neutral | 🟥 Risk-On]Risk appetite remains constructive but cautious as markets digest a gauntlet of catalysts this week - including the Fed decision, Q2 GDP, PCE inflation, and the Aug 1st tariff deadline.

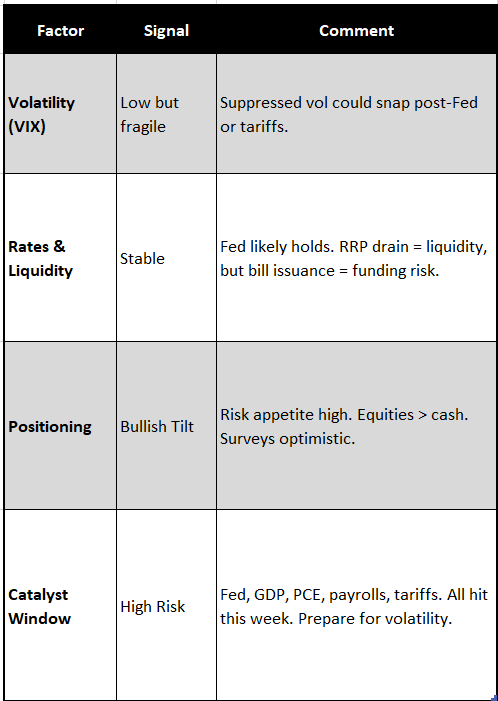

The signal board reflects fragile optimism:

Volatility (VIX): Still low but precarious. Any hawkish Fed tone or negative earnings/data surprise could uncoil compressed vol.

Rates & Liquidity: The Fed is likely on hold. RRP drainage continues, freeing up liquidity, but the heavy Treasury bill issuance introduces a funding friction that could tighten conditions.

Positioning: Bullish tilt persists - investor surveys and equity/cash allocations suggest confidence, but complacency risk is rising.

Catalyst Window: This week is a high-risk zone. With bullish futures and reduced tariff shock, the tone leans constructive - but the dense calendar of data and central bank risk still demands tactical discipline.

Bottom line: We’re not chasing upside, but we’re not pulling back either. Positioning for selective participation with downside protection remains the smart stance.

🧠 Final Take

The last full week of July delivered a familiar message: America’s economy continues to hum in services and labour but is wobbling in goods production. New home sales remain stuck near post‑pandemic lows and durable‑goods orders posted their largest drop in years. Yet services activity and jobless claims are unexpectedly strong, helping push equity markets to repeated record highs. Canada’s consumer and business surveys paint a softer picture, suggesting the Bank of Canada may need to ease further.

For investors, the near‑term outlook hinges on how tariff deadlines, the Fed meeting and key economic data shape expectations for growth and policy. With valuations stretched and sentiment bullish, prudence is warranted: quality, balance‑sheet strength and pricing power remain essential attributes heading into a week that could reset the market narrative.