📈 Weekly Market Recap and Preview – June 30, 2025

Markets surged to record highs despite tariff threats and geopolitical tension. A packed macro week lies ahead.

🗓️ The Week in Review

U.S. and Canadian equities rose again, with the S&P 500 (+3.4%) and Nasdaq (+4.3%) closing at fresh all-time highs. The TSX lagged modestly (+0.7%) as energy softened and Canada was hit by trade headlines.

Trump abruptly canceled trade talks with Canada, sending the CAD and TSX lower Friday. Tariff threats may materialize this week.

Bonds rallied early, then yields rebounded. U.S. 10-year closed at 4.28%, down slightly week over week.

The U.S. core PCE came in at 2.7% YoY, continuing the trend of cooling inflation - not low enough to trigger cuts, but trending toward target.

Canada’s GDP remained stable and the CAD hovered near $0.7312. The BoC is on hold for now but watching employment closely.

Oil prices spiked then collapsed, with WTI dropping from $77 to $65. Geopolitical tensions (Iran–Israel) calmed quickly.

Gold hit record highs, then sold off sharply - down ~4% to $3,285/oz as safe-haven demand faded.

🔭 The Week Ahead: June 30 – July 5

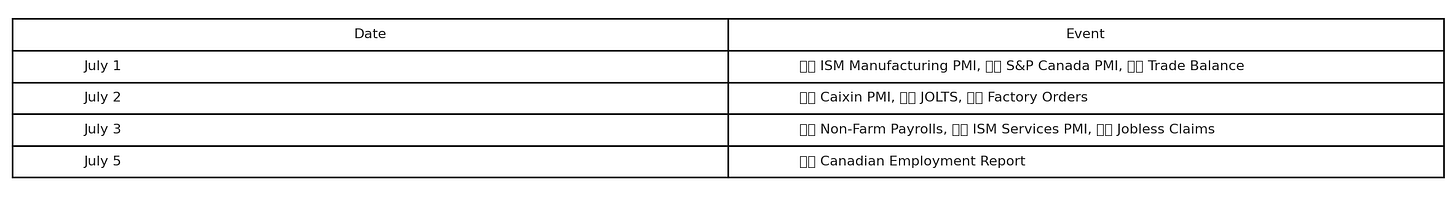

🧾 Macro Calendar Highlights

Markets will have to digest a heavy macro slate amid a shortened trading week:

Key risk: Non-Farm Payrolls (July 3) could shift expectations for September cuts. Canada’s jobs report (July 5) may reprice BoC path.

Note: U.S. markets early close Thursday (July 3) and closed Friday (July 4). Canada closed Tuesday (July 1) for Canada Day.

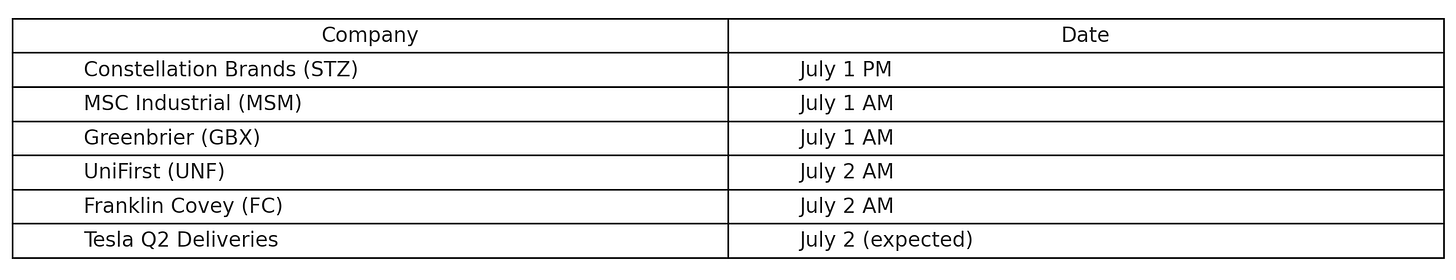

💼 Key Earnings Reports

Not a heavy earnings week, but Tesla Q2 deliveries (July 2) and Constellation Brands will draw attention:

Watch for updates on U.S. consumer demand and manufacturing cost pressures.

⚠️ Policy & Geopolitical Watch

U.S.–Canada tariff retaliation window now open - headlines could hit at any moment.

Trump’s “One Big Beautiful Budget” hits July 4 vote deadline.

U.S.–China trade pause expires July 9 - extension expected but not guaranteed.

Global manufacturing PMIs (China, Europe) will move commodities.

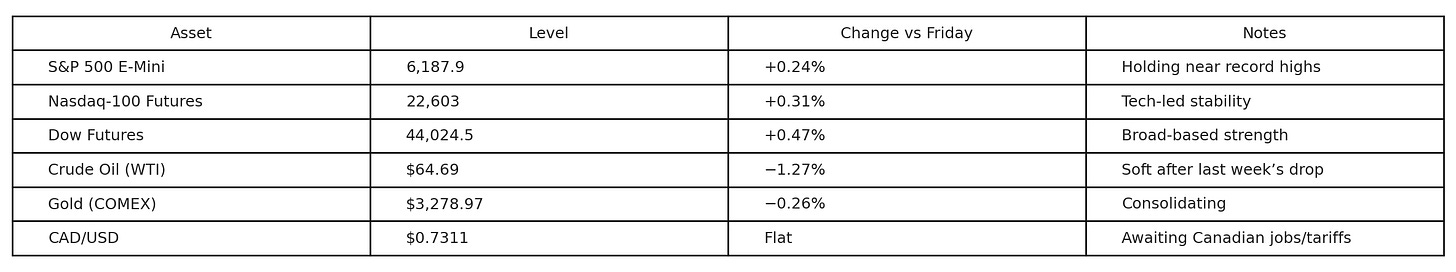

📉 Futures Snapshot (as of Sunday 7:00 PM ET)

Slightly bullish tone in U.S. equity futures. Crude and gold are stabilizing post-whiplash:

🎯 Conviction Barometer

Current Tilt → 🟩 Neutral to Mild Risk-On

[🟦 Defensive | 🟩 Neutral | 🟥 Risk-On]Sticky inflation is fading, central banks are on pause, and geopolitical noise is softening - but valuations are stretched, so we stay tactically engaged but rotationally cautious.

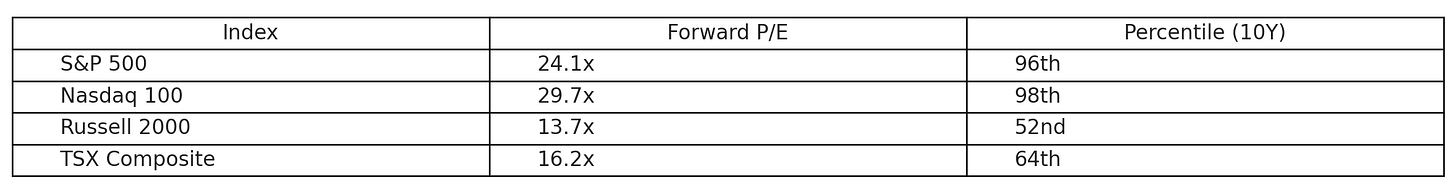

📊 Valuation Snapshot

S&P 500 at 96th percentile valuation means we are not underpriced. U.S. equities remain richly valued, especially vs. small caps and international peers.

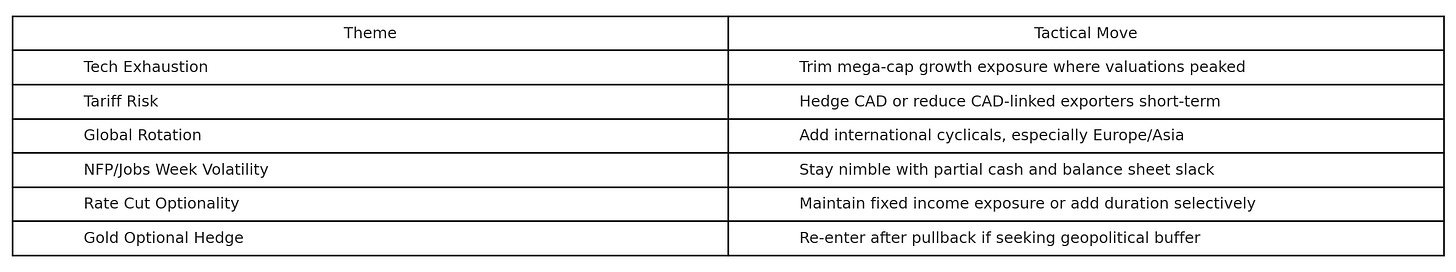

Trim mega-cap exposure selectively

Rotate toward undervalued regions (Europe, Japan, select EM)

Watch for earnings disappointment risk at these multiples

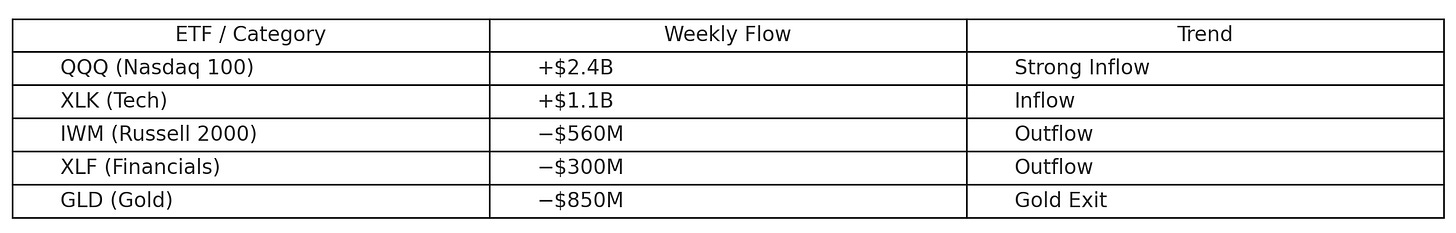

🔄 Flow Watch

Key insights:

Tech remains dominant, but flows into QQQ and XLK are slowing.

Small-cap and financials still seeing outflows - the deep value rotation isn’t fully engaged.

Gold outflows may be contrarian buy signal if volatility rises again.

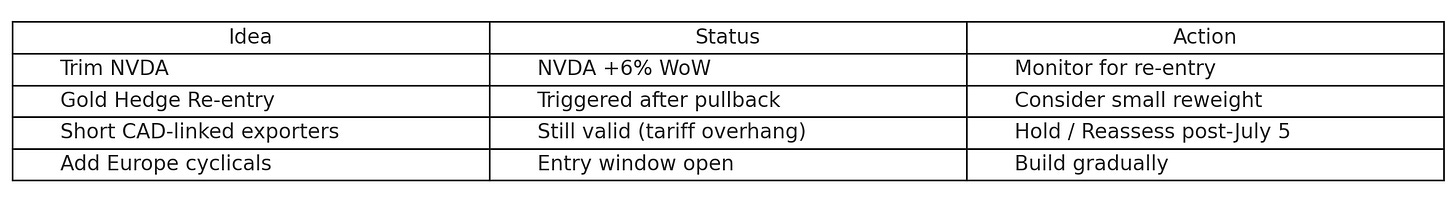

📈 Trade Tracker Follow-Up

NVDA trim worked well - up 6% WoW. No need to chase here.

Gold re-entry window now open after sharp pullback.

CAD-linked exporters still face risk; July 5 CAD jobs data is a key catalyst.

European cyclicals gaining traction - valuation + FX tailwinds support rotation.

🥔 Potato Capital View

🔄 Macro Takeaways

Liquidity flows and inflation deceleration support risk-on bias.

Both Fed and BoC remain on pause - next moves likely cuts, pending labor data.

Trade war risk reintroduced, but currently not pricing panic.

💡 Sector Signals

Tech and AI still leading, but valuation risk is real.

Healthcare and financials present contrarian opportunity.

Small-cap value and Canadian cyclicals could outperform if tariff risk fades.

🌍 Asset Class Views

U.S. equities: Overvalued. Trim where stretched.

Europe & Japan: Better relative value.

Bonds: 4.2–4.5% IG yield is attractive with upside.

Gold: Still a hedge; re-enter after pullback.

✅ Portfolio Playbook

🧠 Final Take

This market loves a Goldilocks regime - cooling inflation, dovish central banks, and receding geopolitical risks. The June rally reflects this perfect storm.

But let’s be clear: valuations are high, positioning is crowded, and July catalysts (NFP, CAD jobs, trade headlines) could shift sentiment quickly.

At Potato Capital, we’re:

Rotating into quality,

Avoiding crowding,

Leaning into underpriced conviction.

Stay macro-aware. Stay valuation-disciplined. Stay fundamental.

Happy Canada Day and July 4th to our readers on both sides of the border.