📈 Yield Curve Steepening

Exit from Inversion, Macro Shift, and Portfolio Strategy

🔑 Executive Summary

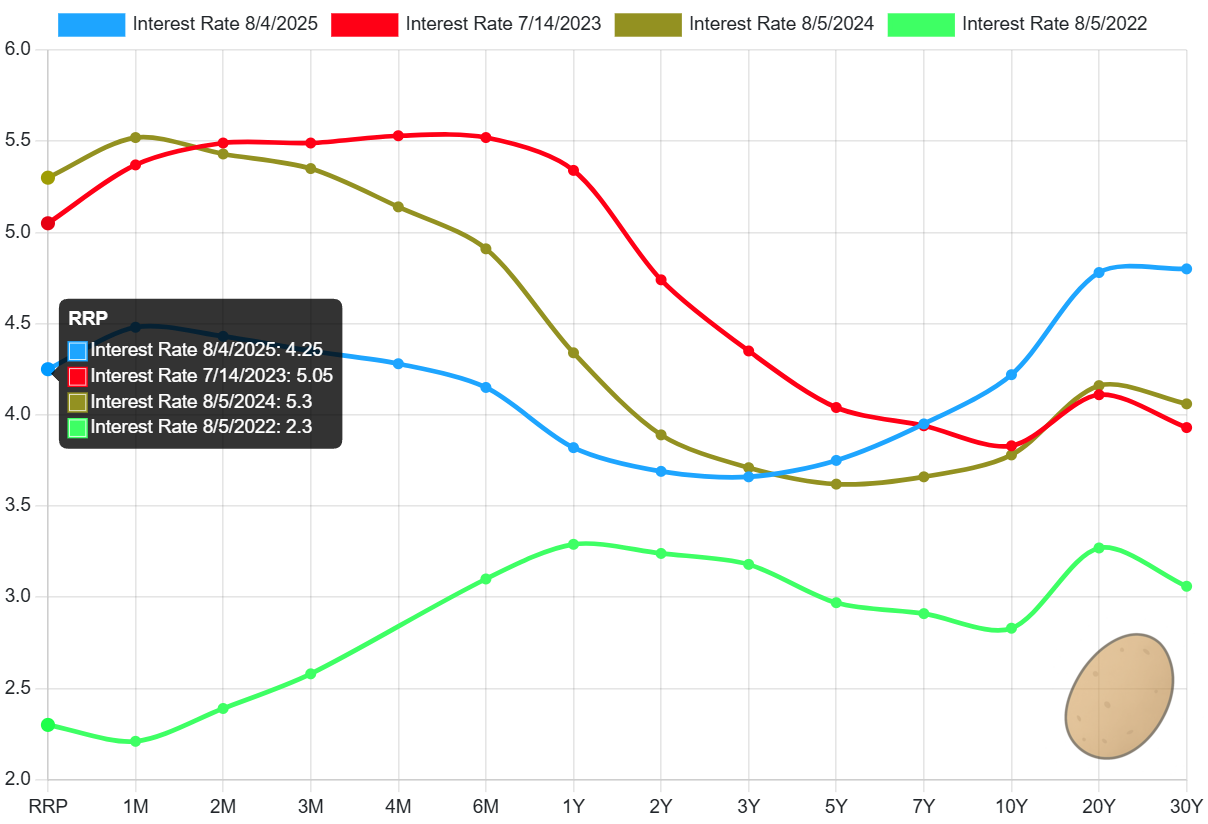

After a historic 793-day inversion - the longest since the early 1980s - the U.S. yield curve has finally re-steepened, marking a pivotal macro regime shift. As of August 2025, the 2s10s spread has rebounded to ~+50bps after hitting a record low of –107bps. The 3m10y curve is now approaching flat, following 14 months of inversion. This re-steepening reflects a blend of Fed rate cuts, moderating inflation, and resilient long-end term premia.

But does the curve’s upward slope signal a soft landing - or the calm before a delayed recession?

In this report, we break down the regime shift across four fronts:

Macro catalysts driving the steepening

Historical precedents post-inversion

Sector and asset class rotation frameworks

Portfolio strategies for navigating the transition

🌍 Macro Lens: Drivers of the Steepening

Fed Policy Shift: After 11 rate hikes through 2022–23, the Fed pivoted in late 2024 - cutting the policy rate to ~4.25% and igniting a classic bull steepener: short-end yields fell sharply while the long end held firm.

Inflation Collapse: Headline CPI dropped from 9.1% in mid-2022 to ~2.5% by mid-2025, giving the Fed cover to ease without immediately un-anchoring inflation expectations.

Sticky Long-End Yields: Despite rate cuts, the 10Y remains near 4.2%, held up by elevated term premium, Treasury issuance, and lingering global macro risk premia - keeping the curve steeper but not yet loose.

🖼️ Visual: Curve Evolution Timeline

📊 Historical Context: The Inversion's Track Record

Every U.S. recession since 1960 has been preceded by a yield curve inversion - but importantly, the downturns typically arrive after the curve has re-steepened.

This pattern held in:

1990: 2s10s turned positive in early 1989, recession followed ~12 months later.

2001: Curve un-inverted in 2000, dot-com collapse hit shortly after.

2008: Inversion ended in 2006; recession arrived by late 2007.

2020: Curve re-steepened post-2019 inversion, then COVID accelerated the shock.

Today’s setup closely mirrors 2006–07: a prolonged inversion, followed by re-steepening driven by policy easing - and an economy that looked stable until it wasn’t.

The yield curve doesn’t predict timing. It marks conditions. And once those conditions shift, the countdown often begins.

⚔️ Soft Landing or Delayed Collapse?

Bull Case

The Fed acted before a recession could take hold - unlike in 2000 and 2007.

Labor remains relatively firm: 73,000 jobs added in July, though prior months were revised sharply lower (−258,000 jobs collectively). Unemployment rose to 4.2% in July from 4.1%, signaling initial softening.

If the neutral rate (r*) is higher than assumed, the inversion may have overstated recession risk.

Bear Case

Historically, steepening often precedes recessions, not confirms recoveries.

The cumulative effects of ~500bps of tightening are still filtering through credit and consumption.

Leading indicators - including the LEI (−0.3% in June, at 98.8), CRE metrics, and bank lending surveys - continue to deteriorate.

The steepening is undeniable. But so is the risk. We’re not in smooth territory yet - just a new macro terrain.

Markets see resilience; data shows strain. The outcome hinges on which lens dominates.

📈 Equity Market Playbook: What Tends to Win

Financials & Banks:

Beneficiaries of a steepening curve. Net interest margins (NIMs) expand as funding costs stabilize and loan yields rise. Regional banks with sticky deposit bases are positioned to recover first.

Industrials & Cyclicals:

Outperformers in early-stage macro optimism. Rising capital expenditures, infrastructure tailwinds, and global trade normalization support multi-quarter earnings momentum.

Tech (Selective Long-Duration Growth):

Still dominant but richly valued. Favor cash-flow generative AI, semis, and infrastructure enablers over speculative SaaS or pre-profit names. Duration sensitivity remains a risk if long-end yields rise.

Defensive Sectors (Utilities, Staples, Health Care):

Now underperforming after leading during inversion. Maintain as macro hedges, especially if growth surprises to the downside or long yields roll over.

Small & Mid Caps:

Breadth is finally improving. Rotation beyond the Magnificent 7 into domestic cyclicals and small caps suggests growing risk appetite. Watch for confirmation in equal-weighted index outperformance.

💸 Fixed Income Strategy: Navigate the Curve

Barbell Positioning:

Maintain a barbell structure: harvest ~5% front-end carry while layering in long-duration hedges against tail risk or growth surprises. T-bills and long bonds both serve distinct roles in this macro regime.

Curve Trades:

The steepener trade has largely played out. Now focus on roll-down capture across 3-7Y tenors and credit curve steepening in IG. Quality matters more than direction from here.

Credit Markets

High-yield spreads remain historically elevated. Favor BBs and rising stars over CCC-rated issuers. Credit remains a carry game, not a beta trade - and illiquidity risk is rising on the margin.

TIPS & Inflation Protection

With breakevens drifting up (~2.3% on the 10Y), inflation hedging is still prudent. TIPS provide asymmetric protection if inflation reaccelerates from commodity or policy shocks.

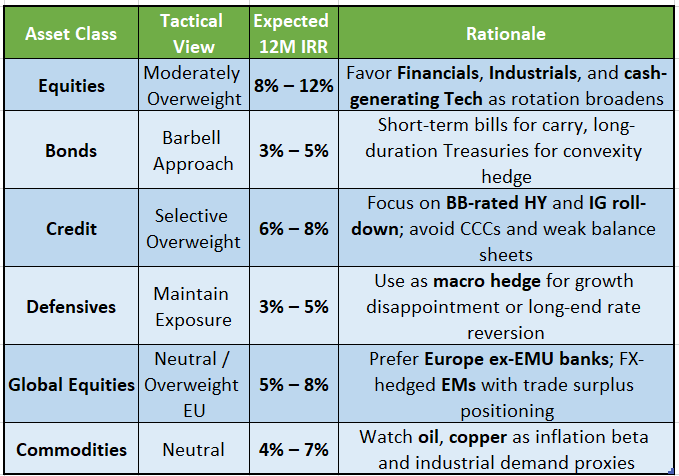

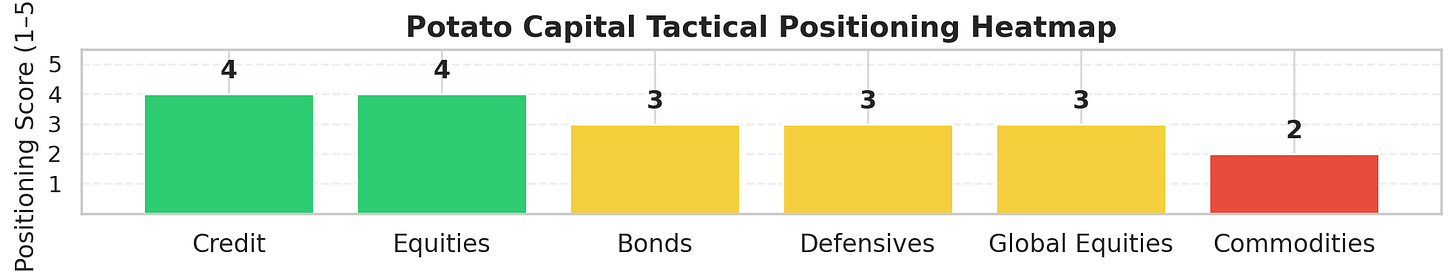

📁 Portfolio Allocation Framework

📌 Key Signals to Monitor

🔁 Yield Curve Confirmation

3m10y Spread: A sustained move into positive territory would historically validate a soft landing narrative. But a re-inversion or flattening would suggest renewed macro stress.

📊 Inflation Prints

August CPI & Core PCE: Key to gauging whether disinflation momentum continues or stalls. A surprise re-acceleration would tighten financial conditions and reset Fed expectations.

🎙️ Fed Messaging

Watch FOMC minutes, speeches, and dot plots for any shift between “pause,” “skip,” or “re-tighten.” Powell's Jackson Hole speech (late August) will likely be pivotal.

📉 Credit & Demand Conditions

Track Senior Loan Officer Surveys, HY spreads, and CRE stress. Deterioration here is a leading indicator of recessionary credit impulse.

📦 ISM New Orders

A clean rebound in ISM Manufacturing New Orders (last: 47.1) would suggest bottoming. A continued contraction flags industrial softness

🧑💼 Labor & Claims

Initial Jobless Claims, continuing claims, and labor revisions remain leading macro signals. A rolling over of claims is key to sustaining soft landing hopes.

🥔 Final Take

The yield curve is no longer screaming recession - but it’s still whispering uncertainty.

This steepening marks a new macro phase:

For bulls, it’s a green light for cyclical rotation - into financials, industrials, and small caps.

For bears, it may be the eye of the storm, where calm precedes credit stress and consumption fatigue.

The truth? Macro doesn’t resolve overnight. The curve is a lens - not a crutch.

The smartest positioning is flexible, data-driven, and forward-scanning.

Sources: U.S. Treasury (FRED), Bureau of Labor Statistics (BLS), Federal Reserve, ISM, Conference Board, MarketWatch, Bloomberg, Reuters, Morgan Stanley Global Fixed Income Bulletin (2025), YCharts, and Advisor Perspectives.