📈 Weekly Market Recap and Preview - July 13, 2025

US Bank earnings in focus this week.

🗓️ The Week in Review (July 7–13)

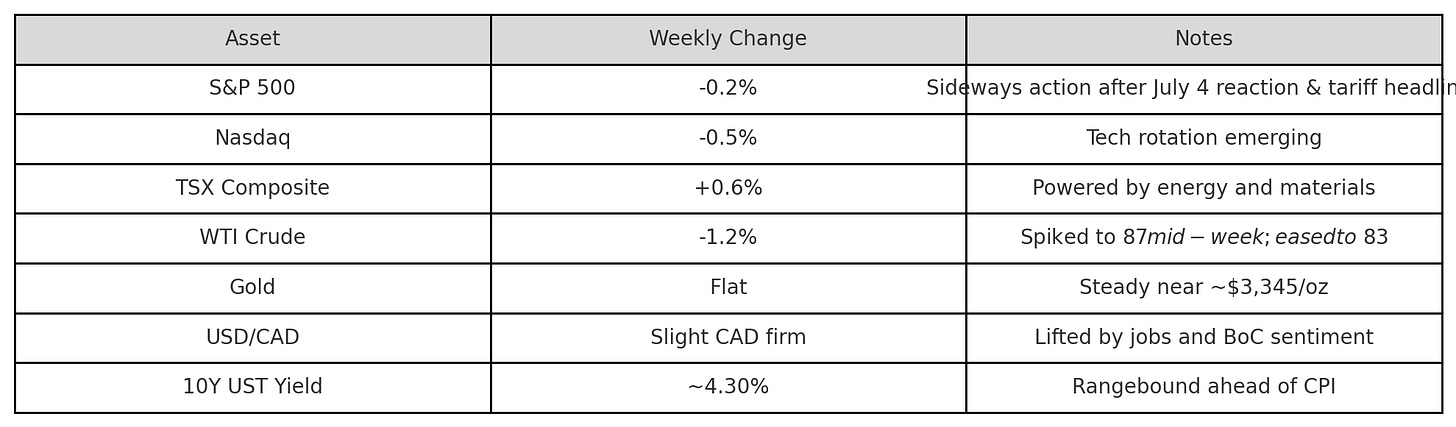

Markets remained largely indecisive ahead of major data releases, but a few key U.S. and Canadian inputs moved the dial.

🔹 Canadian Highlights

Canada Jobs Report (June, released Fri July 12)

+83.1K jobs added - strongest monthly gain since January

Unemployment down to 6.9%

Gains primarily in part-time work, across retail, healthcare, manufacturing

→ Boost for CAD and validation of BoC’s neutral pause view

Canada Ivey PMI (June, released Mon July 8)

PMI rose to 53.3 (from 52.5) - highest in four months

🔹 U.S. Data & Market Outcomes

U.S. Retail Sales (June, early July readings)

NRF reported a 0.3% drop MoM (core retail) in June - first decline since February, citing tariffs and sentiment concerns

SPGI preview notes show retail sales and industrial production data due mid-July - expected flat to modestly positive

U.S. Online Spending (July 8–11)

Adobe Analytics: ~$24.1B in online sales - a 30.3% YoY surge during Prime Day promotions

🔹 Market & Commodities Snapshot

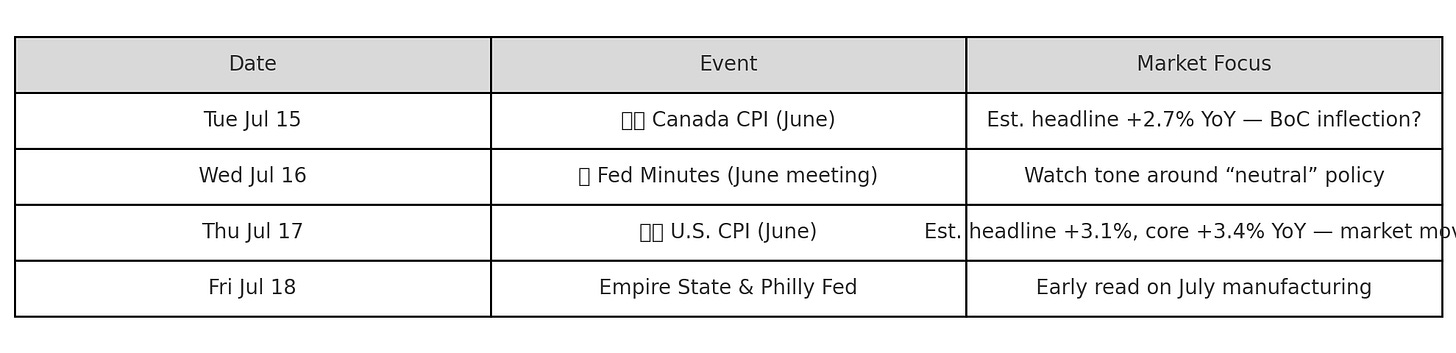

🔭 The Week Ahead (July 14–19)

This is one of the most critical macro weeks of the summer.

Both U.S. and Canadian CPI prints drop midweek - and together, they’ll shape how markets price the rate path into Q3. The Fed and BoC are both in pause mode, but they’ve left the door open. One hot surprise could slam it shut.

Beyond inflation, we’ll get updated Fed commentary and an early pulse on July manufacturing activity.

🧾 Macro Watchlist

Both CPI prints are meaningful - but U.S. inflation carries more global weight. A miss here could reshuffle everything from rate cut timing to equity leadership.

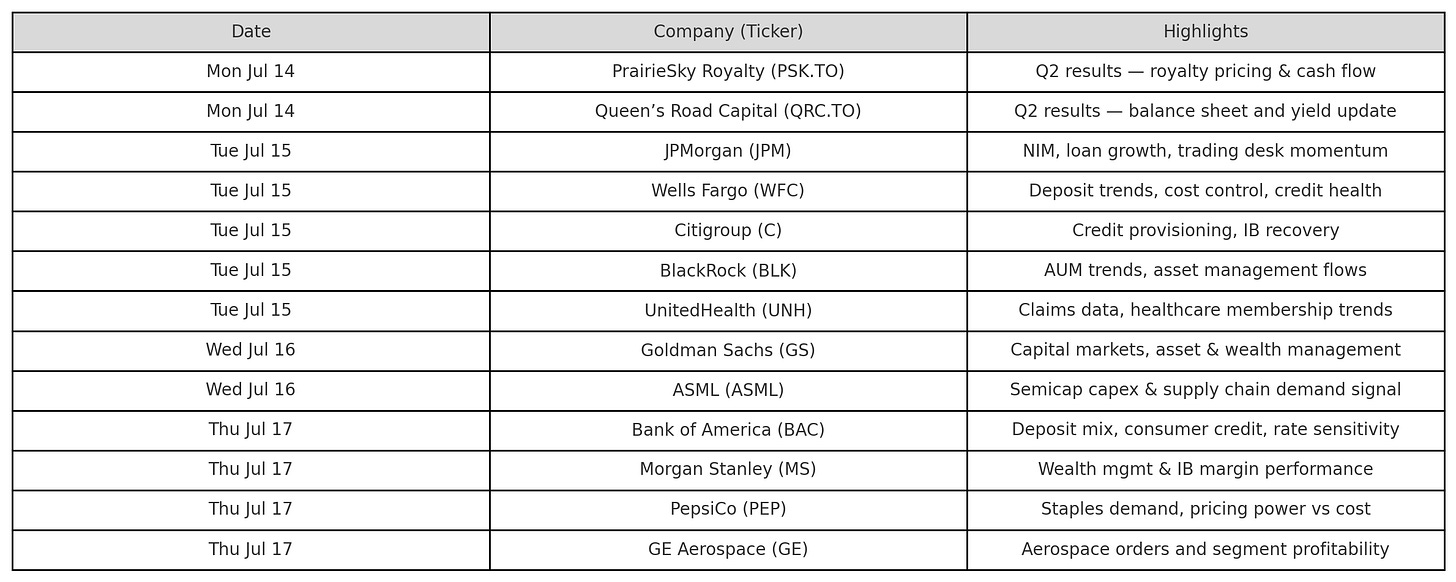

💼Earnings Preview

Big banks lead off U.S. earnings season this week, alongside select names in healthcare, consumer staples, and Canadian royalty plays.

⚠️ Policy & Geopolitics

The macro calendar isn’t the only thing with fuse wires this week. Several policy risks are simmering just below the surface.

U.S.–Canada Tariff Risk

The USTR’s digital services tax retaliation window remains open through early August.

So far, no official action - but the tone from D.C. has hardened. A unilateral move could reopen trade tensions quickly.

Keep watch on cross-border tech, telco, and e-commerce names.

U.S.–China Trade Watch

The July 9 “pause” agreement quietly expired with no extension. While headlines have been quiet, the risk of tariff escalation - particularly from the Trump campaign - remains live.

Any spark could bring U.S. chip, industrial, and shipping names into the crosshairs.

France Elections: Fiscal Rebalancing Risk

The left-wing coalition’s surprise win may nudge the EU toward looser fiscal posture - raising questions about EU bond issuance and capital flows. So far, markets have taken it in stride.

Not a direct U.S./Canada mover - but worth watching for global asset allocation shifts.

🎯 Conviction Barometer

Current Tilt → 🟩 Neutral to Mild Risk-On[🟦 Defensive | 🟩 Neutral | 🟥 Risk-On]Markets are calm - maybe too calm. The VIX remains pinned, credit spreads are tight, and equity volatility is near cycle lows. But that serenity rests on two assumptions:

Inflation remains contained

Earnings hold up

Both will be tested this week.

Leadership remains narrow, valuations are stretched, and rate cut optimism is fragile. Until proven otherwise, we stay selectively risk-on - not broadly bullish.

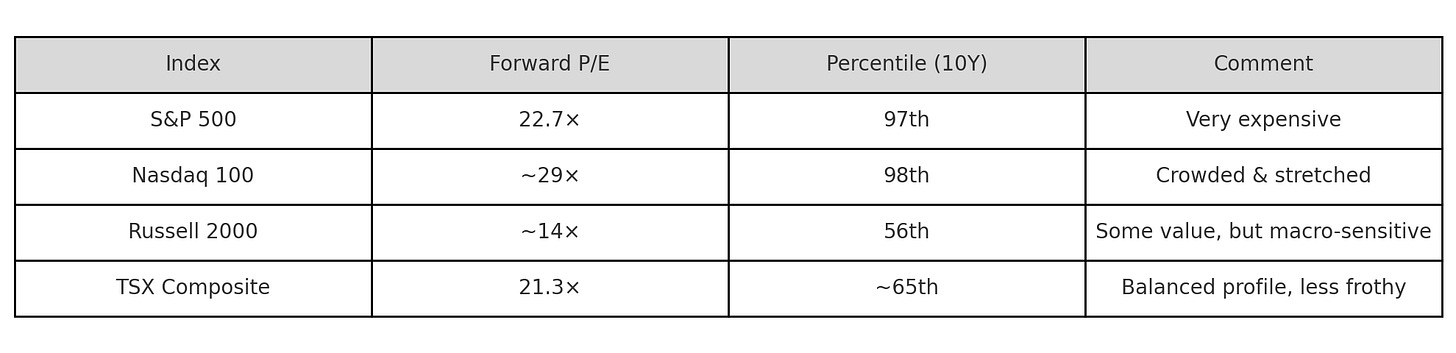

📊 Valuation Dashboard

Equity markets aren’t cheap - and the burden of proof is back on earnings and inflation.

U.S. large-cap multiples are pricing perfection. The only margin of safety lies in small caps and Canada - but they require macro support to unlock it.

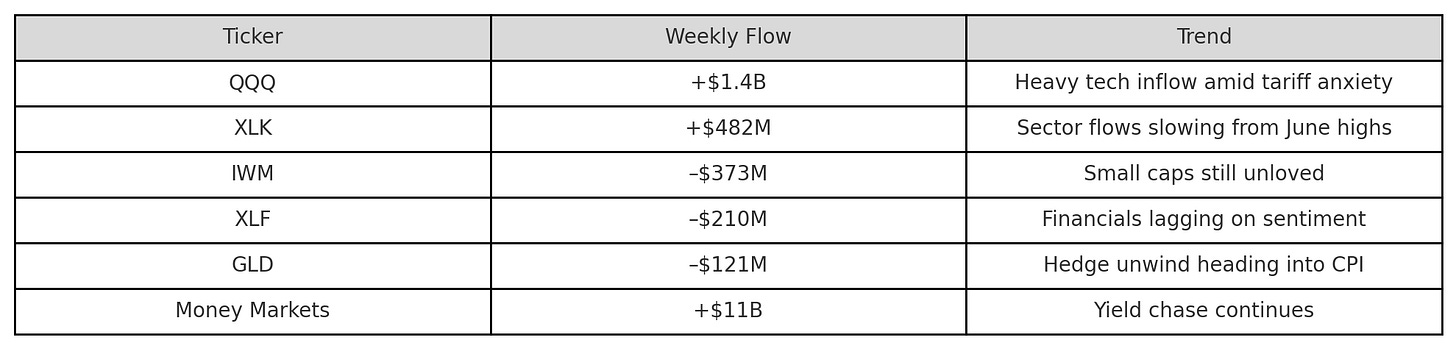

🔄 ETF & Flow Tracker

Fund flows are sending mixed signals beneath the surface. Tech remains dominant - but the momentum is fading. Meanwhile, value, financials, and small caps continue to leak capital.

The message? Crowded trades are easing off the gas, but new leadership hasn't emerged yet. Watch CPI and JPM earnings this week for a rotation spark.

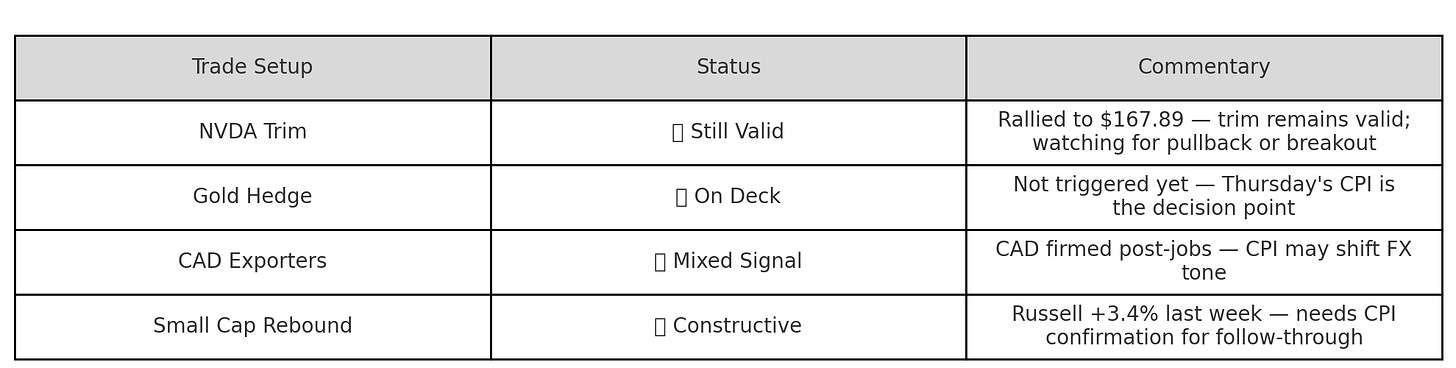

📈 Trade Tracker

Positioning remains cautious, with no active triggers hit - yet. But several setups are nearing critical inflection points as CPI and earnings season converge this week.

Key trigger: Thursday’s CPI print. It could unlock both the gold hedge and small-cap rotation - or kill both if inflation reaccelerates.

🥔 Potato Capital View

🔄 Macro Lens

Central banks are still in “wait-and-see” mode - neither hawkish nor easing.

Disinflation is in motion, but not fast enough to force immediate rate cuts.

This week’s U.S. and Canadian CPI prints are the decisive macro catalysts. If inflation surprises hot, markets will need to reprice the path forward - quickly.

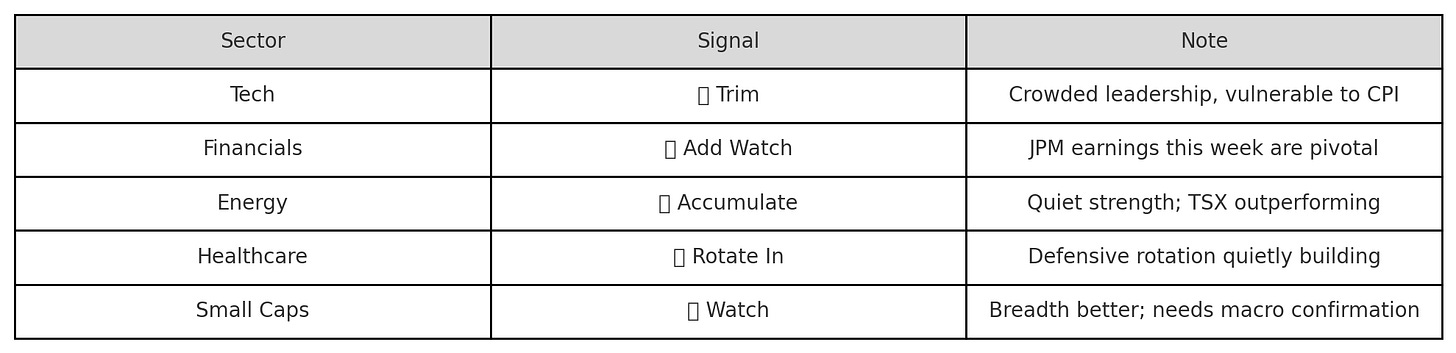

💡 Sector Signals

Rotation potential is building. If CPI is soft, small caps and defensives could take the lead. If hot, leadership likely reverts to defensible tech.

🌍 Cross-Asset Views

U.S. Equities → Rich valuations, narrow leadership - stay tactical

Canadian Equities → Attractive setup with energy tilt and more reasonable multiples

Europe / Japan → Still compelling on FX tailwinds and relative value

📉 Bonds → Neutral duration into CPI - curve is coiled for volatility

🪙 Gold → Still a valid hedge - CPI is the primary trigger

💱 USD/CAD → Rangebound near 0.731 - both CPIs could spark movement

✅ Portfolio Playbook

Here’s how we’re positioned heading into one of the most pivotal macro weeks of the summer:

🔒 Holding core compounders - but trimming where valuations exceed their math

⚙️ Rotating toward cyclicals - energy and financials offer better skew into earnings

📊 Watching CPI + JPM - these will set the tone for Q3 leadership and flows

🛡 Hedges on standby - gold and FX overlays stay ready in case inflation reignites

Positioning is cautious but flexible. We’re not pressing exposure - we’re preparing for pivots.

🧠 Final Take

This market is walking a tightrope.

It looks calm on the surface - but just beneath it sits a cluster of catalysts:

CPI, big bank earnings, and tariff noise.

This week is a moment of truth.

A single surprise could do more than move bonds - it could snap leadership and force a full rotation.

We’re not chasing the rally. We’re preparing for what breaks it.

At Potato Capital, we remain:

🔄 Rotationally active

📉 Valuation-disciplined

🧠 Macro-aware